Dogwifhat (WIF), the largest meme coin by market capitalization on Solana, registered notable recovery over the last 30 days. This rebound ensured that WIF’s price climbed by 50% and almost retested $3.

Despite the impressive rally, technical analysis points to the possibility of a correction, as this classic bearish formation typically signals a potential downturn.

Dogwifhat Forms Bearish Pattern

On October 14, WIF’s price almost hit $3. However, the resistance at $2.82 ensured that the meme coin could not reach the threshold again for the first time since July.

Following this development, BeInCrypto observed that WIF had formed a rising wedge on the daily chart. Also called an ascending wedge, this pattern arises when two upward slopes converge, signaling an imminent downward trend reversal.

In most cases, this wedge indicates that a cryptocurrency has hit the local top. For WIF, the local top appears to have been around $2.96, where the wick of the green candlestick hit on Monday.

Read more: How to Buy Dogwifhat (WIF) and Everything Else To Know

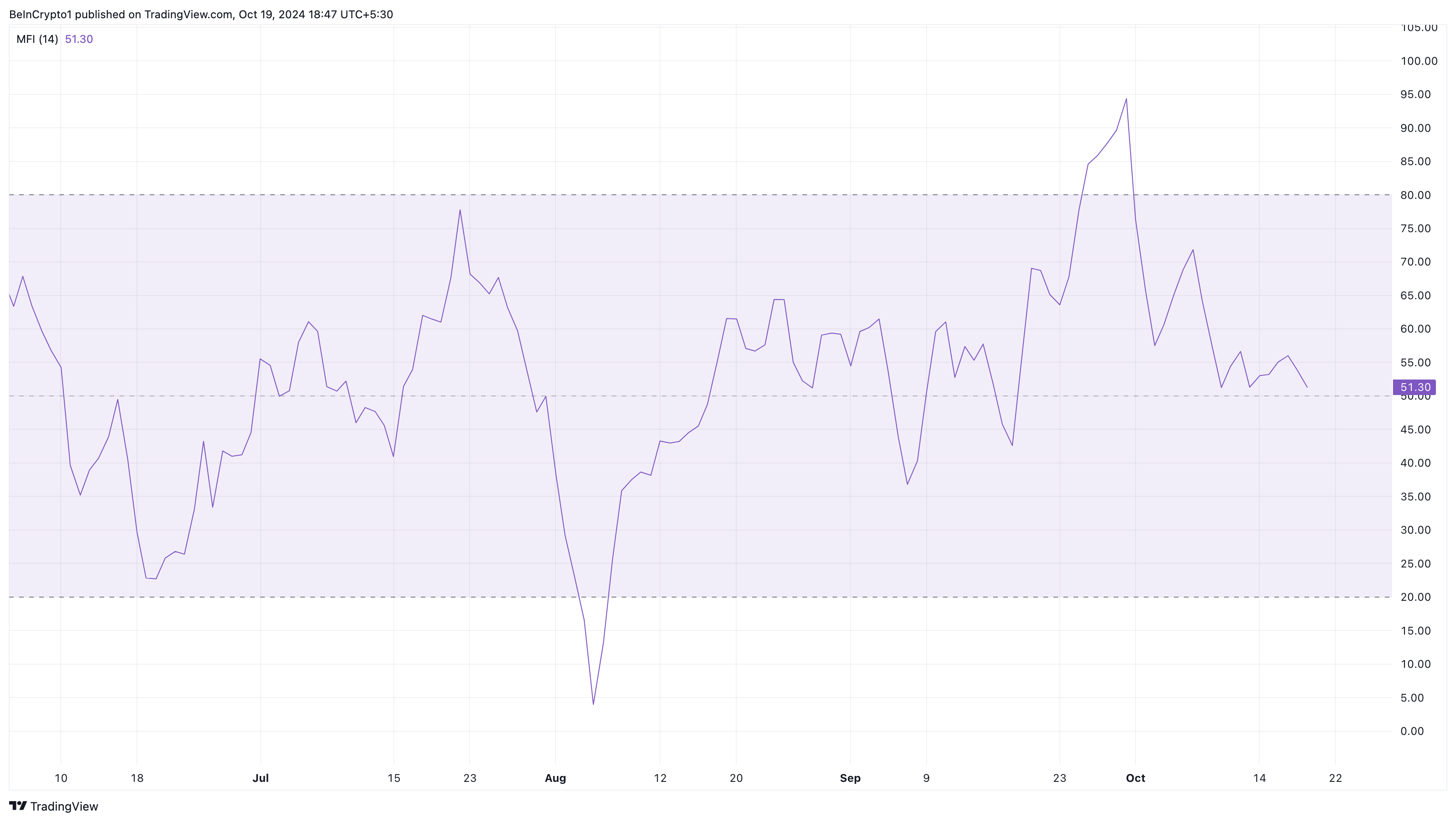

The Money Flow Index (MFI) is another indicator signaling a potential correction for WIF. The MFI assesses both volume and price to gauge buying and selling pressure in the market.

An increase in the MFI reflects rising buying pressure, while a decrease points to growing selling activity. As shown below, the MFI on the WIF/USD daily chart has dropped and is on the verge of slipping below the neutral line.

Given these conditions, it suggests that WIF’s price has lost bullish support and might undergo an extended decline.

WIF Price Prediction: 20% Correction Next

A closer look at the daily chart suggests that WIF could struggle to break above $2.82, as it appears to be following a downward trend seen since July.

On July 22, WIF reached $2.82 but faced resistance. By August 6, the price had dropped 55% to $1.25. However, this doesn’t necessarily mean Dogwifhat will experience a similar decline.

Still, a quick rebound seems unlikely. WIF could fall by 20%, as indicated by Fibonacci retracement levels, which highlight potential support and resistance.

Read more: 5 Best Dogwifhat (WIF) Wallets To Consider In 2024

If the token drops to the 50% retracement level, it may reach $2.08. However, if bulls defend the $2.33 support, WIF could rebound to $3.11.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/wif-price-prediction-to-decline/

2024-10-19 23:55:00