Although PEPE had a sluggish start this month, its price still managed a 25% increase. However, the bullish momentum around the meme coin has waned over the last 24 hours, raising questions about the sustainability of its recent rally.

According to several key on-chain metrics, PEPE may struggle to maintain this momentum.

Pepe Investors Put More Tokens in Circulation

A key metric suggesting this is the Mean Dollar Invested Age (MDIA), which tracks the average period a cryptocurrency has been in the same wallet.

When the MDIA increases, holders keep the same tokens in the same wallet. Conversely, a decreasing MDIA indicates that previously dormant wallets are now moving back into circulation.

Read more: 5 Best Pepe Wallets for Beginners and Experienced Users

While the former is a bullish sign, the latter is a bearish one. According to Santiment, PEPE’s 90-day MDIA was 42.30. At press time, it had decreased, indicating rising trading activity and a potential price drop.

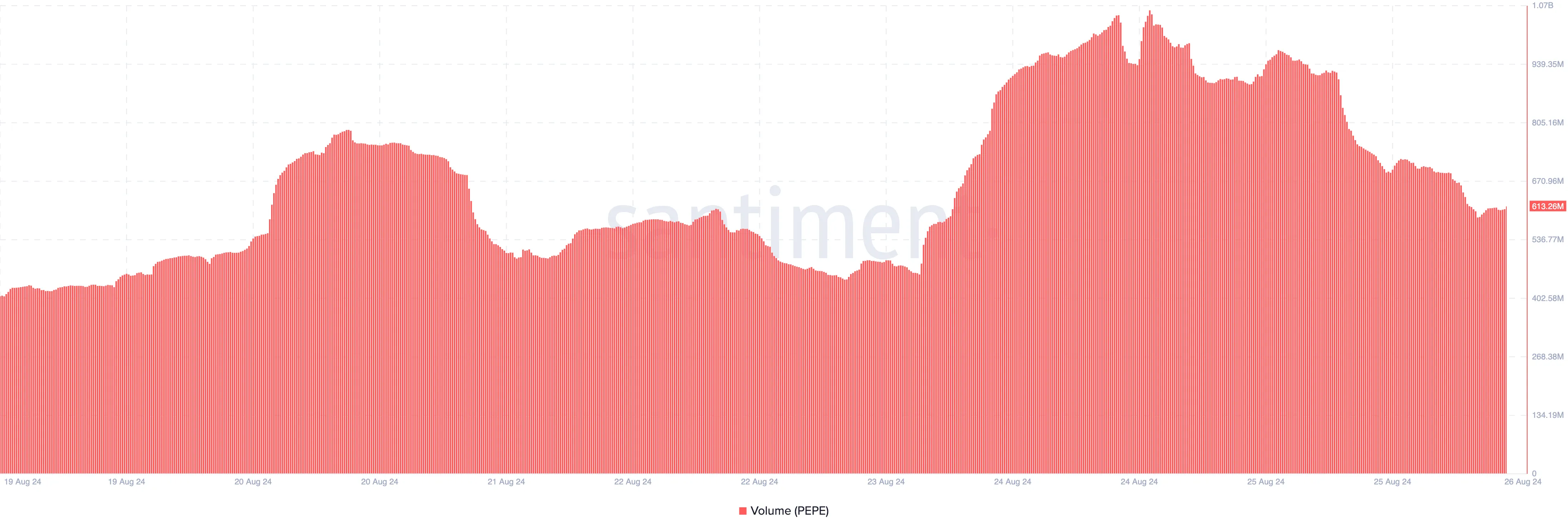

Additionally, trading volume has declined, currently sitting at $613.26 million. Typically, rising volume alongside a rising price strengthens the uptrend.

However, when volume drops after a notable price increase, it suggests that the upswing may not persist.

PEPE Price Prediction: Critical Resistance Close

According to the daily chart, PEPE’s price faces resistance around the 50-day Exponential Moving Average (EMA), shown in yellow. The EMA indicates a cryptocurrency’s trend direction. Currently, the meme coin trades slightly below this level, suggesting a potential bearish trend.

However, the price remains above the 20-day EMA (blue). Given the recent red candlestick, there’s a risk of the price falling below this shorter-period indicator.

Additionally, the token is yet to break above the descending triangle pattern. If this continues, the frog-themed meme coin could see a price drop, with the next target near $0.0000077.

Read more: What Are Meme Coins?

This outlook could change if crypto whales start accumulating the token in large volumes. In that scenario, PEPE might break above the descending triangle, potentially reaching $0.0000098.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/pepe-holders-behavior-raises-red-flag-for-price/

2024-08-26 19:30:00