Solana (SOL) has been on a tear, recording a 12% price surge in the past week. The altcoin currently trades at $170.16, just below the crucial $171 resistance level. If it maintains its momentum, Solana’s price may break through this resistance during the current trading session.

A successful breach would open the door for a further rally, with the next major hurdle at $186.32. If SOL can overcome this resistance, it could reach the $200 mark. But how soon can this happen?

Solana Sees Spike in Activity

Solana’s key momentum indicators, assessed on a one-day chart, confirm the recent surge in the demand for altcoin. For example, its Relative Strength Index (RSI), which tracks its overbought and oversold market conditions, is in an uptrend at 68.50.

This indicator’s values range between 0 and 100, with values above 70 suggesting that the asset is overbought and may soon witness a correction. Values below 30 indicate an oversold condition and hint at a possible rebound.

Read more: 13 Best Solana (SOL) Wallets To Consider in October 2024

SOL’s current RSI signals that the market has seen sustained buying pressure, which is driving the price higher. However, while not technically in overbought territory, the asset is close, which could mean that the price could face selling pressure soon.

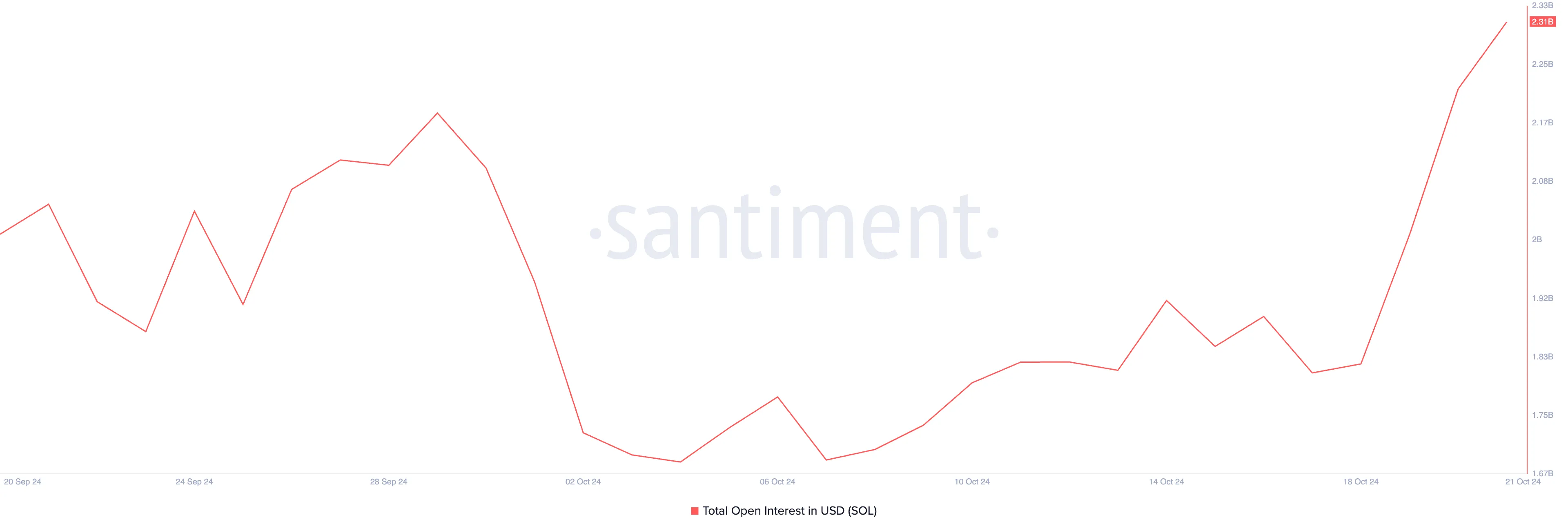

Nevertheless, over the past few days, Solana’s Open Interest has skyrocketed. As of this writing, it sits at $2.31 billion, having risen 29% since October 18. It currently sits at its highest level since August 1.

An asset’s open interest measures the number of outstanding derivative contracts (futures or options) that are currently active and have not been settled or closed. When it rises along with an asset’s price, it signals that the uptrend is strong and backed by significant market participation.

SOL Price Prediction: Coin May Surpass $200 Or Fall To $131

If a large portion of rising open interest consists of short positions (bets against the price), and the price continues to climb, it could trigger a short squeeze. However, this hasn’t been the case for Solana. Instead, the demand for long positions remains strong, as shown by its positive funding rate of 0.012% at press time.

Funding rates, which are periodic fees, help keep an asset’s contract price aligned with its spot price. A positive funding rate indicates that more traders are betting on a price rally rather than a decline.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

If this trend continues, Solana could break through the $171.74 resistance. Should momentum persist, the next significant level to watch is $186.32. A decisive move past this point could push the price toward $209.90, a level last seen in March.

However, profit-taking could dampen this bullish momentum, possibly pulling the price back toward $131.38.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/solana-on-the-verge-of-breakout/

2024-10-21 09:00:00