Avalanche (AVAX) began trading within an ascending channel on August 6, following the broader market downturn on August 5, which resulted in over $1 billion in leveraged positions being liquidated.

As of now, the altcoin is trading at $20.66, marking a 5% increase from its August 5 closing price of $19.54.

Avalanche Sees Bullish Resurgence

When an asset trades within an ascending channel, its price moves within a range comprised of a flat horizontal upper resistance line and a rising lower support line.

This pattern is considered bullish as it suggests that an asset’s buyers are gradually gaining strength and driving its price high. However, at the same time, its sellers are maintaining a consistent level of resistance.

Readings from AVAX’s Moving Average Convergence/Divergence (MACD) indicator confirm the surge in buyers’ presence in the market. On August 17, the token’s MACD line (blue) crossed above its signal line (orange).

When an asset’s MACD line crosses above its signal line, it signals a potential momentum shift from bearish to bullish. This crossover indicates that the shorter-term moving average is gaining speed over the longer-term average, often interpreted by traders as a buy signal and a precursor to a rally.

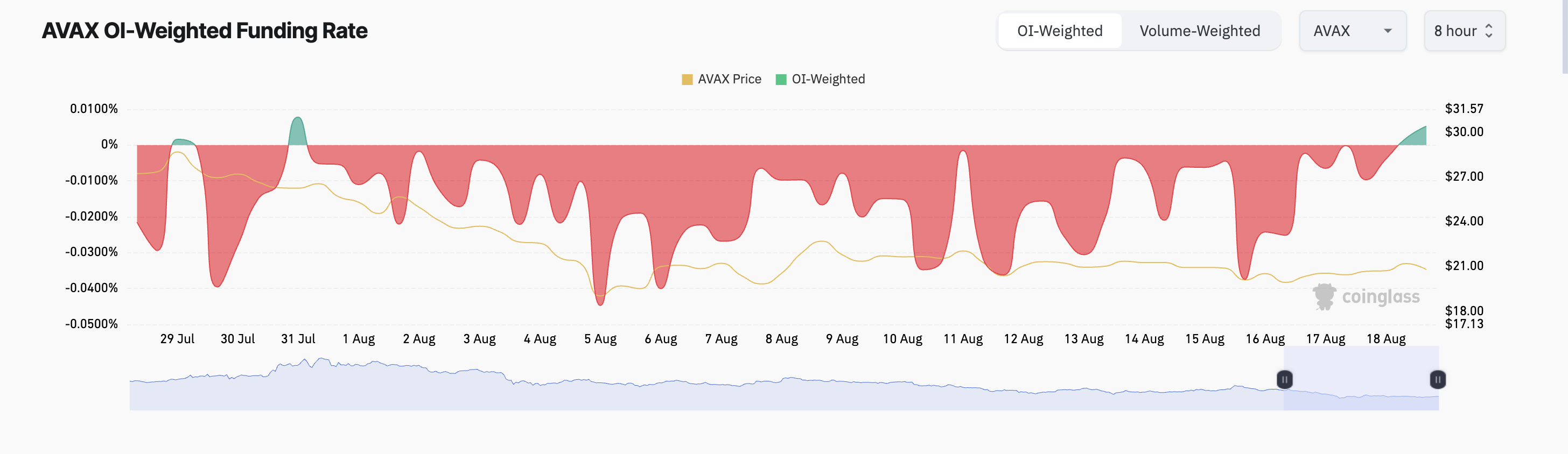

Adding to this bullish sentiment, AVAX’s funding rate across exchanges has turned positive for the first time since early August, according to Coinglass data. This positive funding rate reinforces the growing optimism among traders.

Read more: How To Buy Avalanche (AVAX) and Everything You Need To Know

A positive funding rate signals a higher demand for long positions. This means more traders in the asset’s futures market are buying it in anticipation of a rally than those betting against price growth.

AVAX Price Growth: The Bulls Are Not Strong Enough

While AVAX’s bullish MACD and positive funding rate point to potential upward momentum, other indicators reveal underlying weakness. For instance, AVAX’s Relative Strength Index (RSI) stands at 39.53, well below the neutral 50 level, suggesting that selling pressure still outweighs buying interest.

Additionally, the Chaikin Money Flow (CMF) remains negative, indicating that despite the recent price rally, buying pressure isn’t strong enough to offset ongoing selling activity. These indicators suggest that AVAX’s bullish momentum may be limited.

Read more: 11 Best Avalanche (AVAX) Wallets to Consider in 2024

If selling pressure intensifies, AVAX may break below the support line of its ascending triangle, potentially retesting the August 5 low of $19.54.

However, if buying activity persists and overshadows token distribution, AVAX’s price will rally above $20 to trade at $28.64.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/avax-shows-bullish-signs-selling-pressure-persists/

2024-08-19 07:16:03