XRP’s muted reaction over the past few weeks has presented a buying opportunity. On-chain data shows that the altcoin is undervalued, and some investors may want to “buy the dip.”

However, the asset’s technical setup suggests that the downturn is far from over.

Ripple May Look Attractive, But There Is a Catch

XRP has shed almost 10% of its value in the last month. This price drop has led to a negative market value to realized value (MVRV) ratio, suggesting that the seventh crypto asset by market capitalization may be undervalued.

As of now, XRP’s 30-day and 90-day MVRV ratios are -3.85 and -2.66, respectively. These figures indicate that the current price is lower than the average cost of all XRP tokens in circulation, making the altcoin an attractive option for traders looking to buy at a lower price than its historical cost basis.

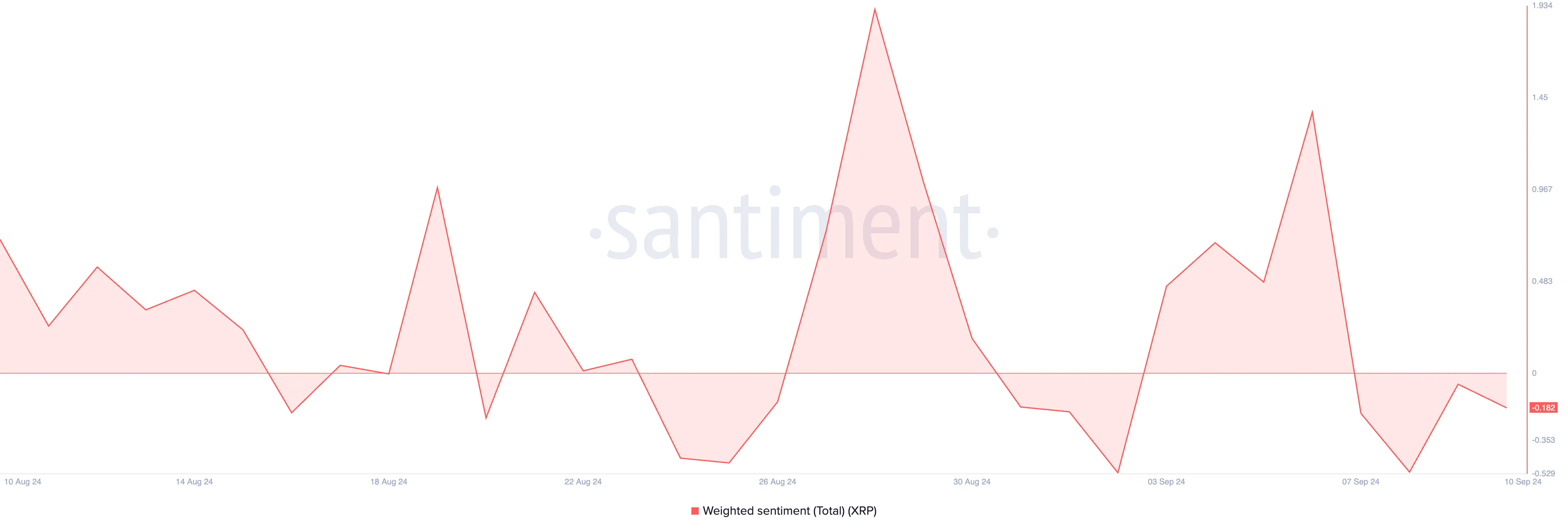

However, XRP is not out of the woods yet. The asset continues to face negative sentiment, as reflected by its weighted sentiment score, which currently stands at -0.18.

When the value of an asset’s weighted sentiment is below zero, most social media discussions are fueled by negative emotions like fear, uncertainty, and doubt. In a downtrend, it hints at a continued decline.

Read more: 10 Best Altcoin Exchanges In 2024

XRP Price Prediction: Token Aims For New Low

Ripple’s technical setup reinforces the bearish outlook. The Elder-Ray Index (ERI), which tracks buying and selling pressure, shows that selling pressure has dominated the XRP market since August 27, with only negative values recorded. This indicates that sellers are outpacing buyers.

Additionally, XRP’s Directional Movement Index (DMI) shows the positive directional indicator (blue) sitting below the negative directional indicator (red). This setup confirms stronger selling pressure, signaling that the market remains in a downtrend.

Read more: How To Buy XRP and Everything You Need To Know

If XRP’s price decline continues, it risks losing support at $0.45, potentially dropping to $0.38. However, if the market sentiment shifts from negative to positive, XRP’s price could rise and target $0.65.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/xrp-buy-signal-may-hurt-your-investments/

2024-09-11 17:43:45