The Sui (SUI) token price, which increased by 30 within the last 30 days, has now dropped from the $3 mark, threatening newly accumulated gain. Yesterday, November 12, SUI price rallied to $3.30.

However, as of this writing, the altcoin’s value has dropped to $2.97. While holders might be hopeful that the SUI will shake off this decline, this analysis suggests that it could take some time before that happens.

Metrics Turn Bearish for SUI

Sui’s price decrease is in line with the broader market correction as the crypto market takes a breather following more than a week of gains. Based on BeICrypto’s findings, this decline could be linked to profit-taking from holders. However, there are other reasons for the slump.

Firstly, the Open Interest (OI), which measures the level of speculative activity around a cryptocurrency, jumped to 644.30 million on November 10. Today, the same value has tanked to $493.53 million.

Typically, the OI helps to confirm a trend’s strength. For context, rising open interest typically reinforces the trend, while declining open interest may indicate that the trend is weakening. Further, the significant decline in OI for the Sui token appears to be a key reason why the uptrend has recently lost momentum.

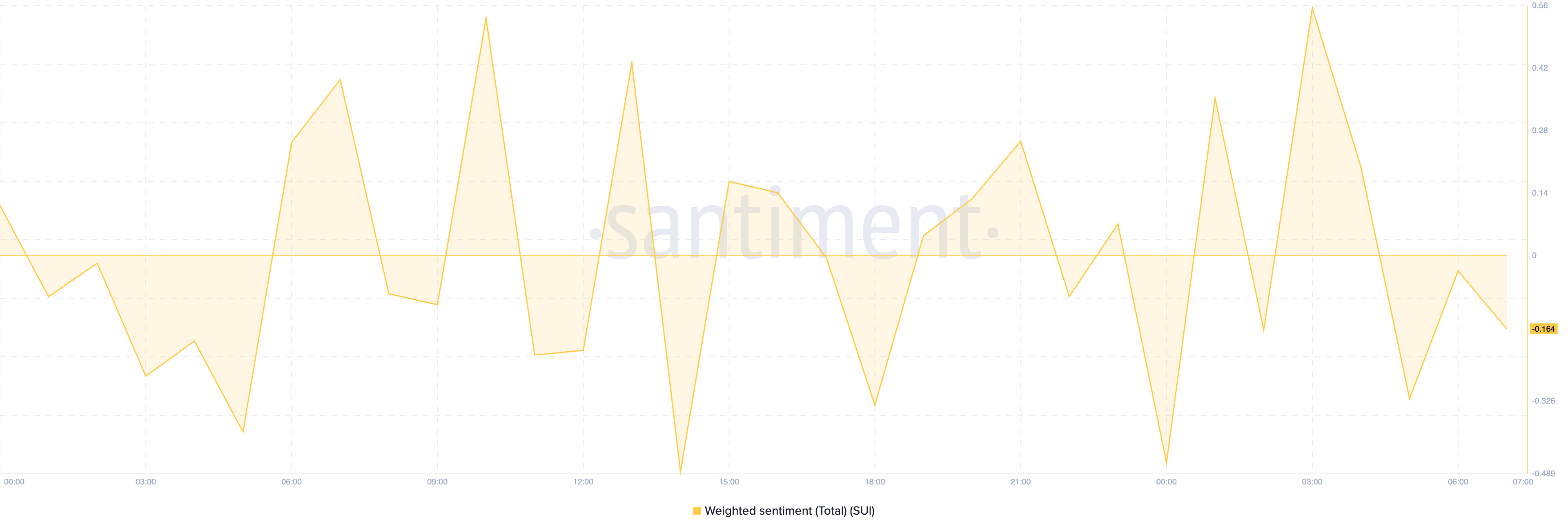

Besides the drop in OI, the Weighted Sentiment has dropped to the negative region. This metric tracks if there is a high level of mention around a blockchain or cryptocurrency. When it spikes to positive territory, it means that most remarks about the token are positive.

However, in this case, the decline implies that most comments about SUI are pessimistic. If this remains the same, the altcoin might find it challenging to see increased demand. Also, a decrease in demand means the Sui token price might fail to register a significant bounce.

SUI Price Prediction: Further Fall Possible

From a technical perspective, the 4-hour chart shows that the Bull Bear Power (BBP) reading has dropped to the negative region. The BBP is a technical oscillator that measures the strength of buyers and sellers across various timeframes.

When the reading is positive, it means that bulls have more buying power, and prices can increase. However, that is not the case with the SUI token price. Specifically, the drop in the reading indicates rising selling pressure by bears.

Should bears continue to sell, the SUI token price could decline further. Using the Fibonacci retracement indicator, the altcoin’s value might drop to $2.26 as long as selling pressure intensifies.

On the other hand, if SUI sees a notable rise in buying pressure, that could change. In that scenario, the token could bounce to $3.34.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/sui-token-price-rally-fades/

2024-11-13 08:30:00