The Bitcoin (BTC) market is currently giving off mixed signals. On-chain data indicates stability and caution, making it unclear whether the coin is charting its way toward the $64,500 high or eyeing the $49,500 low.

This piece explores these on-chain metrics, what they mean, and what investors should look for.

Bitcoin Holders at Crossroads

The first key metric to examine is Bitcoin’s Net Unrealized Profit and Loss (NUPL)m, which gauges overall investor sentiment and profitability. Currently, the NUPL stands at 0.45, indicating that if investors sold their coins at current market prices, they would, on average, realize a 44% profit compared to the price at which they last acquired their coins.

This level reflects a moderately positive sentiment in the market.

However, CryptoQuant reports that BTC’s current NUPL value suggests holders are hesitant to sell. This anxiety stems from uncertainty around the upcoming Consumer Price Index (CPI) release, potential 50 basis point interest rate cuts by the Federal Reserve, and the forthcoming US presidential elections.

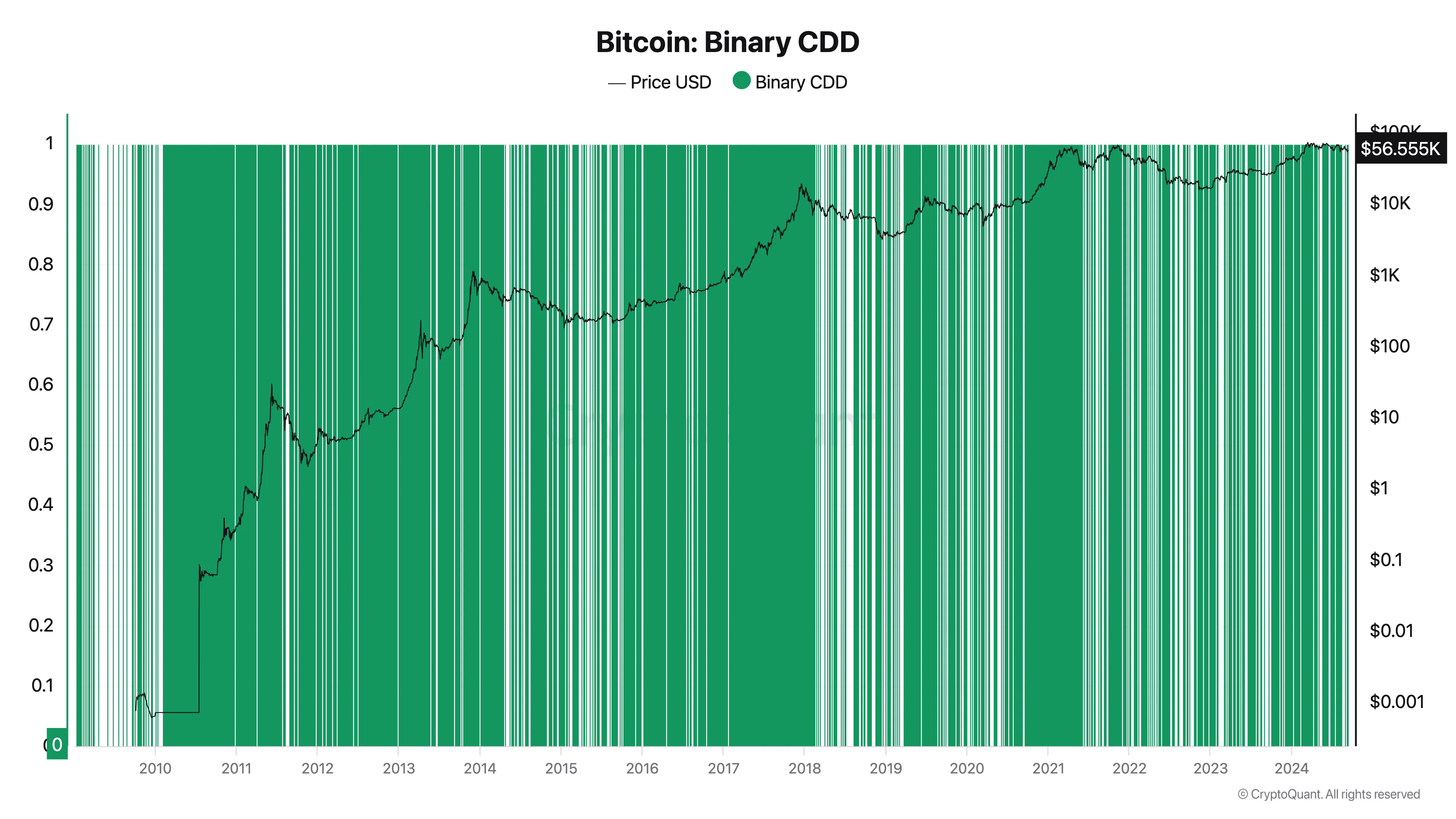

Despite this, many BTC long-term holders are displaying strong HODLing behavior. This is reflected in the coin’s Binary Coin Days Destroyed (BCD) metric, which indicates that long-term holders are not moving their coins.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

At 0.28 at the time of writing, this metric reflects confidence in Bitcoin’s performance and market stability, as holders feel no need to move or sell their coins.

A combination of BTC’s NUPL and BCD points to a clear sentiment: investors are anxious about potential price drops, yet the fear of missing out on future gains keeps them from selling.

BTC Price Prediction: A Rally Above $60,000 or a Decline Toward $49,000?

In a note to clients, Markus Thielen, founder of 10X Research, warned that the uncertainty around the US presidential election, CPI, and the FOMC meeting will majorly determine Bitcoin price targets.

“A lower CPI reading could also provide a temporary boost to positive momentum. However, with the FOMC meeting expected to introduce further uncertainty next week and the US election outcome still uncertain after a possible surge of optimism for Trump (Tuesday debate), Bitcoin may continue searching for a more robust support level to mount a more significant rally toward year-end,” Thielen wrote.

Mati Greenspan, the founder & CEO of Quantum Economics, takes a more negative stance. The expert believes that it is too early to think about new highs.

“Bitcoin’s price action has been in a sideways chop for more than half a year now, and there’s no telling when it might break out. Ultimately, this sideways movement is good for Bitcoin adoption as price stability can be a key driver for growth and reliability,” Greenspan told BeInCrypto.

If macro trends are favorable, an uptick in BTC’s demand will push its coin toward the $64,520 support level. If it crosses above this level, the leading coin may target $68,599.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks After 2024 Halving

However, if bearish macro trends prevail, Bitcoin’s price could fall toward the August 5 low of $49,516.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/bitcoin-price-path-in-doubt/

2024-09-11 12:23:47