Solana (SOL) recently failed to breach the local resistance barrier of $138, which could have spurred a new rally for the cryptocurrency. Despite its strong performance over the past year, the market sentiment has shifted, and the support level of $120 may not hold for long.

Solana’s price action now faces increased scrutiny as it hovers close to critical levels that could alter its future trajectory.

Solana Faces New Dangers

Solana is on the verge of forming a death cross, a bearish technical pattern where the 200-day Exponential Moving Average (EMA) crosses above the 50-day EMA. Should this occur, it would signal a potential end to the 11-month bull run that started in October 2023.

The looming death cross has created concern among investors who have been bullish on Solana for nearly a year. A breakdown in the market structure could invalidate the gains that SOL has made during this period.

Read more: 11 Top Solana Meme Coins to Watch in August 2024

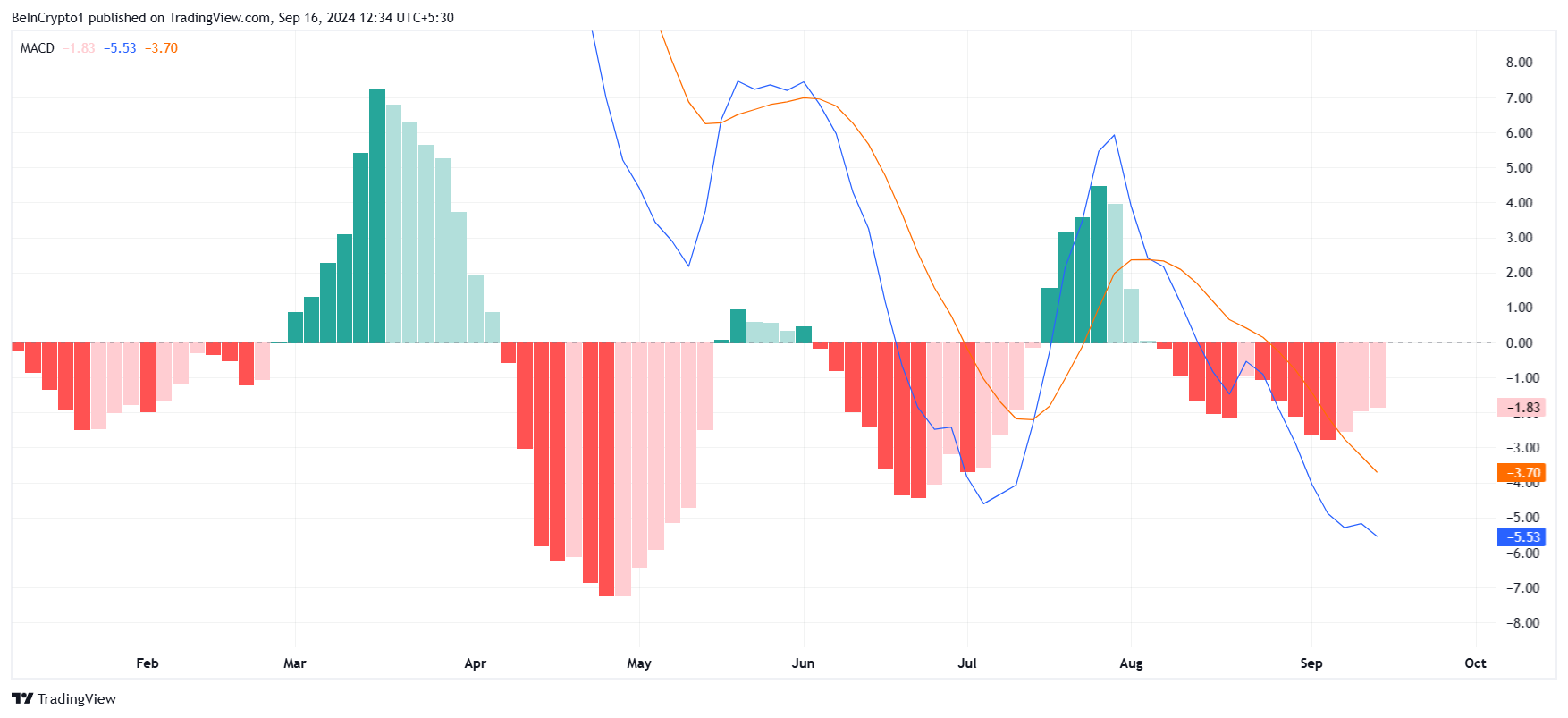

While the macro outlook leans bearish due to the potential death cross, the Moving Average Convergence Divergence (MACD) indicator paints a more nuanced micro picture. On the short-term timeframe, the MACD suggests that bearish momentum could be waning, implying a possible bounce back for Solana. This indicator has shown signs of a potential recovery near the $124 support level, providing a glimmer of hope for investors looking for a reversal.

If Solana can bounce off the $124 level as it did in early September, it may stave off further losses. The MACD signals indicate that while the long-term outlook might be uncertain, there is room for optimism in the short term.

SOL Price Prediction: Finding a Path

Currently trading at $130, Solana is eyeing a potential bounce off the $124 support level, similar to its price action earlier this month. A break below this level is unlikely in the immediate future, and even if it occurs, Solana has a critical safety net at the $120 support floor.

Solana has been consolidating above the $120 mark since March, making $138 a key resistance level for now. Breaching this resistance would indicate that SOL could continue its upward trajectory despite recent bearish concerns.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

But if the death cross occurs, Solana could face intense selling pressure, driving its price below $120. This would invalidate the bullish-neutral thesis and could lead to significant losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/death-cross-threatens-solanas-11-month-long-bullish-streak/

2024-09-16 07:53:33