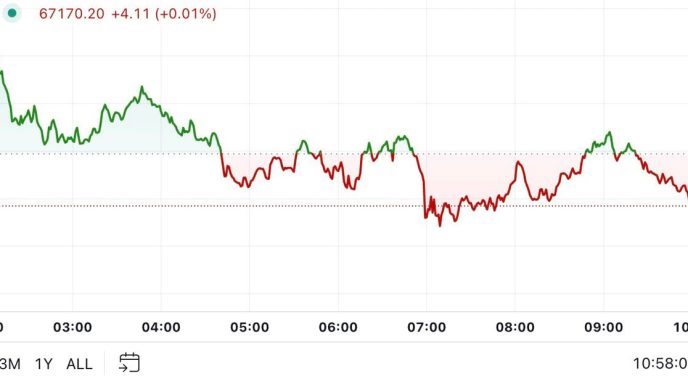

Bittensor (TAO) price has dropped by 6% in the last 24 hours, reversing the earlier trend where it closed in on $700 just days ago. This decline has ensured that TAO’s price is now below the $600 threshold.

With this condition, the altcoin may struggle to retain its current levels, as this analysis shows that it could soon break below $500. Here is why.

Bears Take Control of Bittensor’s Momentum

According to Santiment, the Weighted Sentiment for TAO has fallen into the negative region. This metric considers unique social volume, reflecting the crypto community’s overall perception of a project.

When the reading is positive, it signals that market participants are confident in potential short-term gains for a cryptocurrency. Conversely, a negative reading suggests that most are anticipating a bearish move.

At the time of writing, TAO’s sentiment reading stands at -0.026. This indicates a broadly bearish outlook for the altcoin, suggesting that demand for TAO could decline, and its price may continue to decrease.

Read more: How to Invest in Artificial Intelligence (AI) Cryptocurrencies

Another indicator suggesting that TAO’s price might decline is the 20-day Exponental Moving Average (EMA). The 20 EMA is calculated by averaging the asset’s prices over the past 20 trading days, giving more weight to the most recent prices and making it more responsive to recent price movements.

When the price is above the EMA, the trend is bullish. However, as soon as the price drops below the threshold, the token undergoes a correction. For instance, when a similar thing happened around July 31, TAO’s price dropped by 32% within three days.

On August 28, the token fell below the 20 EMA, and by September 6, it had lost 25% of its value. If TAO drops below this threshold again, it could face a double-digit correction.

TAO Price Prediction: Sharper Decline

On looking critically again at the daily chart, BeInCrypto observes that the Moving Average Convergence Divergence (MACD) has turned negative. The MACD is primarily a technical oscillator used to measure momentum and trade trends.

When the MACD is positive, it signals bullish momentum, suggesting that price could rise. Conversely, a negative MACD reading points to bearish momentum. In TAO’s case, the MACD shows that the 12-day EMA (blue) crossed below the 26-day EMA (orange), indicating that sellers are in control and reinforcing the bearish sentiment.

Read more: Top 9 Safest Crypto Exchanges in 2024

If this remains the same, TAO’s price might sink below the 38.2% support floor and hit $452.30. On the contrary, the altcoin could bounce if bulls ensure that it does not drop below the support. Should that happen, TAO might jump to $648.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/bittensor-tao-price-may-tumble/

2024-10-17 12:00:00