Telegram-linked Toncoin (TON) has shed almost 10% of its value over the past week and continues showing signs of market weakness. Its downward trend has pushed its price toward the lower line of its horizontal channel, forming a crucial support floor since March.

The token’s technical setup hints at the possibility of another double-digit decline soon if the support level fails to hold. This analysis delves into what TON holders need to know.

Toncoin Traders Look the Other Way

Toncoin’s funding rate has remained predominantly negative recently, signaling traders’ lack of confidence in a near-term price rebound. As of this writing, this stands at -0.0068%.

The funding rate refers to the periodic fee paid to ensure that an asset’s contract price stays close to its spot price. Put simply, it represents the cost of holding a long or short position over a specific period.

A negative funding rate means more traders are shorting the asset than going long. This can put downward pressure on the price as these traders are incentivized to sell to reduce their exposure.

Read more: What Are Telegram Bot Coins?

TON’s falling price, combined with its negative funding rate, can create a self-reinforcing cycle where the falling price leads to more shorting, pushing the value down further.

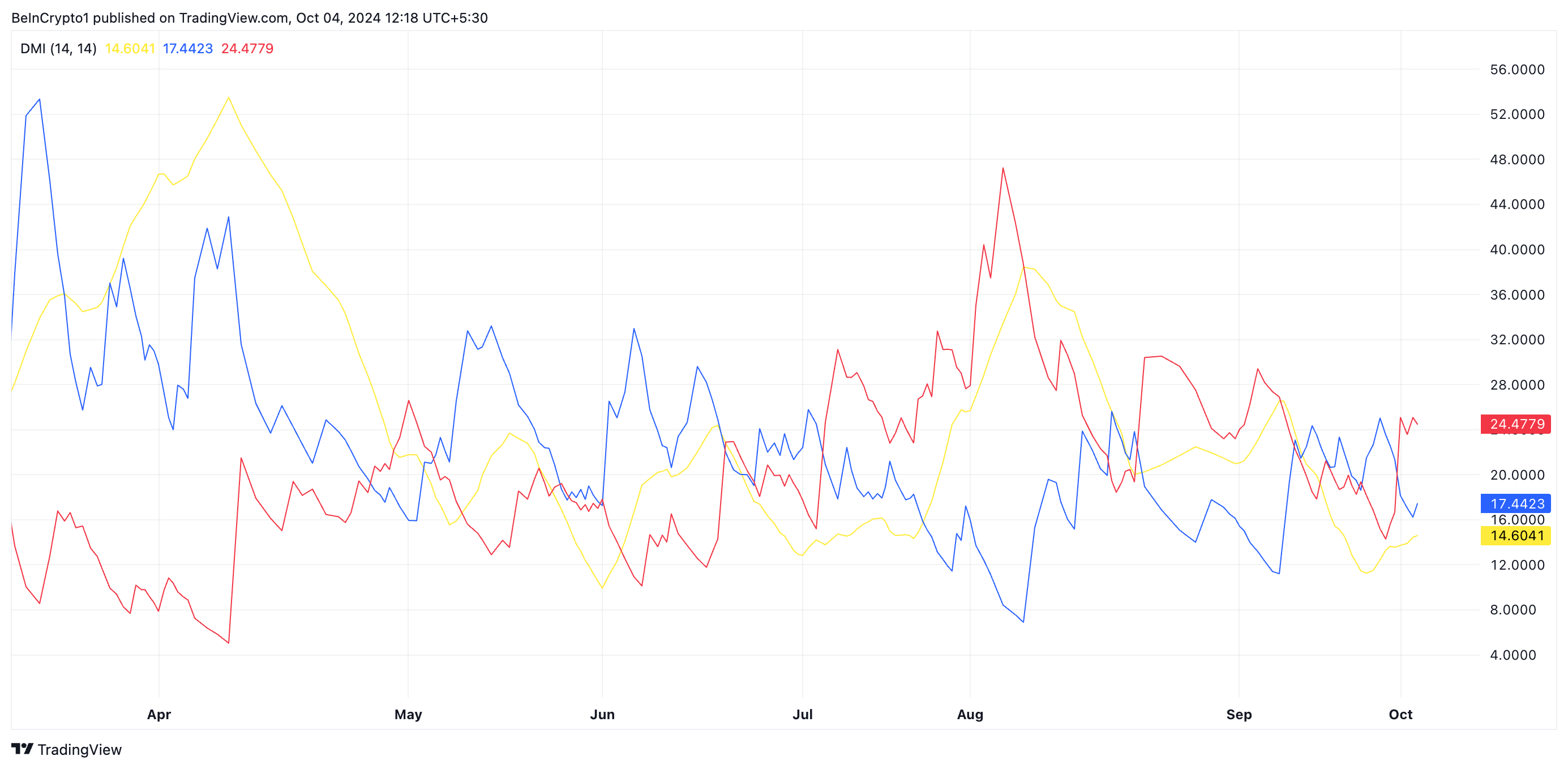

Moreover, an assessment of buying and selling pressures in the TON market reveals the balance of power in favor of the bears. Readings from the token’s Directional Movement Index (DMI), which measures strength, show TON’s positive directional indicator (blue) below its negative directional indicator (red).

When set up this way, the asset is witnessing more downtrends than upward movements. Traders view this as a bearish signal, suggesting that sellers are stronger than buyers.

TON Price Prediction: Will History Repeat Itself?

At press time, TON trades at $5.34 and trends toward the lower line of its horizontal channel, which has formed support since March. It fell to this line in early September but failed to break below it as the bulls could defend it.

If this repeats, Toncoin’s price will reverse its course and rally toward resistance at $7.96.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

However, if the support level fails to hold, the price will plummet by 17% to a monthly low of $4.43, thereby invalidating the bullish projection above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/toncoin-price-may-drop-further/

2024-10-04 10:00:00