Bonk (BONK), the Solana meme coin with the second-highest market cap, has seen its volume hit $1 billion today. This milestone comes after BONK’s price climbed by 43% within the last seven days.

While many traders might hope that the hike in BONK volume is a bullish sign, this on-chain analysis suggests that it may not be so.

Bonk Sees Rising Interest, But Falling Bullish Sentiment

Data from on-chain analytic platform Santiment showed that Bonk’s volume was about $125 million on November 9. Trading volume is a key metric in crypto, reflecting a coin’s popularity and hinting at potential price direction.

High volume often indicates a rise in interest. Low volume, on the other hand, indicates waning interest. Therefore, the rise in BONK’s volume to $1 billion signifies rising interest in the meme coin.

From a price perspective, rising volume can be bullish, but only if the cryptocurrency’s value climbs alongside it. But in the last 24 hours, BONK’s price has hovered around the same region at $0.000026. Should this remain the same, then the meme coin could find it challenging to build on the recent 43% rise.

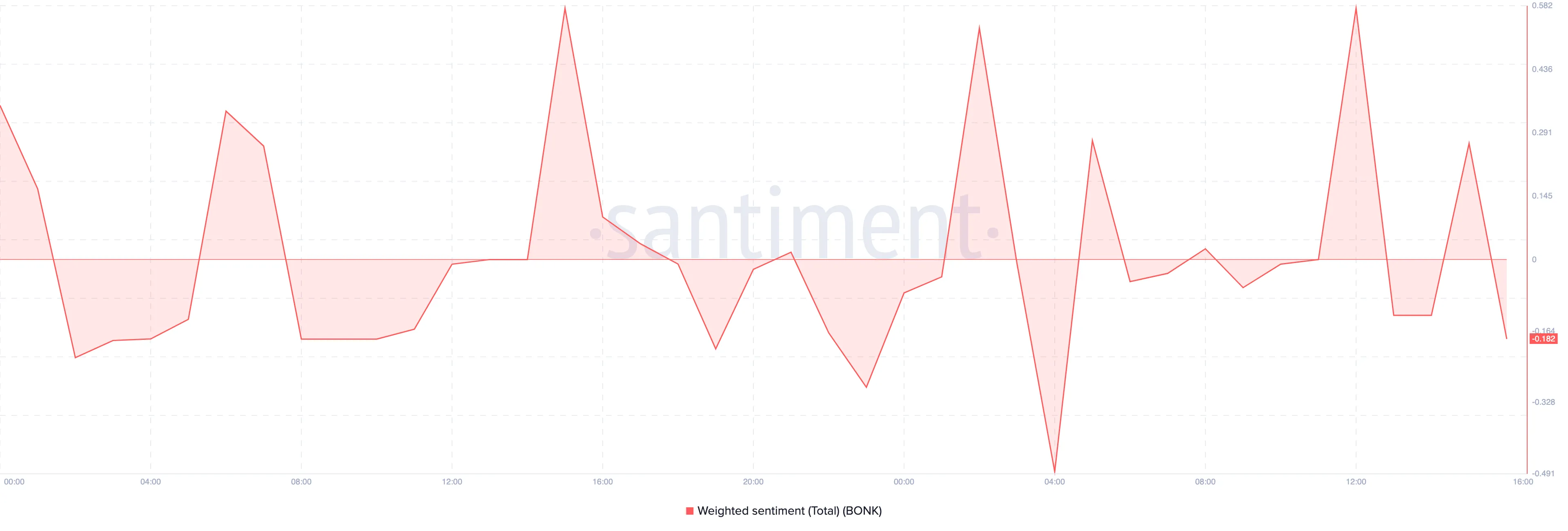

Beyond the volume, the Weighted Sentiment is another metric suggesting that BONK could struggle to continue appreciating.

The Weighted Sentiment metric adjusts values by factoring in the number of mentions, standardizing data to make sentiment across various assets more comparable. This means that spikes or dips in the metric occur when there is a high volume of mentions for a particular coin.

For the Solana meme coin, sentiment has turned negative, indicating that most commentary on the cryptocurrency is bearish. If this trend continues, demand could weaken, potentially leading to price consolidation or a downturn.

BONK Price Prediction: Brief Drawdown Likely

On the daily chart, Bonk’s price continues to show signs that it could move higher. This is also backed by a rise in the Money Flow Index (MFI) reading.

The MFI is an indicator that gauges buying and selling pressure by analyzing both price and volume data. It ranges from 0 to 100, where an MFI above 80 signals an overbought condition, suggesting a potential sell opportunity, while an MFI below 20 indicates an oversold condition, signaling a potential buy opportunity.

With the reading close to 80, BONK could soon be overbought. If that is the case, then the meme coin’s value could drop to $0.000023. However, if Bonk’s volume continues to rise and BONK finds solid support around $0.000026, the price might rally to $0.000030.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/bonk-price-faces-hurdles/

2024-11-11 21:00:00