Leading meme coin Shiba Inu (SHIB) has recently attracted the attention of its largest holders, or “whales.” A key on-chain metric has indicated a potential buying opportunity, prompting these large investors to accumulate more SHIB tokens.

Despite this, gains may not materialize as quickly as expected. Market sentiment surrounding Shiba Inu remains bearish, suggesting the coin could face further declines.

Shiba Inu Whales Swing Into Action

The volume of large transactions involving Shiba Inu has more than doubled since Sunday. Data from IntoTheBlock reveals a staggering 406% surge in large transactions — those exceeding $100,000 — over the past three days.

For context, Sunday’s large transaction volume amounted to 395 billion SHIB. But by Tuesday, it had surged to an impressive 2.51 trillion SHIB. In dollar terms, this equates to a leap from $5.31 million to $33.41 million, highlighting a significant rise in market activity.

Read more: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

The reason for this spike in whale activity is not far-fetched. This cohort of investors is simply taking advantage of the coin’s undervalued nature. Since Shiba Inu’s price peaked at $0.000016 on August 24, its value has declined by 19%.

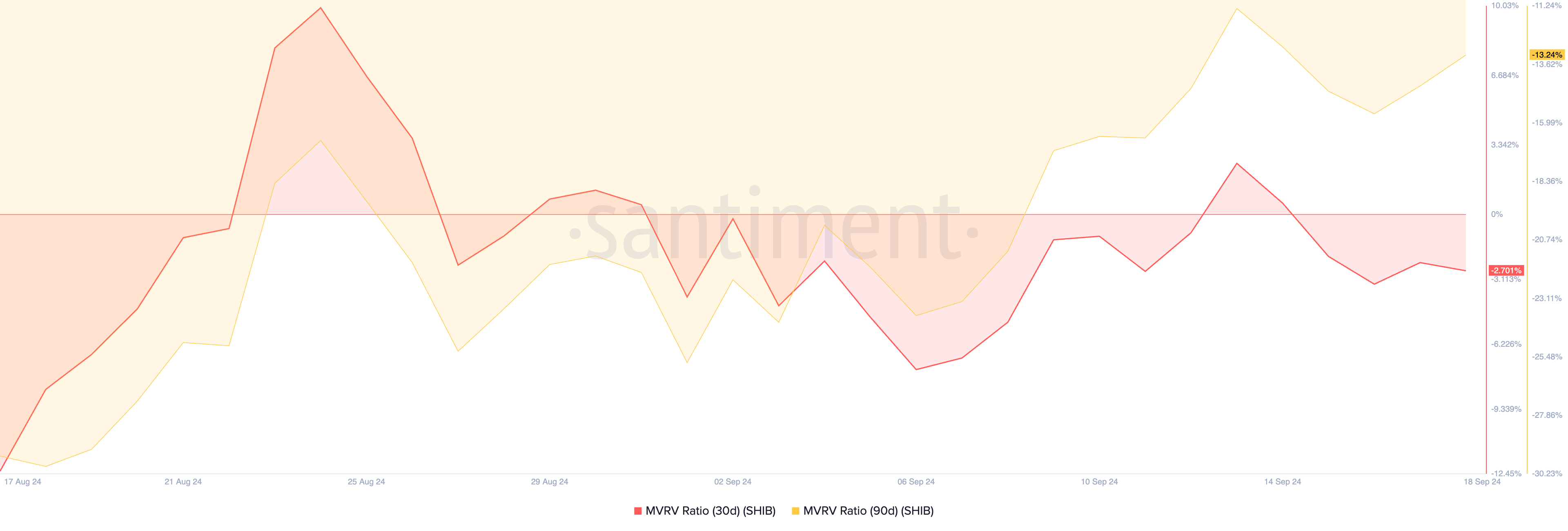

This price drop has led to a negative market value to realized value (MVRV) ratio, suggesting that the meme coin may be undervalued, presenting a buying opportunity for those looking to “buy the dip.”

As of this writing, SHIB’s 30-day and 90-day MVRV ratios are -2.70 and -13.24, respectively, indicating that its current value is lower than the average price of all its tokens in circulation. Historically, this is a buy signal, as investors can accumulate the asset at a low price and hope to sell at a higher value.

SHIB Price Prediction: The 36% Price Rally in Jeopardy

However, these anticipated gains may face delays as bearish sentiment around Shiba Inu continues. For instance, the Elder-Ray Index (ERI), which tracks the balance between buying and selling pressures, has remained negative since Monday, signaling that sellers are in control while buyer activity weakens.

Moreover, the Directional Movement Indicator (DMI) also reflects a bearish trend. The negative directional indicator (red) is positioned above the positive directional indicator (blue), reinforcing that selling pressure is currently stronger than buying demand.

Read more: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

If buying pressure weakens further, SHIB’s value could extend its decline, potentially reaching its August 5 low of $0.000010. This would be a setback for whales currently accumulating the meme coin, hoping to drive its value up by 36%.

This rally would only occur if demand picks up and Shiba Inu’s price moves toward the resistance level at $0.000018.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/shiba-inu-whales-attempt-to-boost-coin/

2024-09-18 07:45:09