Solana (SOL) volume has risen to a three-month high of $8.33 billion following reports that Donald Trump is set to be announced the winner of the November 5 US presidential elections. This development also comes with a notable 11% price increase for the altcoin within the last 24 hours.

Will this significant increase have a greater effect on SOL’s price? This on-chain analysis checks whether the cryptocurrency’s value may continue to increase.

Interest in Solana Spike During US Elections

According to Santiment data, on November 5, before the elections began, Solana’s on-chain volume was less than $3 billion. However, as of this writing, the metric has risen by over 150%, indicating a notable increase in interest in the cryptocurrency

This rise also coincides with BeInCrypto’s forecast that the US elections could positively impact the price. At press time, Solana’s price has hit $183.84. From a trading perspective, when a cryptocurrency’s price rises alongside the volume, it means there is enough strength to buck the trend.

On the other hand, falling volume during an upswing suggests that the trend is weak and that the price can retrace. Thus, if Solana’s volume continues to rise alongside the price, then SOL could climb well above the current value.

Read more: How to Buy Solana (SOL) and Everything You Need to Know

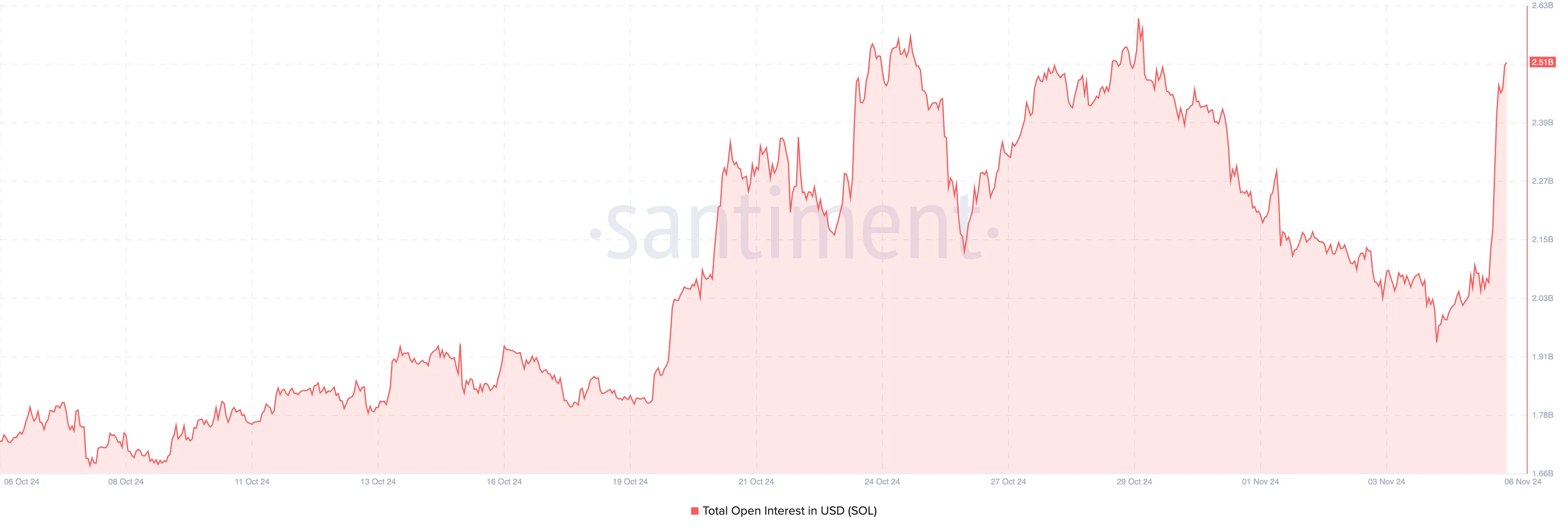

Besides trading volume, Solana’s Open Interest (OI) has also seen a significant uptick. Currently, the OI stands at $2.51 billion, marking its highest level since October 30. High OI is often a signal of strong momentum behind the current market trend, whether bullish or bearish.

On the other hand, a low OI indicates that fewer traders are actively involved in the market. Therefore, this increased OI reinforces the underlying price direction and makes it likely that the current trend will continue.

SOL Price Performance: Rally to Move Closer to $260

On the daily chart, Solana has formed a bullish flag pattern, a continuation setup that typically signals further upward movement after a brief consolidation. This pattern emerges when a strong upward price movement, or “flagpole,” is followed by a period of sideways or slightly downward action, forming a “flag” shape.

Following the bullish flag formation, SOL experienced a breakout above the flag’s upper trendline, which led to a notable rally. Should this trend remain the same, SOL’s price might break above the overhead resistance at $193.90.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

If that happens, the altcoin’s value could move much closer to the all-time high of $260. On the contrary, a decline below the $161.81 support and Solana’s volume might invalidate this thesis. In that scenario, SOL’s value could drop to $141.98.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/solana-volume-soars-amid-trump-win/

2024-11-06 12:00:00