Earlier this month, Ripple’s (XRP) price dropped by 18% within three days. Since October 3, however, the token has stabilized, trading between $0.52 and $0.55.

While big market players are accumulating XRP, which could boost its value, it’s uncertain if this is enough to prevent the token from dipping below $0.50.

Ripple Bulls Show Support for the Altcoin

According to Santiment, addresses with holdings between 100 million and 1 billion XRP owned 9.63 billion tokens on October 17. That amount has since increased to 9.77 billion, indicating an accumulation of around 140 million XRP, valued at about $77 million.

Typically, when large investors accumulate tokens, it signals an expectation of a price increase. Conversely, a reduction in holdings often suggests an impending price drop. Given the recent accumulation, XRP could be poised to rise above $0.55.

Read more: XRP ETF Explained: What It Is and How It Works

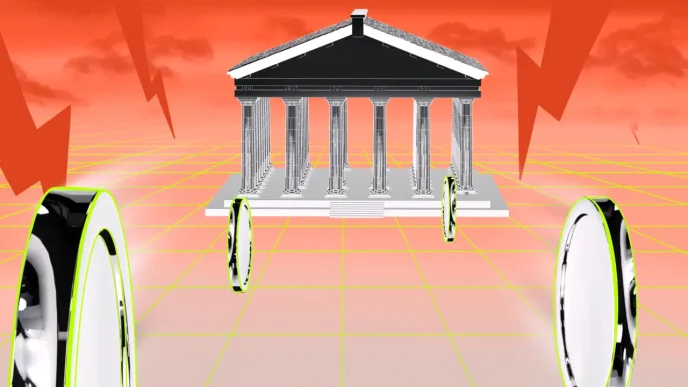

Another factor supporting this prediction is the Funding Rate, which measures the difference between the mark price of perpetual futures and the index price, representing the spot price of the underlying asset.

When the Funding Rate rises, longs are paying shorts, signaling that traders are generally bullish. A decline in the rate indicates shorts paying longs, reflecting bearish sentiment.

For XRP, the Funding Rate is currently positive. If this trend continues, the altcoin’s price could increase, leading to potential profits for traders holding long positions.

XRP Price Prediction: Bounce Imminent

On the daily chart, XRP’s price is swinging between $0.52 and $0.54. However, a look at the chart shows that the $0.52 level is strong support for the token because bulls have defended the price from below that point several times over the last few weeks.

Considering this position, it is highly unlikely that altcoin will drop to $0.50 or below it. Instead, the Fibonacci indicator, which measures support and resistance, reveals that XRP’s price might bounce off that support.

Read more: How to Buy XRP and Everything You Need To Know

With increasing buying pressure, the cryptocurrency’s value might hit $0.60. However, if XRP slips below $0.52 and bulls fail to defend the token, a drawdown to $0.49 could be next.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/xrp-price-to-evade-fall/

2024-10-19 21:00:00