On Tuesday, Bitcoin (BTC) exchange-traded funds (ETFs) experienced their first net negative flow in seven days. This comes amid the steady decline in market activity, which has caused the leading coin’s price to plummet to a weekly low.

As of this writing, Bitcoin trades at $66,776, noting a 2% price drop over the past week. With bearish sentiment steadily increasing around the coin, holders may need to prepare for potential further losses.

Bitcoin ETFs Record Outflows

Data from SosoValue shows that BTC spot ETFs experienced a net outflow of $79.09 million on Tuesday, breaking a streak of seven consecutive days of inflows that totaled over $2 billion.

Read more: Top 7 Platforms To Earn Bitcoin Sign-Up Bonuses in 2024

Tuesday’s negative flow was primarily due to a $134 million outflow from the ARK 21Shares Bitcoin ETF, as other ETF products saw either inflows or recorded no activity. Moreso, the largest ETF provider by assets under management, BlackRock’s iShares Bitcoin ETF (IBIT), recorded $43 million in inflows, significantly down from $329 million the previous day.

This decline in institutional demand is largely attributed to the recent drop in Bitcoin’s value. Over the past week, the cryptocurrency has fallen by 2%, reaching its lowest price point in seven days as of press time.

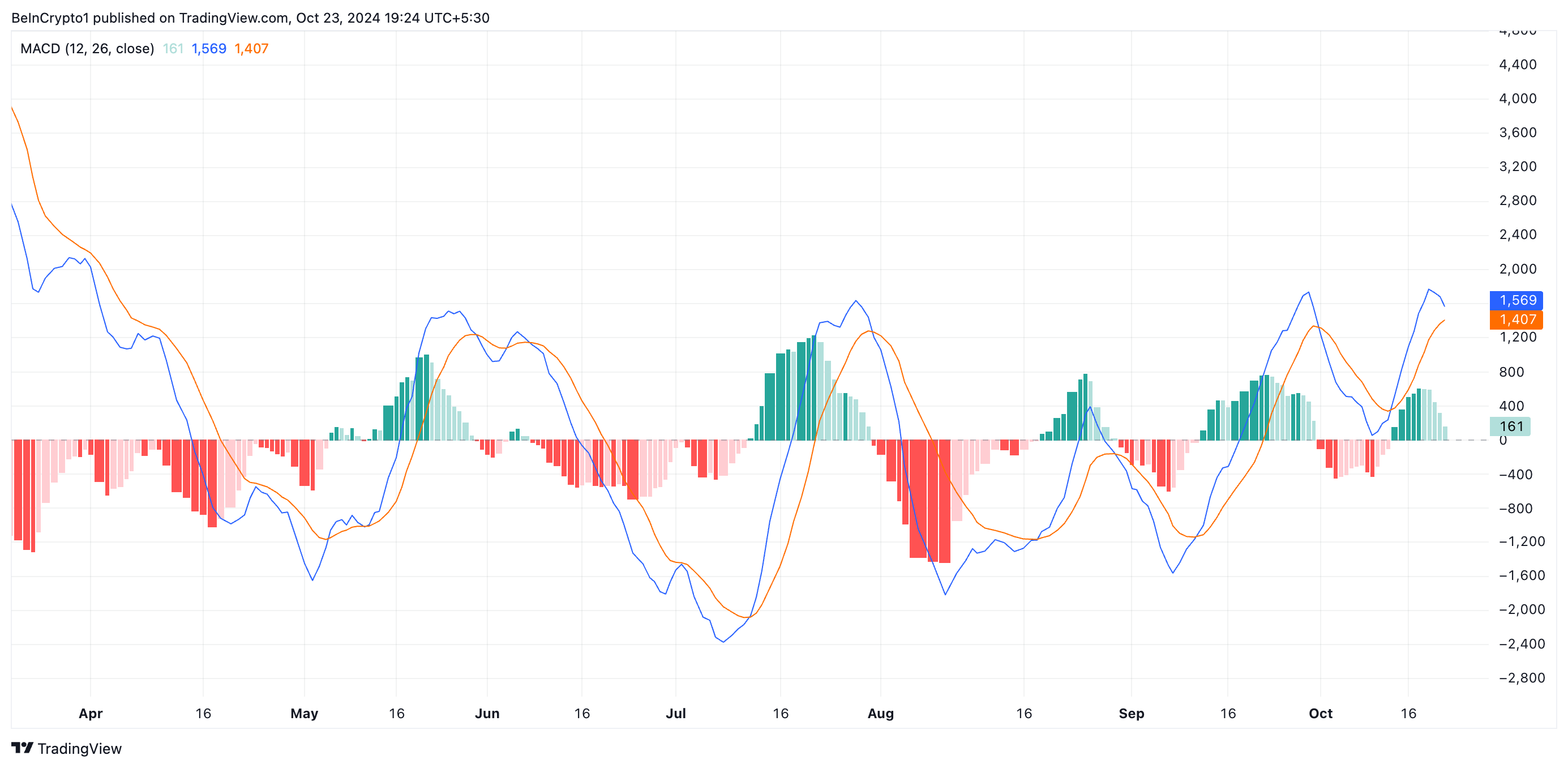

BeInCrypto’s assessment of its momentum indicators has revealed the gradual growth in bearish sentiment toward the leading coin. For example, readings from its Moving average convergence/divergence (MACD) show its MACD line (blue) poised to cross below its trend line (orange).

This indicator measures an asset’s price trends and momentum and identifies potential buy or sell signals. When set up this way, it confirms increased selling pressure in the market. The potential crossover suggests that the asset’s price momentum is weakening, and a downward trend or correction could follow.

BTC Price Prediction: Coin Has Only Two Options

Bitcoin’s price is falling toward its 20-day exponential moving average (EMA), which measures its average price over the past 20 trading days.

When an asset’s price falls toward this level, it suggests the asset is pulling back but may find support around the 20-day EMA. If the price fails to hold above the 20-day EMA and breaks below it, this significantly increases the possibility of a trend reversal. It suggests that bearish sentiment is growing, and further downside might follow.

As of this writing, Bitcoin is trading at $66,776. This is just above the previous resistance level of $64,543, which it recently flipped into support.

If the growing bearish sentiment causes this support to fail upon retest, Bitcoin’s price could drop toward its next major support at $61,686. Should BTC bears break through this level, the price may plunge further to $58,828.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, if market sentiment improves and bullish momentum builds, Bitcoin could rally toward $68,612. Clearing this resistance would position BTC for a potential run to reclaim its all-time high of $73,794.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/bitcoin-etfs-see-outflow/

2024-10-23 18:00:00