This month, the Solana (SOL) network has seen a surge in demand, with daily active users and new user counts skyrocketing. With just six days remaining in September, the month is on track to be Solana’s busiest in terms of user activity since the start of the year.

This heightened network demand has sparked speculation that SOL’s price could reach $160 by month’s end. But how realistic is this projection?

Solana Sees Uptick in Demand

Over the past 23 days, the number of unique addresses that have signed transactions across the Solana network has totaled 61 million. This represents a 57% surge from the 26.31 million unique active addresses that used the blockchain network in August. Year-to-date, Solana’s monthly active address count has increased by over 900%.

Read more: Solana vs. Ethereum: An Ultimate Comparison

New users have also flocked to the chain, taking advantage of its low transaction fees. So far this month, the number of unique first-time signers transacting on the Solana network has surged to 78 million, marking an 85% increase from August’s 40 million.

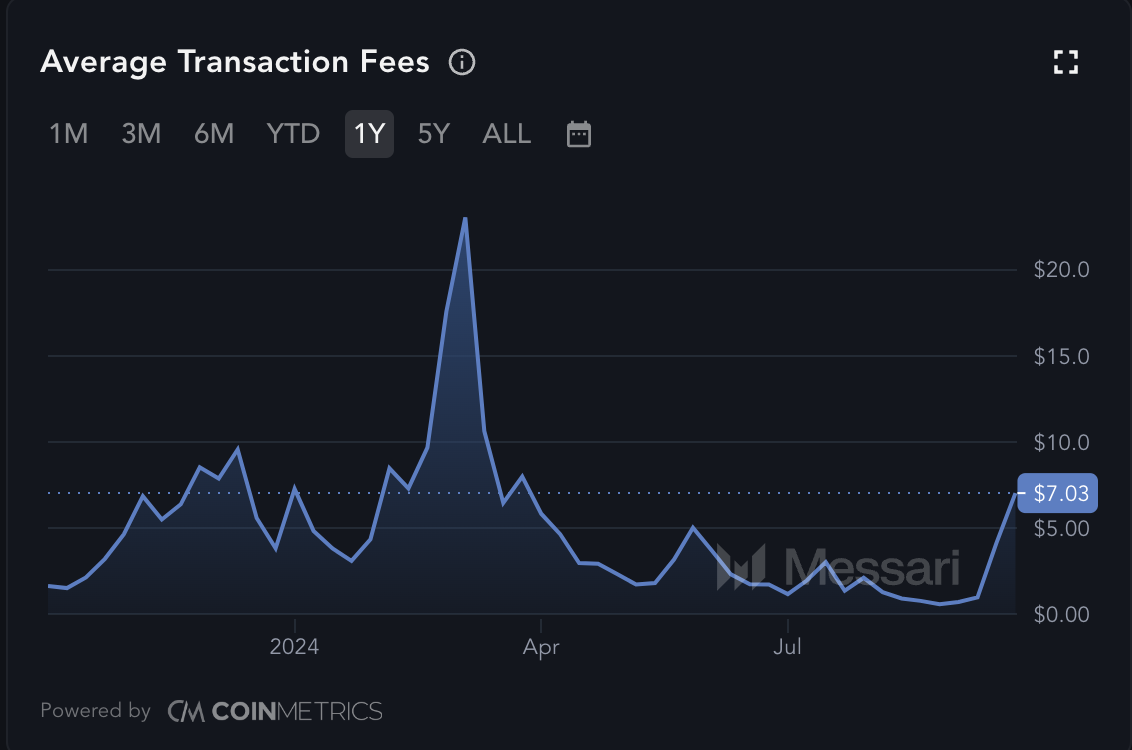

The sharp rise in Ethereum’s average transaction fees throughout September has contributed to Solana’s growing popularity over the past month.

For context, as of September 23, the average transaction fee on Ethereum had soared to $7.03, up from just $0.71 at the start of the month — an increase of over 800% in just 24 days. For comparison, the average Solana gas fee costs between $0.003 and $0.030.

SOL Price Prediction: Bulls May Push Coin’s Price Past $160

This surge in demand for Solana has fueled speculation that SOL’s price could soon hit $160. The bullish readings from the altcoin’s key momentum indicators support this outlook.

For example, SOL’s Relative Strength Index (RSI), which measures its overbought and oversold market conditions, is in an uptrend at press time. This indicates that buying pressure outweighs selling activity among SOL market participants.

Further, the position of the dots that make SOL’s Parabolic Stop and Reverse (SAR) indicator confirms the bullish bias toward the altcoin. This indicator, which tracks trend direction and identifies potential reversal points, has its dots resting below SOL’s price at press time. When the dots are in this position, it signals a strong bullish trend.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

Given the current market sentiment, Solana’s price is expected to maintain its upward trajectory. If buying pressure remains strong, the altcoin could rally past the key resistance at $159.96. A successful breakthrough at this level would pave the way for SOL to target $186.40.

However, if selling pressure intensifies and prevents a breakout, SOL’s price may reverse course. The coin could retrace to its support level at $131.32 in such a scenario.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/solana-price-bullish-month/

2024-09-24 14:20:50