Cardano (ADA) faces the risk of slipping below the critical $1 mark after days of volatile, see-saw price action. Since the weekend, the altcoin has struggled to stabilize, hovering around the same price region.

While ADA holders would hope that the current choppy movement will end in a breakout, this on-chain analysis indicates otherwise.

Cardano Short-Term Potential Faces Setback

To start with, the token’s price could experience a downturn due to the signs the Cardano large holders’ netflow shows. The large holders’ netflow measures the activities of addresses holding between 0.1% to 1% of the circulating supply.

When the netflow rises, it means these addresses bought more tokens compared to the ones sold. On the other hand, a decline in the netflow indicates rising distribution over accumulation. According to IntoTheBlock, Cardano large holders netflow has fallen to 142% in the last seven days.

This indicates that altcoin has faced intense selling pressure during the stated period. Given this current condition, ADA’s price might not experience a notable bounce in the short term. Instead, it is likely to decrease.

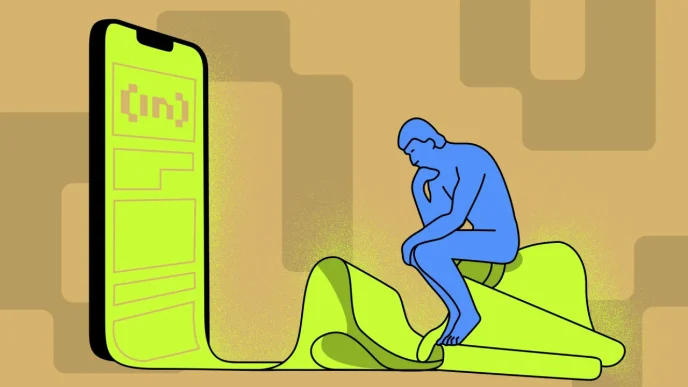

In addition to the metric above, the number of ADA holders is another metric suggesting that the token’s value might decrease. Typically, when the number of cryptocurrency holders grows, it indicates trust in the short-term potential.

It also signifies rising demand, which could lead to a price increase. On the other hand, a decline in the number of holders indicates otherwise. In November, the number of Cardano holders was about 4.47 million.

However, as of this writing, the figure has decreased to 4.40 million. The decrease suggests that some ADA holders have booked profits off the significant price increase the token has had since November. Should this metric continue to slide, then the altcoin’s value might also do the same.

ADA Price Prediction: Lower This Time

Based on the 4-hour chart, ADA’s price has dropped below the 20 and 50 Exponential Moving Averages (EMA). The EMA tracks the changes in a cryptocurrency’s price to measure the trend.

If the price rises above the EMA, the trend is bullish. However, in this case, Cardano’s value has dropped below the 20 EMA (blue) and 50 EMA (yellow). This decline suggests that the altcoin risks dropping below the $1.05 underlying support.

Should this be the case, ADA might slide to 0.95 in the short term. However, if bulls push the price above the indicators mentioned, the prediction will be invalidated. In that scenario, ADA could climb to $1.19 or beyond.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/ada-holders-bullish-momentum-under-pressure/

2024-12-16 12:30:00