Ripple’s XRP has been consolidating within a symmetrical triangle for the past month. Recent market gains have pushed its price closer to the upper line of this channel, suggesting a potential breakout.

If this breakout is successful, XRP’s price might reach $0.70, a price high last recorded in March.

Ripple Attempts a Rally Above Resistance

When an asset trades within a symmetrical triangle, it signals a period of consolidation or market indecision, where its price fluctuates between two converging trend lines, forming resistance and support levels. Currently, XRP is trading at $0.58, just below the key resistance at $0.60.

Read more: XRP ETF Explained: What It Is and How It Works

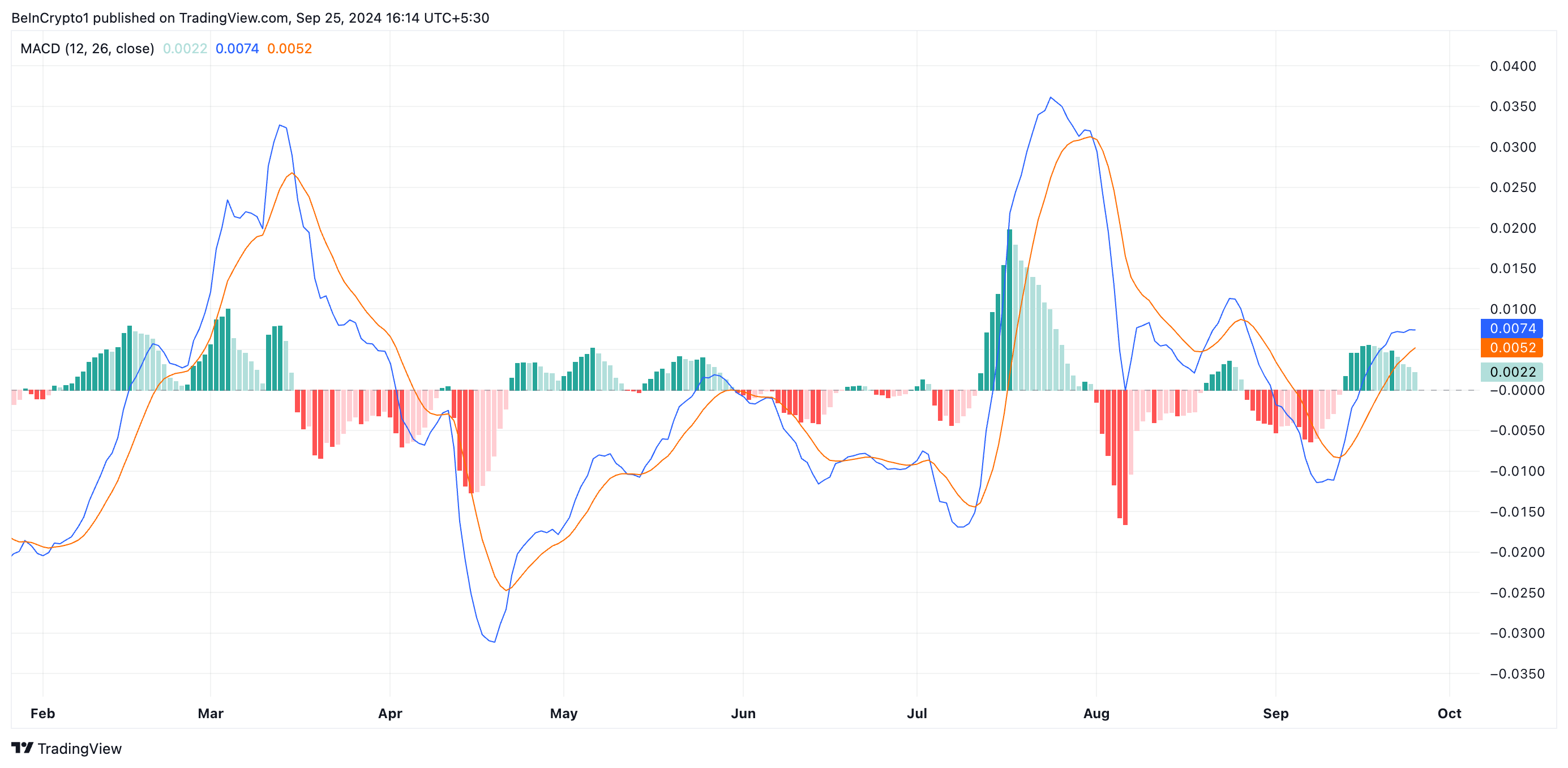

A breakout above this resistance would indicate that XRP bulls have overpowered bearish forces, confirming the potential for further price gains. The token’s moving average convergence/divergence (MACD) indicator, which identifies changes in its price trends, suggests that such a breakout could happen in the near term.

Currently, XRP’s MACD line (blue) is positioned above both its signal line (orange) and the zero line, indicating that the token’s short-term momentum is outpacing its long-term momentum. This bullish signal is often interpreted as a sign to exit short positions and enter long trades on an asset.

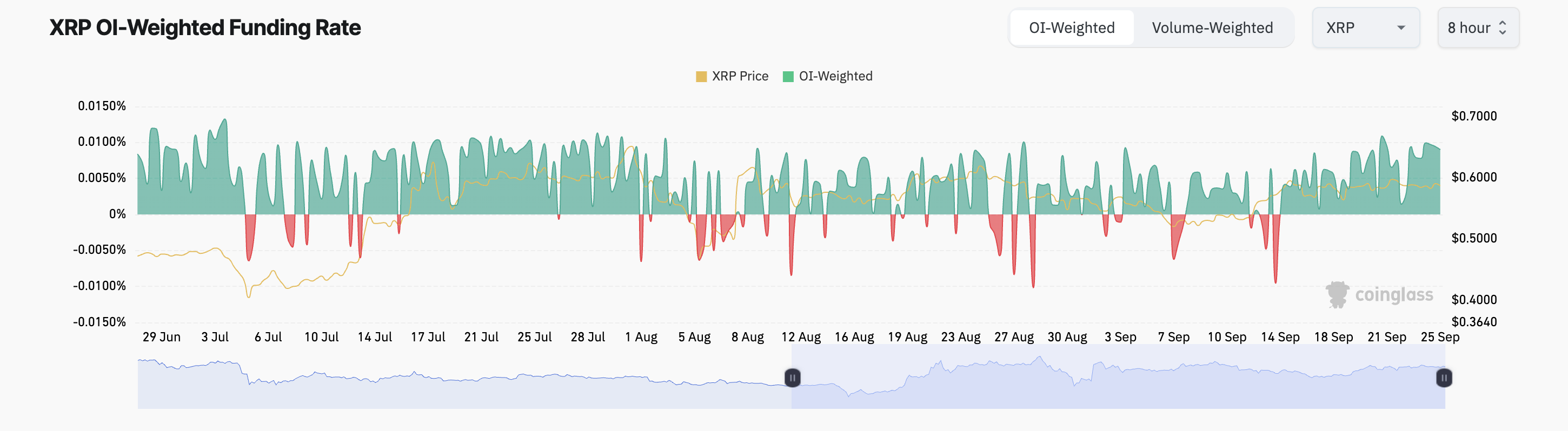

Additionally, the current streak of positive funding rates recorded by XRP is another reason why its price may soon touch $0.70. At press time, the token’s funding rate is 0.0090% and has returned only positive values since September 14.

A positive funding rate generally indicates that the demand for long positions exceeds short ones, reflecting strong market confidence in the potential for a continued price rally.

XRP Price Prediction: Will History Repeat Itself?

XRP’s recent rally has pushed its price above the 20-day exponential moving average (EMA). When an asset’s price crosses above this moving average, it signals that buying pressure is strong enough to surpass the average price from the past 20 days, indicating growing upward momentum. This suggests XRP is gaining strength, and its price could continue to rise.

If XRP maintains this uptrend, it could break above the upper trendline of the symmetrical triangle pattern. Continued accumulation could lead to an additional 23% price increase, bringing XRP to $0.73.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

However, if the breakout attempt fails, XRP risks a potential drop to $0.56, repeating previous patterns.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/xrp-price-ready-for-breakout/

2024-09-25 14:29:47