Ripple’s (XRP) price has recently regained the crucial $0.55 support level after briefly losing it on Sunday. If this recovery is supported by increased buying pressure, it could boost XRP’s chances of reaching higher price levels.

However, on-chain indicators suggest that this scenario might not play out as expected. As the price struggles to maintain its position above this critical threshold, the outlook for XRP remains uncertain.

Low User Engagement Undermines Ripple’s Uptrend

As of this writing, XRP trades at $0.56. However, the token’s Daily Active Addresses (DAA) divergence has dropped to -18.62%, indicating a decline in user engagement as the price rises.

This metric is crucial for spotting buy and sell signals, as it reflects whether user activity is supporting the price movement. A positive DAA divergence suggests sustained price growth backed by active participation, while a sharp decline, like the one observed, implies low network activity.

This suggests XRP may struggle to maintain its current price unless more addresses start interacting with it.

Read more: How to Buy XRP and Everything You Need To Know

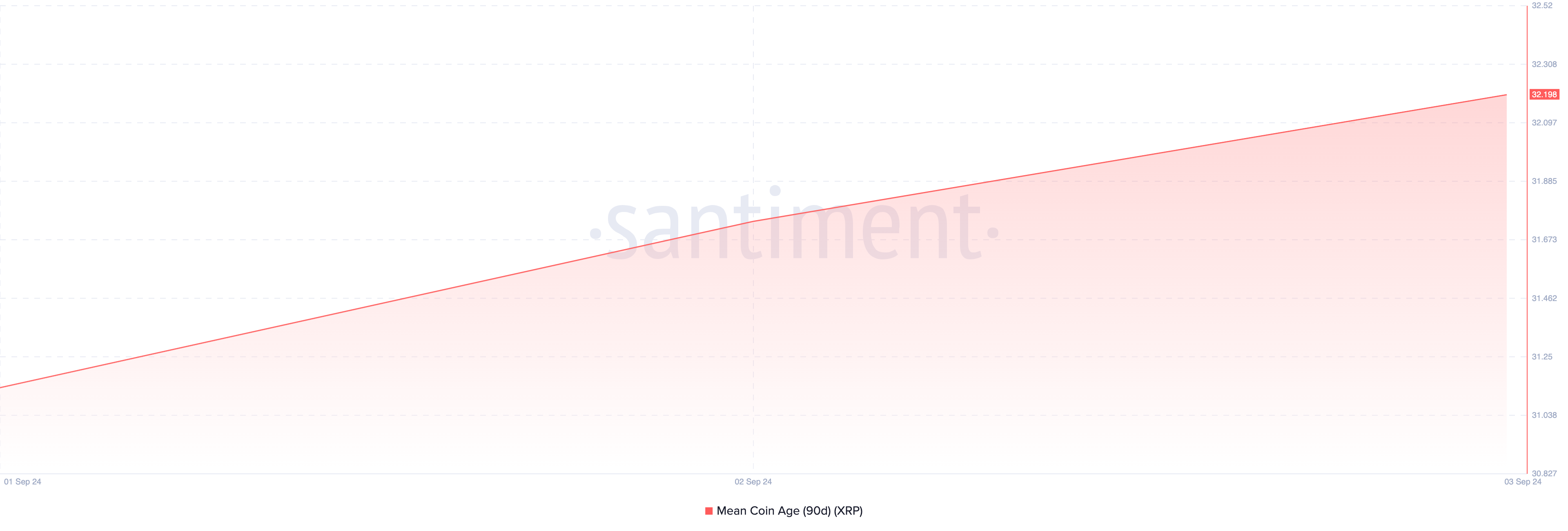

Contrary to the steep fall of the divergence mentioned above, the Mean Coin Age (MCA) spiked. As the name implies, the MCA is the average age of all tokens on a blockchain. However, it does not end there; it also shows whether long-term holders are moving their assets into circulation or HODLing them.

Typically, a low reading suggests that participants are retiring tokens into cold wallets. However, the 90-day MCA for XRP increased, suggesting a rise in the number of tokens allocated for trading. If this number continues to rise, the token might face selling pressure, which could also drag the price down.

XRP Price Prediction: Bearish Reversal Looms

A close look at the daily chart reveals that XRP encountered significant selling pressure as it approached $0.61. Although it has since rebounded from the drop to $0.54, it may face resistance as it attempts to reach $0.57.

Additionally, the Relative Strength Index (RSI) failed to break above the neutral line, indicating that bearish momentum persists and could drive the price lower.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

If this trend continues, XRP might target $0.52. However, if it holds above $0.55, it could surpass $0.57 and aim for $0.61 again.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/ripple-xrp-price-flashes-sell-signal/

2024-09-03 14:58:11