BNB’s price has faced multiple failed attempts at flipping the resistance block between $575 and $619 into support.

To date, BNB has only managed to succeed once, making it challenging for the altcoin to achieve another breakout. This resistance continues to be a significant hurdle, keeping the cryptocurrency from maintaining sustained upward momentum.

BNB Faces Potential Bearishness

The overall macro momentum for BNB shows mixed signals. Technical indicators like the Moving Average Convergence Divergence (MACD) suggest that bullishness is gradually waning. While BNB is likely to breach the $550 resistance, it will face challenges in crossing the $580 level.

Despite some bullish movement, BNB’s momentum is not expected to hold beyond $580. The cryptocurrency has struggled to maintain gains above this level, and current indicators suggest that the pattern could repeat, stalling any significant upward movement.

Read More: How To Trade Crypto on Binance Futures: Everything You Need To Know

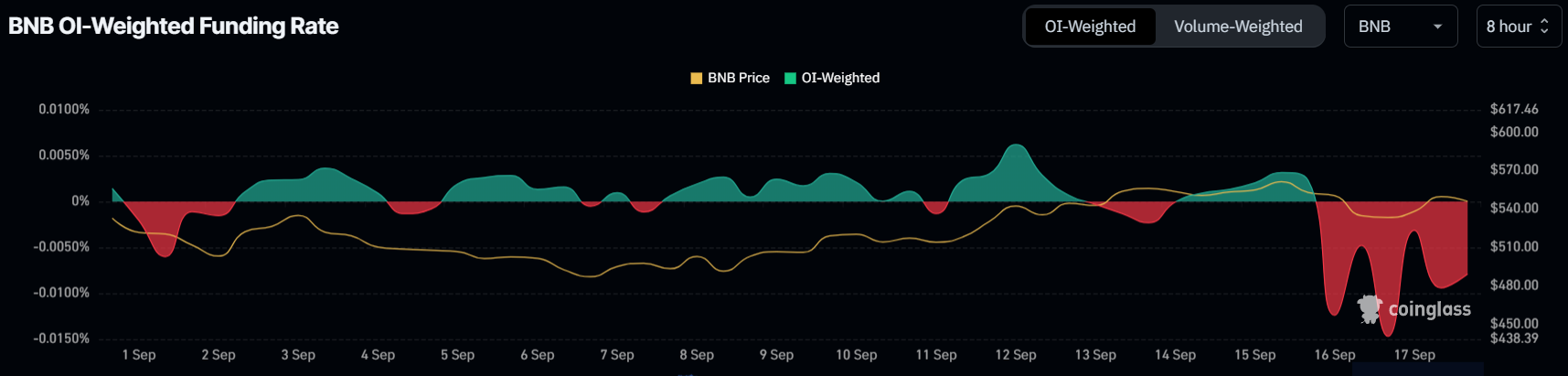

Market sentiment surrounding BNB is notably bearish, as evidenced by the highly negative funding rates. Traders have turned more pessimistic towards BNB than they have been in the last two weeks. The ongoing pattern of failed breaches appears to have led traders to expect a price drop, prompting them to position themselves to capitalize on an eventual decline.

This bearish sentiment creates additional hurdles for BNB’s price rise. With many traders already expecting a reversal, the altcoin may struggle to build enough momentum to break through key resistance levels, further complicating its chances of hitting $600.

BNB Price Prediction: Repeating History

At the time of writing, BNB is trading at $545 and is expected to breach the $550 resistance. However, as the altcoin approaches the $575 to $619 resistance block, it will likely face difficulties. The bullish momentum may not be strong enough to carry BNB past this level, causing a potential reversal.

Given these factors, BNB will likely fall back to $550 after failing to sustain a rise beyond $580. This will diminish its chances of reaching $600 in the short term.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

However, if broader market conditions turn more bullish, BNB could still close above $580, a level it has breached multiple times in the past. In this scenario, BNB could rise to $600, invalidating the current bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bnb-price-will-likely-face-challenges/

2024-09-18 06:30:13