The modular blockchain network Celestia will conduct the large token unlock in October, with a massive $1 billion worth of TIA set to be released. Many of its holders have begun selling their tokens before this event.

If selling pressure intensifies, TIA’s price may fall by 30%. This analysis delves into what you need to know as the unlock date approaches.

Celestia Traders Offload Tokens

Token Unlocks data shows that on October 30, Celestia will release 175.56 million TIA tokens, valued at approximately $1 billion, which constitutes 81.86% of the circulating supply. These tokens will be distributed among early supporters, seed investors, and core contributors.

The anticipation of a large token unlock event such as this can often create uncertainty and negative sentiment among investors, leading them to sell their holdings before the event. This has been the case with TIA, which has witnessed a spike in selling pressure over the past week.

TIA trades at $5.12, noting an 18% price decline over the past week. This makes it the biggest loser among the top 100 cryptocurrencies by market capitalization during this period. The token’s plummeting Relative Strength Index (RSI) confirms the decline in TIA’s demand over the past few days.

Read more: 10 Best Altcoin Exchanges In 2024

This indicator measures an asset’s overbought or oversold conditions. It ranges from 0 to 100, with values above 70 indicating that the asset is overbought and likely to face a decline, while values below 30 suggest it is oversold and may be due for a rebound.

At 46.42, TIA’s RSI shows that selling activity currently outweighs buying pressure, but it does not yet signal extreme conditions. This middle-range reading suggests that the market is relatively neutral, though leaning toward selling pressure.

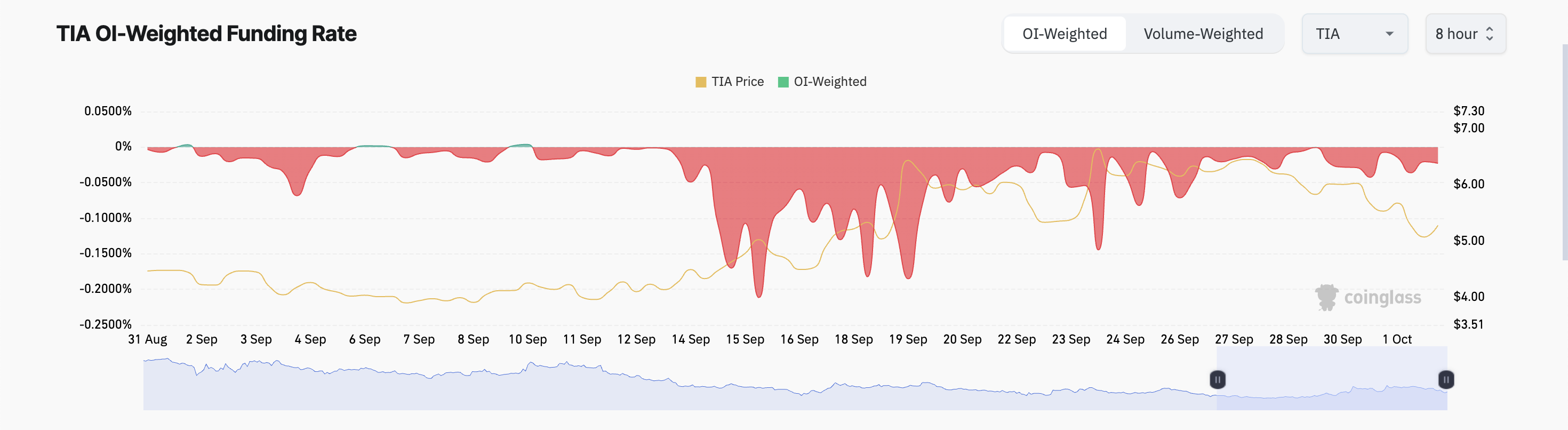

Furthermore, TIA’s negative funding rate reflects the bearish bias. This stands at -0.022% at press time, indicating that futures traders are betting on its continued price decline.

TIA Price Prediction: 30-Day Low on the Horizon

A negative funding rate suggests that more traders are betting against the asset (short positions) than for it (long positions). This puts downward pressure on the asset’s price, reflecting a lack of confidence in price appreciation.

Read more: Which Are the Best Altcoins To Invest in October 2024?

If selling pressure persists, TIA’s price will fall 30% to trade at $3.72, a low it last reached on September 4. However, if it sees a shift in market sentiment from bearish to bullish, and a spike in demand follows, TIA’s price will climb toward $10.37.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/tia-price-may-slip-further/

2024-10-02 23:00:00