Solana-based meme coin dogwifhat (WIF) has experienced a sharp downturn over the past week. It has shed 33% of its value during that period and currently trades at a February 2024 low.

On-chain and technical indicators confirm the weakening demand for the meme coin, suggesting its decline may continue in the short term.

WIF’s Declining Demand Signals Bearish Outlook

An assessment of the WIF/USD one-day chart reveals that the token’s On-Balance-Volume (OBV), a key indicator of buying and selling pressure, has continued to drop, reflecting diminishing demand for the meme coin. At press time, it is at -398.94 million, falling by 285% in just seven days.

A falling OBV like this indicates that selling pressure outweighs buying pressure. It means more traders are offloading the asset than accumulating it.

When an asset’s OBV falls while its price declines, it reinforces bearish sentiment and the likelihood of further losses. This suggests weakening demand for WIF and signals a potential downtrend or continuation of its existing price drop.

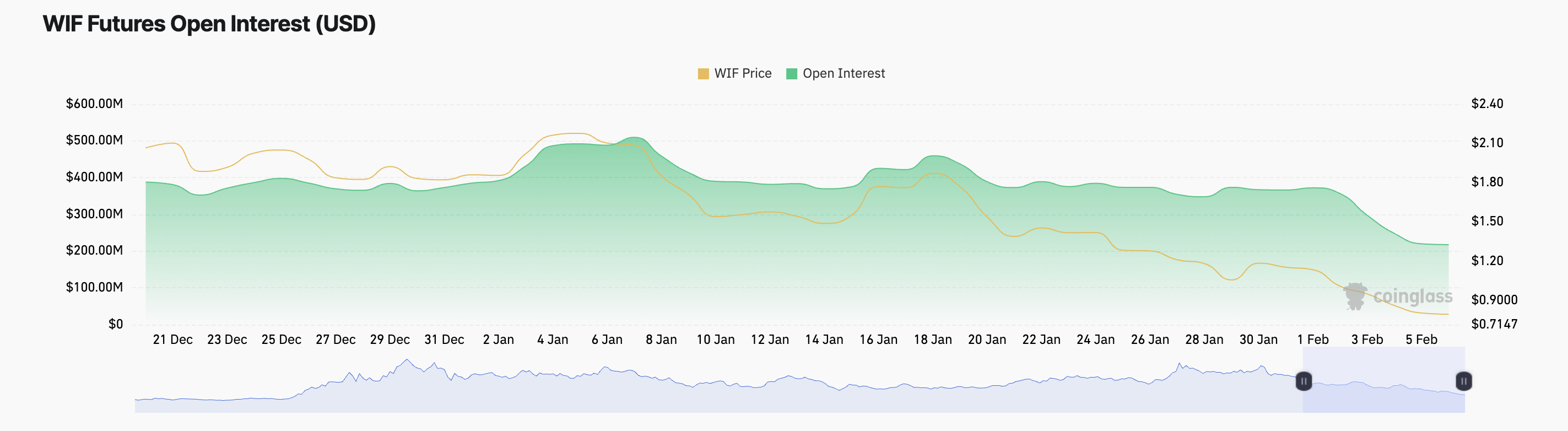

Additionally, WIF’s open interest reinforces this bearish outlook. It has steadily declined since the start of February, plunging by 42%.

Open Interest refers to the total number of outstanding futures or options contracts that have not been settled. When it drops alongside an asset’s price decline, traders are closing their positions rather than opening new ones. This reflects weakening market participation and can signal that the downtrend may continue unless new interest emerges.

WIF Price Prediction: More Declines Ahead?

Readings from WIF’s Awesome Oscillator (AO) confirm the waning demand for the altcoin. This indicator posts red downward-facing histogram bars as of this writing, reflecting the high selling pressure. Its value is -0.60.

The Awesome Oscillator indicator measures market momentum by comparing the recent 5-period moving average to the longer 34-period moving average. When it posts red downward-facing histogram bars, it indicates weakening bullish momentum or strengthening bearish pressure, suggesting a potential continuation of a downtrend.

If WIF’s downtrend continues, its price could plunge to $0.55, representing a 30% decline from its current value.

However, if the meme coin sees a resurgence in demand, it could propel its price past the resistance at $0.92 and toward $1.89.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/wif-price-plunges-yearly-lows/

2025-02-06 09:30:00