Cardano’s (ADA) price recovery has been strong, but it might stop before it reaches $0.38.

This is due to the surge in profits noted among ADA investors, which seems to be luring investors to sell.

Cardano Investors Look out for Themselves

As Cardano’s price began recovering, it brought profits to the network. Investors had been waiting for this for a long time, as the July crash brought the price to a nine-month low. Thus, with the 8% rise in the last 24 hours, gains increased too.

An additional 12% of the ADA supply has become profitable in just three days. This sudden shift into profitability could lead to a wave of selling as investors look to secure their gains.

Read More: How To Buy Cardano (ADA) and Everything You Need To Know

Thus, as more ADA holders find themselves in a profitable position, the temptation to sell may increase. This could potentially put downward pressure on Cardano’s price, disrupt the recent uptrend, and introduce volatility into the market.

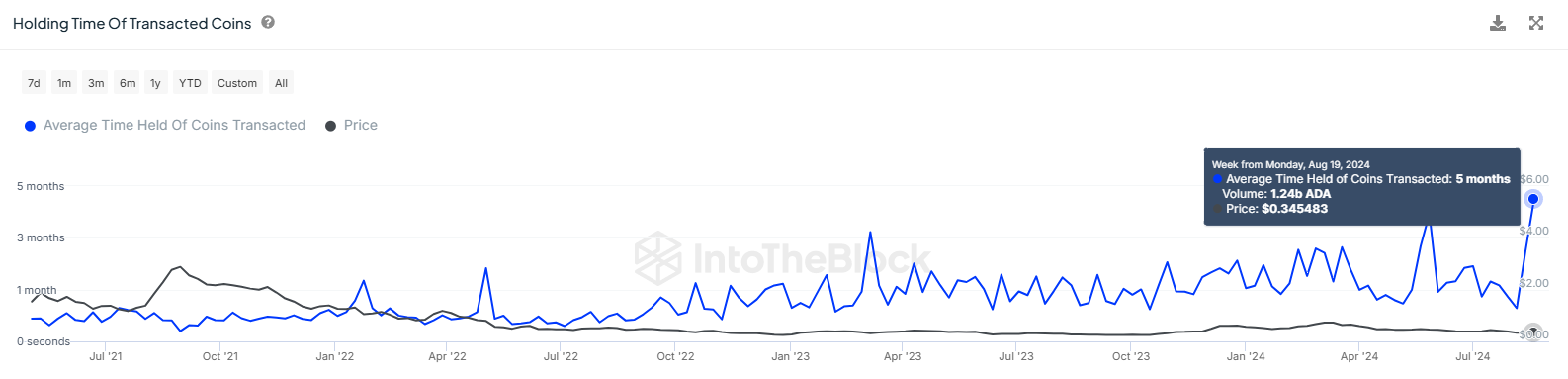

The average holding time of the transacted ADA coins has already risen to five months. This longer holding period suggests that even mid-term holders are selling now. When older coins move, they impact the price action.

This is because these holders are known for their resilience, and their actions are a sign of waning confidence. As a result, Cardano’s price could lose the gains it has noted in the last few days.

ADA Price Prediction: A Breach May Fail

Cardano’s price is standing under the resistance of $0.37, and they are attempting to flip it into a support floor. A bounce back from this level in the past has led to gains for the investors, and the same could happen again.

However, if the aforementioned factors are considered, Cardano may not breach this barrier. As a result, the altcoin could fall back to $0.34, entering consolidation.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

On the other hand, a successful breach could carry ADA to $0.40. Breaching this barrier would bring Cardano to test $0.42 as resistance, invalidating the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-ada-prices-rise-surge-selling/

2024-08-22 15:00:00