Algorand (ALGO) trading volume has spiked by 130% in the past 24 hours, pushing the token’s price to $0.40. This rebound has brought 38% of ALGO holders into unrealized profits.

While this trend could increase the number of profitable holders, on-chain analysis indicates that ALGO’s price might encounter a setback.

Interest in Algorand Rises, but Stakeholders Are Letting Go

Algorand’s price surged from $0.33 on January 1, 2025, to $0.40 today, marking a strong start to the year. This rally positions ALGO as one of the top-performing assets among the top 50 cryptocurrencies.

Beyond that, Algorand’s trading volume climbed from $170.67 million to $468.60 million within the same period. The increase in volume indicates rising interest in the cryptocurrency. The upward trend in both volume and price indicates strong bullish momentum, suggesting the token’s value could climb further.

While rising volume has fueled Algorand’s recent hike, a drop in volume could indicate weakening momentum. However, key metrics now suggest that ALGO’s price may struggle to sustain its upswing in the short term.

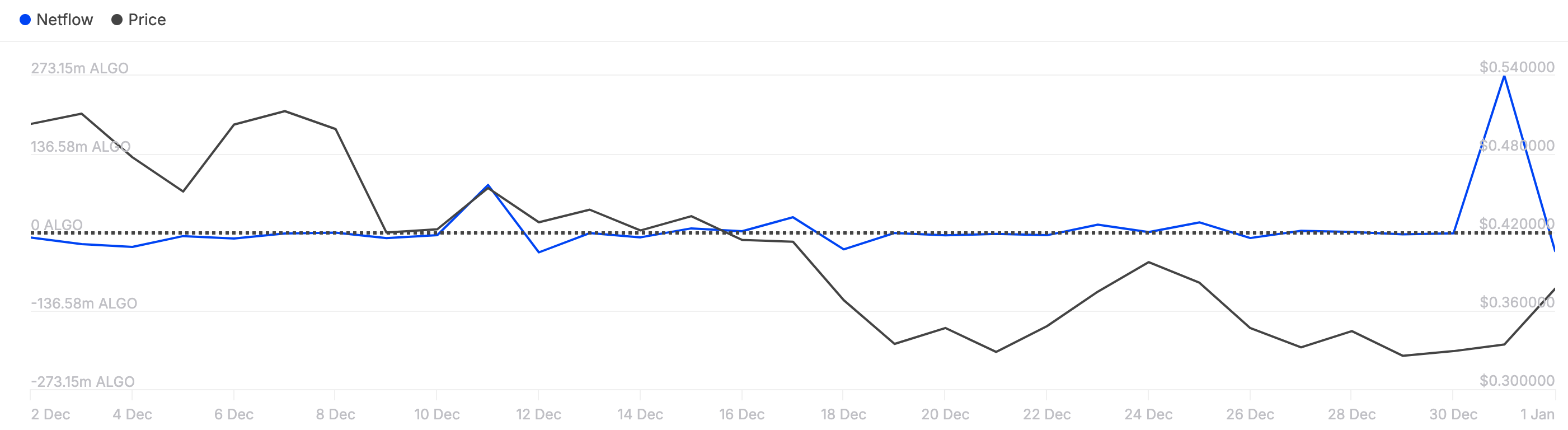

One metric that aligns with this bias is the large holders’ netflow. According to IntoTheBlock data, the netflow, a key metric measuring the balance of buying and selling by addresses holding 0.1% to 1% of Algorand’s circulating supply, has turned negative.

When large holders’ netflow is positive, it indicates that most are accumulating more tokens than they are selling. Conversely, a negative reading signifies distribution, with holders offloading more than they are buying.

This shift indicates these ALGO holders are selling more than buying. If this trend persists, ALGO’s price, currently at $0.40, could face significant downside pressure.

ALGO Price Prediction: Retracement Likely

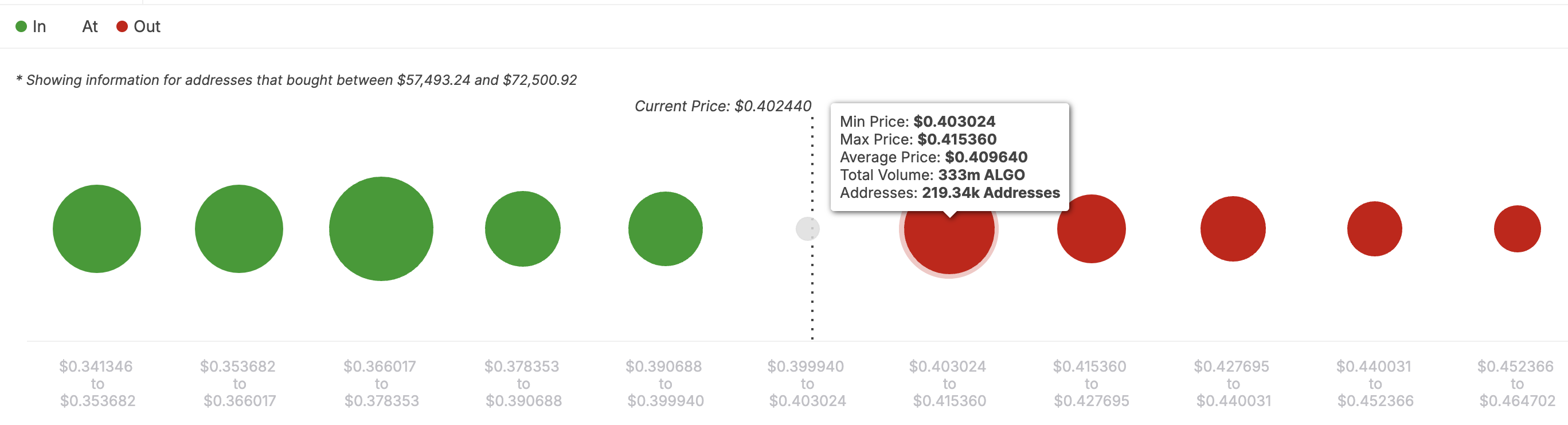

From an on-chain perspective, the In/Out of Money Around Price (IOMAP) shows that ALGO’s price is less likely to trade higher. The IOMAP classified addresses based on those in the money, at the breakeven point, and others out of the money.

Using this data, one can spot support and resistance. Typically, the higher the volume or addresses, the stronger the support or resistance. At press time, 146,530 addresses hold 48.64 million ALGO in the money, purchased at an average price of $0.40.

But at $0.42, 219,340 addresses hold 333 million ALGO and are out of the money. This indicates that Algorand’s price faces significant resistance, which could push it back.

If this remains the case, ALGO could pull back to $0.35. However, if Algorand trading volume rises with intense accumulation, the value could jump toward $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/algo-data-points-to-correction/

2025-01-02 19:00:00