Cardano (ADA) whales, who have been instrumental in driving the cryptocurrency’s price by 270% in the last 30 days, have now sold a bunch of tokens. This sell-off comes ahead of this week’s token unlock, which market participants expect will cause volatility.

As of this writing, ADA trades at $1.23. Will this sell-off draw the price down further?

Cardano Key Holders Offload Some Tokens

On Monday, December 2, Cardano’s large holders’ netflow reached 63.58 million ADA, reflecting a strong buying trend among whales. The netflow metric tracks the difference between tokens bought and sold by these key players. A rising netflow indicates accumulation, while a decline indicates selling pressure.

As of now, the netflow has plunged to 7.62 million ADA, according to IntoTheBlock, suggesting that whales offloaded 55.96 million ADA — either to take profits or rebalance their portfolios. At Cardano’s current price, this sell-off amounts to a staggering $69 million.

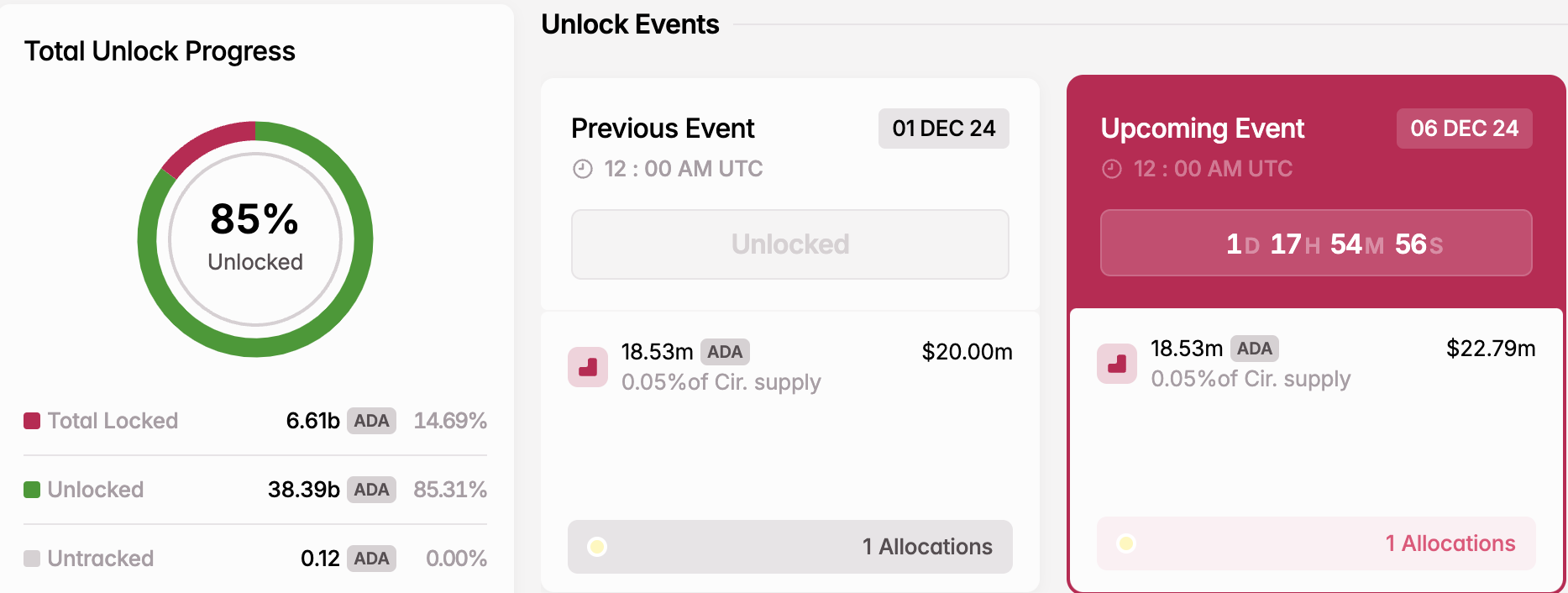

From BeInCrypto’s observation, the recent sell-off may be tied to the upcoming token unlock on December 6.

Token unlocks, which release previously restricted tokens into circulation, often drive significant price movements by altering supply and demand dynamics.

According to Tokenomist (formerly Token Unlocks), Cardano is set to release 18.53 million ADA on that date, valued at $22.79 million. This anticipated supply shock could introduce volatility, potentially hindering the altcoin’s ability to sustain an uptrend during this period.

ADA Price Prediction: Overbought, Retracement Likely

On the daily chart, Cardano’s Bollinger Bands (BB) have widened, indicating heightened volatility. The BB also highlights whether an asset is overbought or oversold.

When the price touches the upper band, it signals an overbought condition, while contact with the lower band indicates oversold territory. Therefore, the image below confirms the thesis that ADA is overbought.

The Relative Strength Index (RSI), which measures momentum, also aligns with the bias. When the RSI reading is above 70.00, it is overbought. On the other hand, when the reading is below 30.00, it is oversold.

At press time, Cardano’s RSI stands at 82.15, firmly placing ADA in overbought territory. Given this condition, a price correction to $0.92 could be next. However, if Cardano whales resume accumulation, the trend could shift, potentially pushing the price above $1.33

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/cardano-whales-shed-ada/

2024-12-04 06:44:01