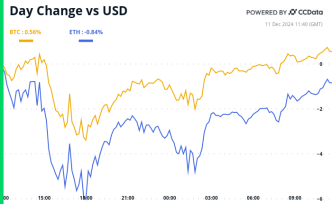

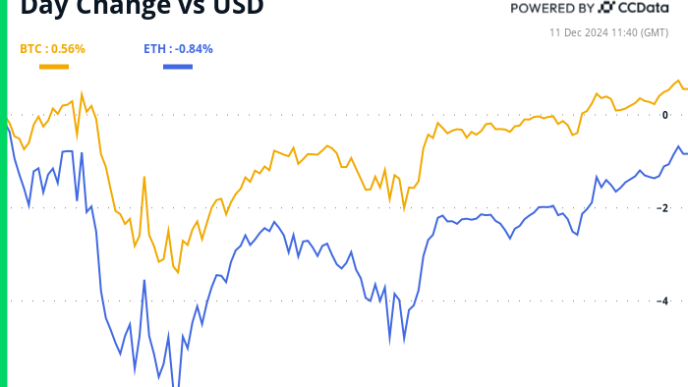

Shiba Inu’s price has dropped 11% over the past week, mirroring the broader market downturn. Unlike other tokens, this decline has not triggered a cascade of sell-offs among SHIB holders.

With bullish sentiment holding steady, the cryptocurrency may be positioned for a potential rebound or consolidation in the near term.

Shiba Inu Investors Keep Faith in the Meme Coin

Historically, when SHIB holders find it difficult to refrain from selling, the price drops significantly — in most cases, it goes lower than the recent 11% decrease. However, according to IntoTheBlock, SHIB’s Coins Holding Time has been increasing since December 8.

As the name suggests, the holding time measures the period that a cryptocurrency has been held without being sold or transacted. When it increases, it means that holders have refused to move their tokens in between wallets or sell them, which is bullish.

On the flip side, a drop in the holding time suggests a lack of conviction in the short-term potential. In this instance, holders liquidate some of their assets, causing downward pressure on the price.

Therefore, the notable rise in Shiba Inu’s case seems bullish for the token. If sustained, this could help accelerate its price recovery.

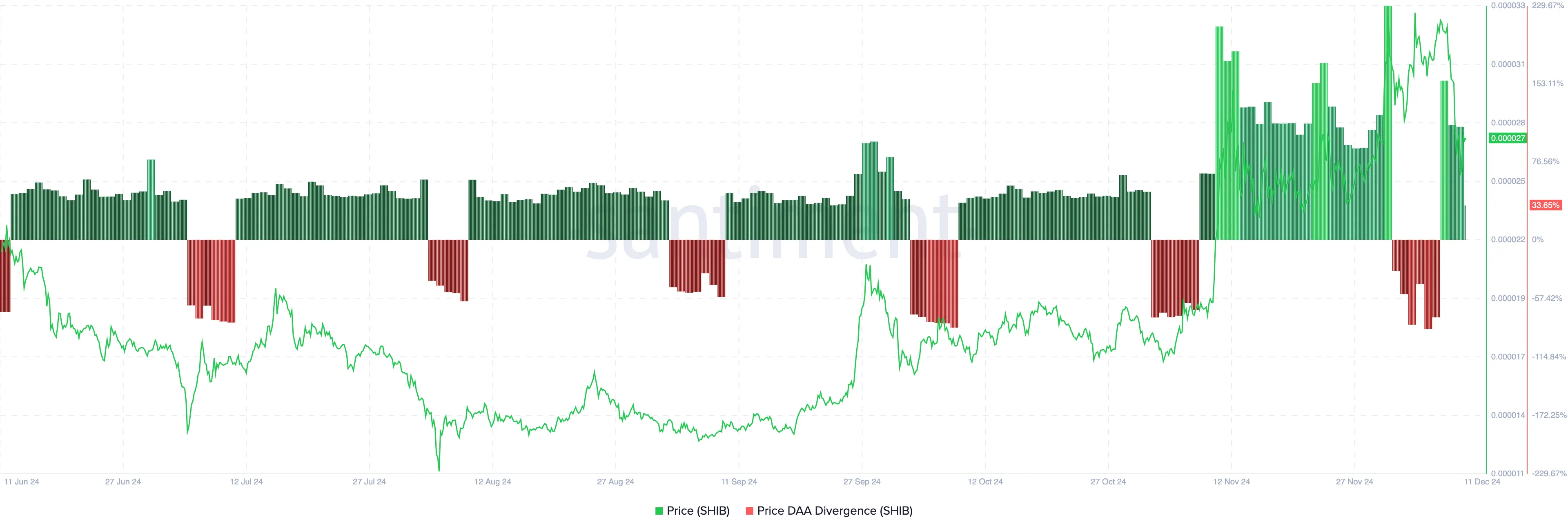

Furthermore, the price-Daily Active Addresses (DAA) Divergence offers a compelling signal for SHIB’s potential rebound. This metric evaluates user participation on a blockchain and its correlation with price trends, revealing crucial insights.

A positive price-DAA divergence signifies rising network activity, often paving the way for price increases. Conversely, a negative divergence points to declining engagement, typically signaling bearish momentum.

Santiment data, as shown above, reveals that SHIB’s price-DAA divergence has surged to 33.65%. If this trend holds, SHIB’s price could surpass $0.000027 in the coming days.

SHIB Price Prediction: Rebound Coming?

On the daily chart, the Accumulation/Distribution (A/D) indicator reading has increased. The A/D indicator combines volume and price to evaluate whether a cryptocurrency is being accumulated or sold off.

When the reading falls, it means that selling pressure is higher than accumulation. On the other hand, a rising A/D indicates rising buying pressure, which is the case with SHIB. However, bulls might need to defend the support at $0.000024 to validate this thesis.

If that happens, then SHIB’s price could rally toward $0.000034. However, if bears breach the support, this might not be the case, and the meme coin could drop to $0.000019.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/shib-holders-resists-shakeout/

2024-12-11 11:00:00