Immutable (IMX) is the newest victim in the latest salvo from US regulators targeting cryptocurrency firms. The blockchain gaming platform revealed that it received a Wells notice from the US Securities and Exchange Commission (SEC).

It adds to the list of Wells Notices issued this year, with the agency’s enforcement regulation still being a contentious issue in the crypto industry.

Immutable Challenges SEC’s Wells Notice

In a statement on Thursday, Immutable accused the SEC of overreach after receiving a Wells Notice. Citing unfair regulation, the blockchain gaming platform described the notice as part of a broader regulatory push that is squeezing the crypto industry. It added that the agency’s actions appear to be part of a “regulation-by-enforcement” strategy targeting crypto companies but offering no clear compliance framework.

“With this action, the SEC is continuing to indiscriminately assert that tokens are securities,” a paragraph in the statement read.

The allegations center on whether its 2021 IMX token listing and sales constitute securities violations. Immutable, however, has contested the SEC’s claims, arguing that the IMX token does not meet the definition of a security.

Read more: What Does It Mean To Receive a Wells Notice From the SEC?

Specifically, Immutable challenged the SEC’s claims that they may involve inaccurate interpretations of statements it made in 2021 regarding the IMX token’s pre-launch pricing. The firm also slammed the SEC for a “one-size-fits-all” approach. Nevertheless, the notice signals potential enforcement action against Immutable.

The SEC reportedly issued a Wells Notice to Immutable following an initial meeting with the company’s legal team — a move the company described as unusual. According to Immutable, such notices typically come after a series of detailed discussions, allowing time for a comprehensive evaluation. Immutable noted that the notice provided “fewer than 20 words of meaningful explanation,” prompting the company to question the SEC’s decision-making process.

“To manufacture a case on a listing that occurred in 2021, with practically no direct communication with the company, is precisely the reason the industry is so skeptical of any attempts from this SEC to argue it is attempting to provide clarity,” Immutable CEO James Ferguson noted.

Immutable criticized the SEC’s allegations as broad and vague, with CEO James Ferguson suggesting that meaningful discussions could have clarified many ambiguities now surrounding the case. Despite these legal hurdles, Immutable reaffirmed its commitment to the blockchain gaming sector and emphasized it will defend its practices vigorously.

“We are prepared to defend the rights of builders, creators, and gamers…we will keep building even in the face of regulatory pressure,” the firm concluded.

In the aftermath of this news, the IMX token is down by a stark 13.29% to trade for $1.18 as of this writing.

Crypto Crackdown Intensifies Ahead of US Elections

Meanwhile, this Wells Notice adds to a growing list of enforcement moves against crypto companies, with the SEC’s increased scrutiny of digital assets prompting a wave of legal defenses across the crypto sector.

Earlier in October, popular exchange Crypto.com launched a lawsuit against the SEC after receiving a similar Wells notice. The company claimed that the SEC was overstepping its regulatory authority by classifying various digital tokens as securities without sufficient basis. Similarly, Uniswap and NFT marketplace OpenSea also recently received Wells Notices.

The trend passes as an attempt to regulate the sector without establishing a formal rulebook. On this account, Blockchain Association, an advocacy group, noted in a recent report that the SEC has filed 104 enforcement actions against crypto entities since the beginning of 2023. Based on the report, these crackdowns saw these companies “waste” approximately $426 million in legal defense fees.

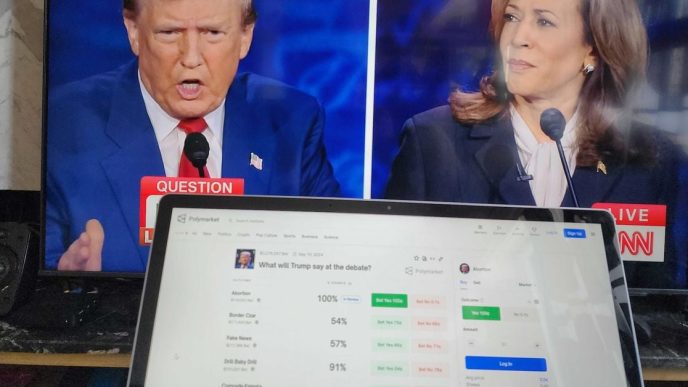

The regulator’s enforcement drive comes at a politically sensitive time, just ahead of the 2024 US presidential election. Some speculate that regulators are tightening their stance on crypto companies as a way to demonstrate heightened scrutiny of digital assets to the public. However, this regulatory push may also heighten industry demands for legislative action to clarify compliance standards for digital assets.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

As the SEC’s enforcement actions expand, Immutable’s case could become a touchstone in the broader debate over crypto regulation. For now, the blockchain gaming firm is digging in for a legal fight.

“We’re ready to do our part, join the companies fighting for crypto, and defend digital ownership in gaming,” Immutable co-founder Robbie Ferguson said.

This standoff with the SEC highlights the pressing need for clearer compliance guidelines that balance consumer protection with innovation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/immutable-gets-sec-wells-notice/

2024-11-01 07:38:32