Hyperliquid (HYPE) has faced a lack of bullish momentum since the start of the year. Despite brief rallies, it has struggled to break through key resistance levels.

Enthusiasts remain optimistic, especially since the token distancing itself from Bitcoin’s broader trends positions HYPE for potential future gains.

HYPE Has A Shot At Breakout

Despite the recent lack of price action, HYPE’s funding rate remains positive, signaling traders’ continued optimism. Many traders have maintained long contracts, anticipating a price recovery. This positive sentiment is crucial for supporting a potential rally and preventing the token from seeing significant declines in the near term.

This optimism suggests that HYPE’s traders are confident about its potential for upward movement, even though the token has been underperforming. The persistence of long positions also shows that traders are betting on a rebound. If this sentiment is sustained, it could help HYPE maintain a stable price floor and set the stage for future growth.

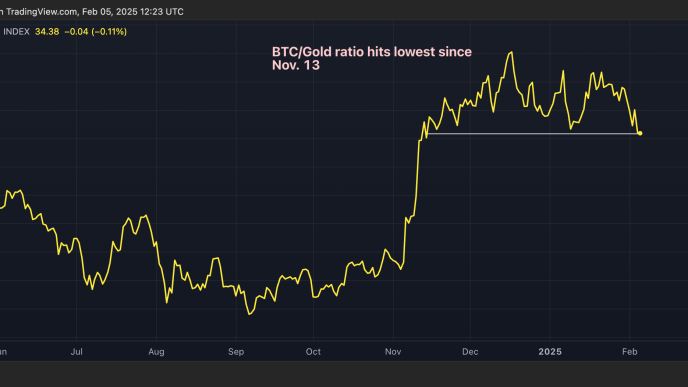

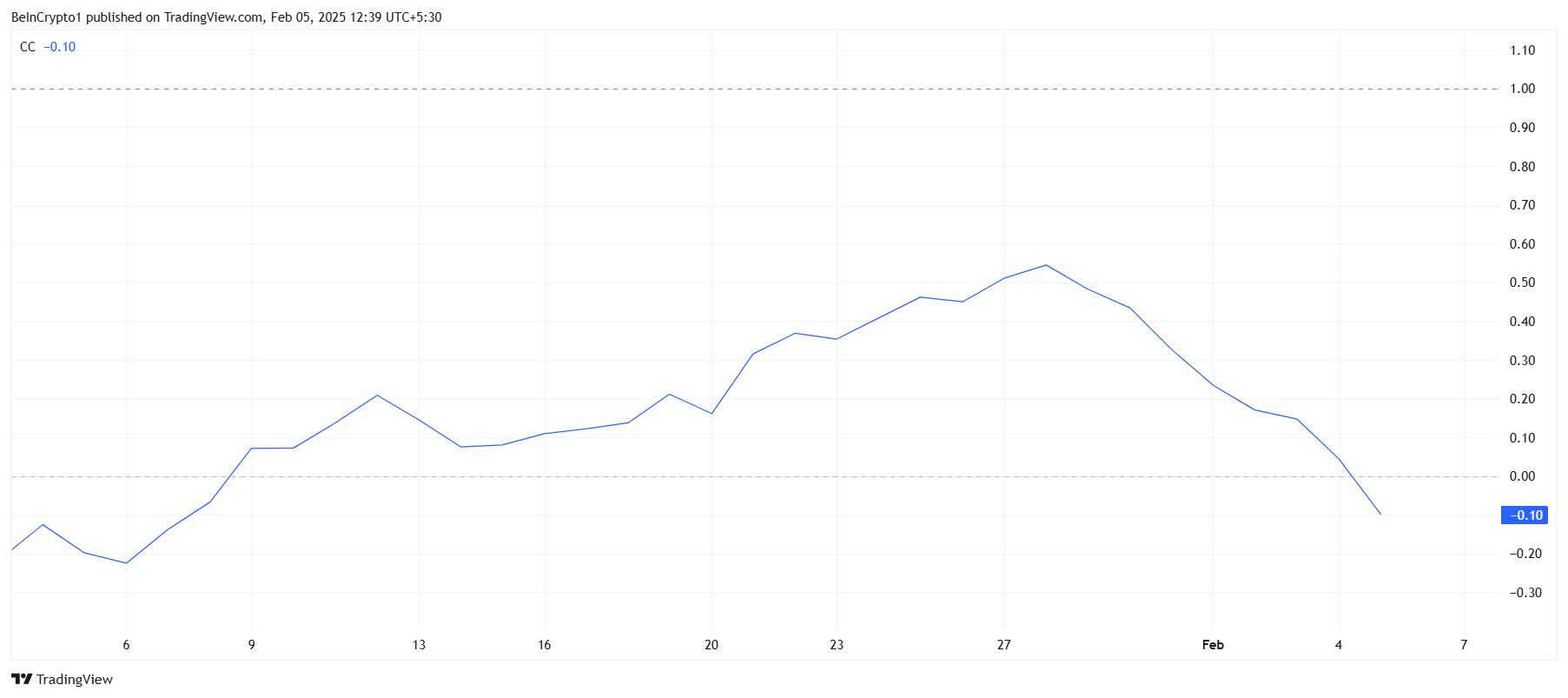

HYPE’s correlation with Bitcoin has been negative, which adds complexity to its market outlook. While Bitcoin has been struggling to maintain support above $100,000, it still presents a bullish outlook. However, HYPE’s decoupling from Bitcoin means that it may not capitalize on Bitcoin’s potential rally, especially with the recent decline in correlation.

The weakening of this correlation could make HYPE more vulnerable to corrections, as its price may not be as responsive to Bitcoin’s moves. If Bitcoin continues to show strength, HYPE’s lack of correlation could lead to further struggles, hindering its ability to break past crucial resistance levels.

HYPE Price Prediction: New High In Sights

HYPE has been stuck in a consolidation range since the beginning of 2025, oscillating between $19 and $27. This range-bound trading suggests that the altcoin is waiting for a breakout. A push above $27 could signal the start of a rally, but the lack of momentum has kept it from making significant gains.

A potential rise toward $32 is within reach if HYPE manages to breach $27 and hold above that level. Achieving this would mark progress toward breaking the all-time high (ATH) of $42, with a 63% rise needed to reach that level. If $32 becomes a support floor, a new ATH could be in sight.

However, if HYPE fails to breach $27 and instead loses support at $23, the price could fall back to $19, continuing its consolidation. This would invalidate the bullish outlook and signal that HYPE may need more time to recover and gather momentum for a more significant rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/hype-traders-hold-hope-upcoming-rally/

2025-02-05 12:30:00