FTT, the native token of the bankrupt crypto exchange FTX, is leading market gains today, surging by double digits in the past 24 hours.

This rally comes as the market awaits the commencement of FTX’s court-approved Chapter 11 Plan of Reorganization on January 3.

FTX To Commence Reorganization Plan in January, FTT Climbs

In a recent press release, the now-defunct exchange FTX confirmed January 3 as the effective date for the commencement of its court-approved Chapter 11 Plan of Reorganization. According to the press release, the first tranche of reimbursements will occur within 60 days of this effective date.

With less than 10 days till this date, trading activity around FTT has begun to surge. As of this writing, the altcoin trades at $3.21, climbing by 14% over the past 24 hours. This double-digit rally has made it the market’s top gainer during that period.

Moreover, FTT’s price hike has led to an uptick in the profitability of its transactions. BeInCrypto’s assessment of its on-chain performance has revealed that the ratio of FTT’s on-chain transaction volume in profit exceeds that in loss.

Per Samtiment, this currently stands at 7.22. This means that for every FTT transaction that has ended in a loss today, 7.22 transactions have returned a profit.

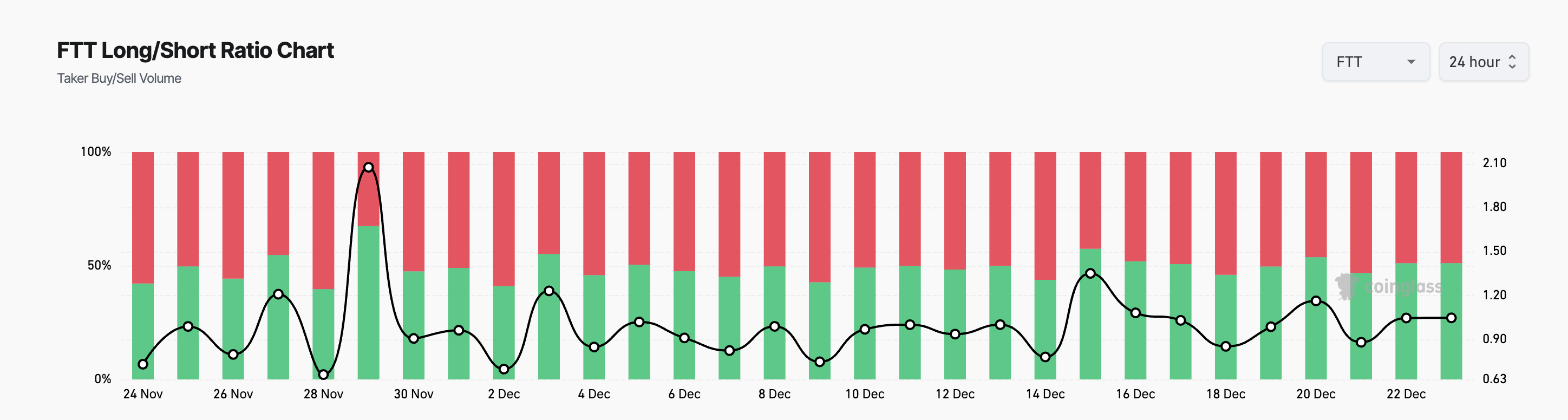

Further, as January 3 draws near, FTT holders have opened more bets in favor of a sustained price rally. Its Long/Short Ratio reflects this. As of this writing, this stands at 51.15%.

This ratio measures the proportion of traders with long positions (expecting prices to rise) against short positions (expecting prices to fall) in a market. FTT’s long ratio of 51.15% means that slightly more traders are betting on price increases than decreases, indicating a mildly bullish sentiment.

FTT Price Prediction: What To Expect?

The FTT token price rally has propelled it above the resistance formed at $3.29. If buying pressure strengthens, the token’s price will breach its next resistance at $3.78 and attempt to reclaim its one-year high of $4.40.

However, a failed attempt to rally past the $3.78 price mark could cause the FTT token price price to initiate a downward trend. In that scenario, the altcoin’s price may fall to $2.95.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ftt-token-price-extend-uptrend-short-term/

2024-12-23 12:30:00