Frog-themed meme coin Pepe (PEPE) has hit a roadblock. The token recently failed to break through a crucial resistance level at $0.000011, potentially setting the stage for a significant price drop.

This analysis dives into what PEPE holders need to know as market activity cools as we enter October.

Pepe Bears Overpower the Bulls

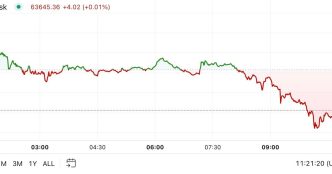

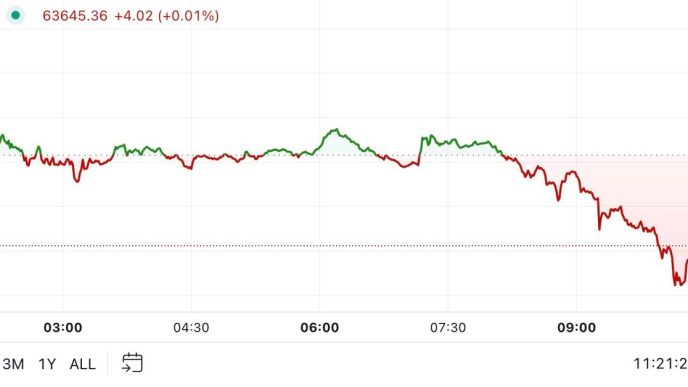

Since June, the $0.000011 price level has served as a crucial resistance point for PEPE. A series of attempts to break above this line have been made, but all retests have failed.

Over the past week, PEPE’s price has climbed by 36%, bringing it closer to the resistance. During Sunday’s trading session, it attempted to breach this level but faced increased selling pressure, resulting in a decline. Currently trading at $0.000010, the meme coin has noted a 2% price drop over the past 24 hours.

Read more: How To Buy Pepe (PEPE) and Everything You Need To Know

The activity of PEPE’s large holders, who hold more than 0.1% of its circulating supply, may be noteworthy here. Over the past week, this group of PEPE holders has gradually sold their coins, as evidenced by the 171% decline in the token’s large holders’ netflow.

When an asset’s large holder netflow declines, its whale addresses are selling their holdings. It is a bearish signal, suggesting potential selling pressure and a risk of price decline.

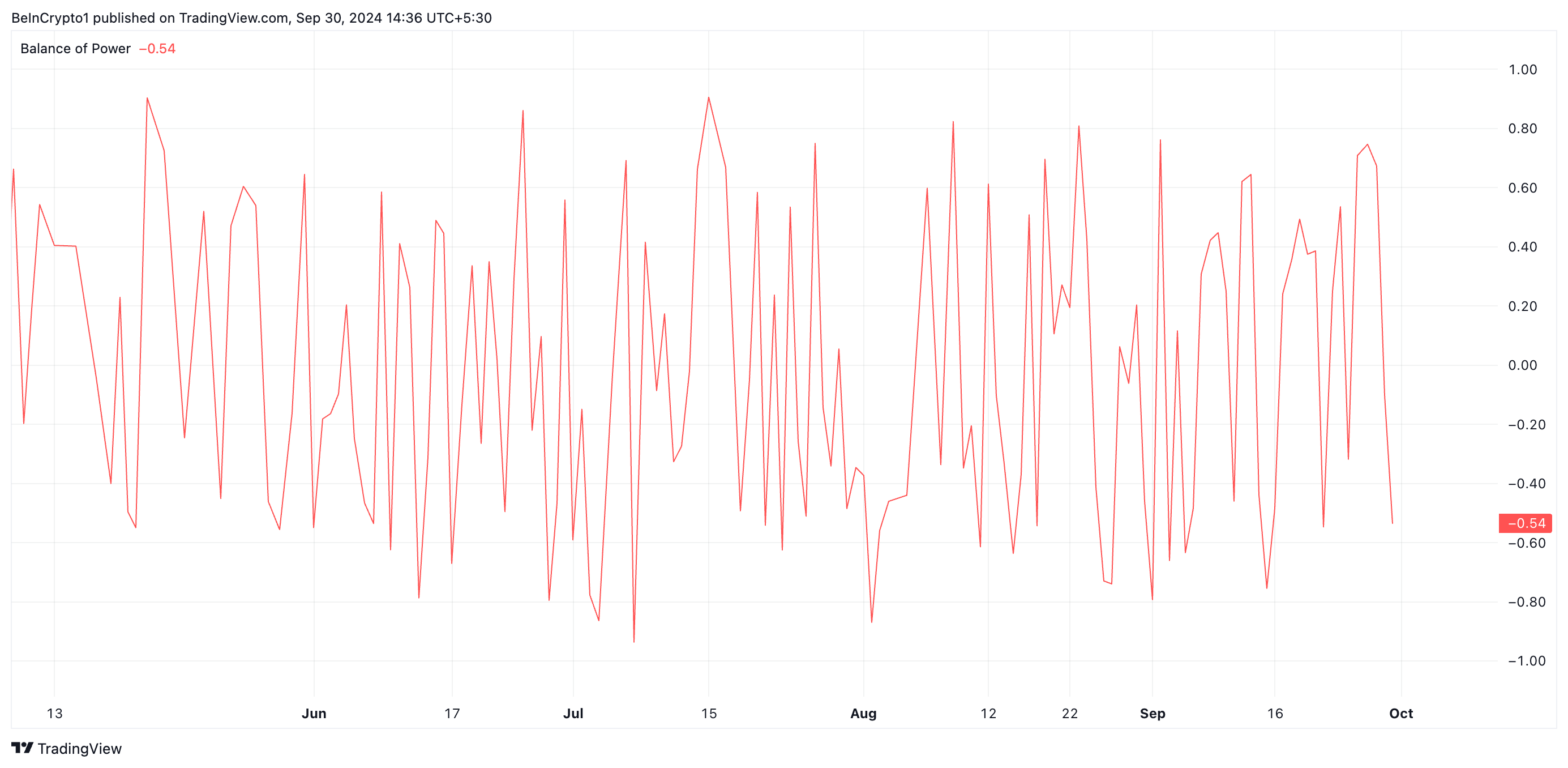

Furthermore, the negative readings from PEPE’s Balance of Power (BoP) indicate that the bears have market control. At -0.54 at press time, PEPE’s BoP, which measures the relationship between its buying and selling pressure, shows a prevailing bearish sentiment and stronger selling pressure.

PEPE Price Prediction: All Roads Lead Downward

If selling momentum heightens, PEPE’s price may drop by 22% to trade at $0.000008. Failure by the bulls to defend this level and turn it into support would likely extend the decline by an additional 32%.

Read more: 5 Best Pepe (PEPE) Wallets for Beginners and Experienced Users

On the flip side, a resurgence in buying activity may drive PEPE toward the $0.000011 resistance. Breaking through this level would pave the way for a potential climb to $0.000014.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/pepe-price-unable-to-break-resistance/

2024-09-30 12:01:56