As the crypto market gears up for its traditional “Uptober” surge, XRP’s participation remains uncertain. The threat of an SEC appeal against the July 2023 ruling in favor of Ripple could result in a double-digit decline in XRP’s price.

This analysis delves into what may happen.

Ripple May Not Rally in October

In a post on X, FOX Business journalist Eleanor Terrett noted that a former SEC lawyer informed her that the regulator plans to appeal Judge Analisa Torres’ July 2023 ruling on Ripple’s programmatic sales of XRP.

In July 2023, Judge Torres ruled that Ripple’s programmatic sales of XRP did not amount to unregistered securities offerings. The SEC filed a Motion for Interlocutory Appeal in August of the same year, seeking the court’s approval to challenge the ruling.

However, Judge Torres denied the motion in October 2023, asking the regulator to wait until the final judgment before filing an appeal. The final judgment was issued on August 7, 2024, with the judge levying a $125 million penalty against Ripple Labs for selling its XRP token without proper registration.

According to Terret, the regulator believes the ruling is incorrect “and should be appealed.”

All Rests With the SEC

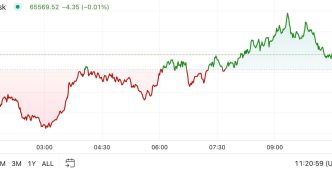

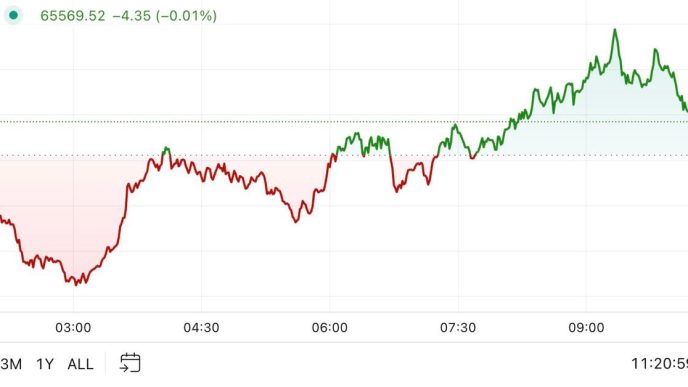

The SEC has until October 7 to file an appeal, a decision which may result in XRP shedding its recent gains. In fact, the token’s technical setup suggests that the talks of this SEC appeal may have already prompted some investors to start selling their XRP holdings.

The asset’s negative Balance of Power (BoP) supports this outlook. This indicator, which measures the strength of buyers versus sellers in a given market over a specific period, is below zero at press time, at -0.03. Sellers have more control over the market when an asset’s BoP is negative.

Read more: Everything You Need To Know About Ripple vs SEC

Further, the readings from XRP’s Parabolic Stop and Reverse (SAR) indicator do not inspire much confidence. At press time, the dots of this indicator rest above the token’s price, signaling a downward momentum in the market.

It suggests that XRP’s price may soon initiate a downtrend, and traders view it as a signal to sell their holdings or avoid taking long positions.

XRP Price Prediction: A 21% Drop Is Possible

XRP may buck the anticipated October uptrend if the SEC decides to file an appeal. The price decline may already be underway, with market sentiment already turning bearish.

If selling pressure wanes further, XRP’s price may drop by 21% to trade at $0.46.

Read more: 10 Best Altcoin Exchanges In 2024

However, this bearish projection will be invalidated if the bulls re-emerge and buying activity gains momentum. It may send XRP’s price up toward $0.74.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/xrp-price-drop-21-in-october/

2024-09-27 11:19:25