VIRTUAL, the native token of the decentralized platform for the creation and monetization of AI agents Virtuals Protocol, climbed to an all-time high of $2.39 during Friday’s early Asian session. While it has since eased by 5%, the VIRTUAL token price remains up 18% in the past 24 hours.

The altcoin currently ranks as the market’s top gainer during the review period and appears poised to extend its gains.

VIRTUAL Witnesses Spike in Trading Activity

VIRTUAL’s double-digit rally has been matched by a surge in trading activity, with volume climbing to $228.71 million — a 13% increase in 24 hours.

When a surge in trading volume accompanies an asset’s price rally, it indicates interest and broad participation amongst market participants. Also, higher volume during a rally suggests that the price increase is supported by actual demand rather than speculative activity.

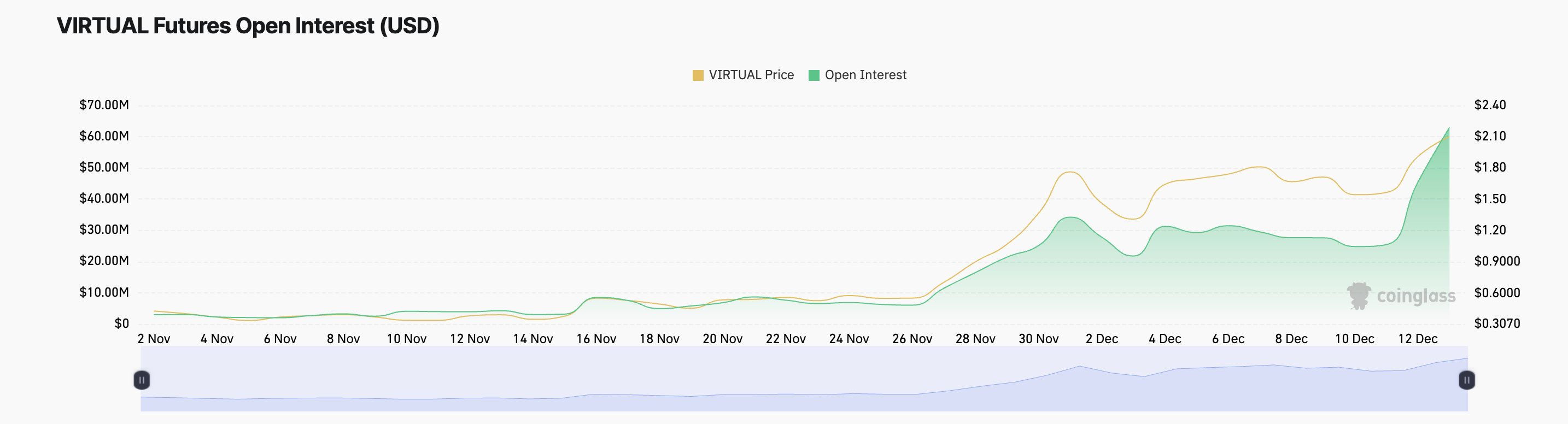

Moreover, the spike in VIRTUAL’s open interest confirms the surge in trading activity. As of this writing, this sits at an all-time high of $63 million, having rocketed by 48% over the past 24 hours.

Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not yet been settled or closed. When open interest climbs during a price rally, new positions are created as more traders enter the market.

This rise signals that the price rally is backed by increasing market participation and could suggest the potential for continued price momentum.

VIRTUAL Price Prediction: Buyers Remain in Control

On the daily chart, VIRTUAL’s Elder-Ray Index supports this bullish outlook. At press time, the indicator is significantly above the zero line at 1.04.

This indicator measures the strength of bullish and bearish pressure in the market by analyzing price movements against a moving average. A positive Elder Ray Index indicates buyers are in control, with the current price exceeding the moving average. This suggests bullish momentum and the potential for further upward movement.

If VIRTUAL maintains its uptrend, it will reclaim its all-time high of $2.39 and rally past it. On the other hand, profit-taking activity could drive the VIRTUAL token price down to $1.83, invalidating the bullish projection above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/virtual-surges-to-all-time-high/

2024-12-13 09:30:00