SUI, the native token of the Layer-1 Move-programmed blockchain, reached an all-time high of $2.36 on October 12. However, significant selling pressure has prevented it from moving higher since then.

As buying momentum weakens further and bearish bias against the altcoin strengthens, SUI is poised to shed some of its recent gains in the near term. This analysis explains why this might happen.

Sui Loses Bullish Support

A look at the SUI/USD 1-day chart reveals that the token has broken below the lower line of the rising parallel channel it traded within for over one month. This channel is formed when an asset’s price moves between two parallel trendlines, sloping upward. It represents a bullish trend, where the price oscillates within the bounds of the upper and lower trendlines.

When an asset’s price breaks below the lower trendline of a rising parallel channel, it signals a potential bearish reversal or weakening of the upward trend. It suggests that the previous support level has been breached. Traders interpret this as a sign that buyers can no longer sustain the upward momentum, and sellers are gaining control.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

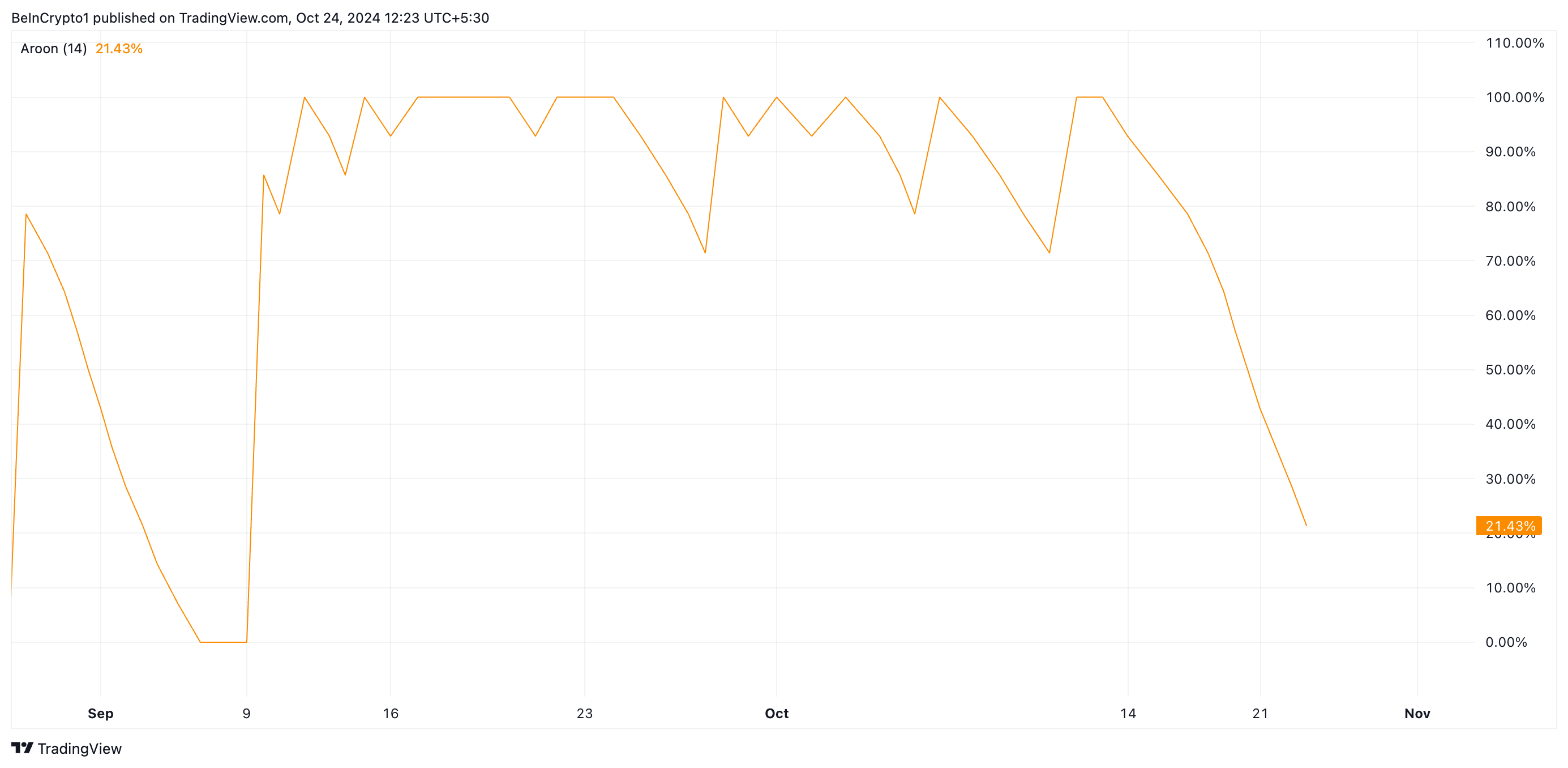

Furthermore, readings from SUI’s Aroon Up Line confirm this bearish outlook. At press time, this line is in a downward trend at 21.43%.

The Aroon indicator identifies the strength and direction of a trend. A reading of 21.43% on an asset’s Aroon Up Line signals that the market is transitioning from a strong uptrend. It reflects weakening bullish strength and hints at a potential for a sustained downtrend.

SUI Price Prediction: Sentiment Has to Shift for Any Rebound to Happen

SUI is currently trading at $2.02, having fallen below the lower trendline of its rising parallel channel, which provided support at $2.30. The next key support lies at $1.91, and if this level fails to hold, SUI could drop further to $1.64 — representing a 19% decline from its current price. If bulls cannot defend this level, the price may plunge to $0.87, where the next major support lies.

Read more: Top 11 Platforms To Trade the Cheapest Cryptocurrencies

However, a resurgence in demand for the altcoin could invalidate this bearish outlook. In such a scenario, SUI’s price would aim to reclaim its previous high of $2.36 and potentially rally beyond it.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/sui-price-drop-on-the-horizon/

2024-10-24 09:30:00