Cardano’s (ADA) highly anticipated Chang hard fork is set to go live on September 1, introducing on-chain governance to the blockchain for the first time since its launch.

However, ADA holders are exercising caution ahead of the upgrade, reducing their trading activity as the date approaches.

Cardano Traders Take a Pause To Observe

An on-chain assessment of ADA’s network activity reveals a decline in daily active addresses since August 27. According to Santiment’s data, the daily count of addresses participating in ADA transactions has decreased by 31%, indicating a drop in demand for the altcoin.

ADA’s negative price-daily active address (DAA) divergence further confirms this decline in demand, as it directly compares price movements with changes in daily active addresses. This metric tracks whether an asset’s price movement is supported by corresponding network activity.

As of this writing, ADA’s price DAA divergence stands at -15.7%, signaling a weakening market and suggesting the potential for further price decline.

Read More: How To Buy Cardano (ADA) and Everything You Need To Know

Fears that the upgrade could become a “sell the news” event are driving the decline in the number of addresses trading ADA ahead of its Chang hard fork.

A “sell the news” event occurs when traders buy in anticipation of a price increase due to an upcoming upgrade, only to sell off their assets once the upgrade is implemented, thereby exerting downward pressure on the price.

To avoid potential losses after the upgrade, ADA traders have gradually reduced their exposure.

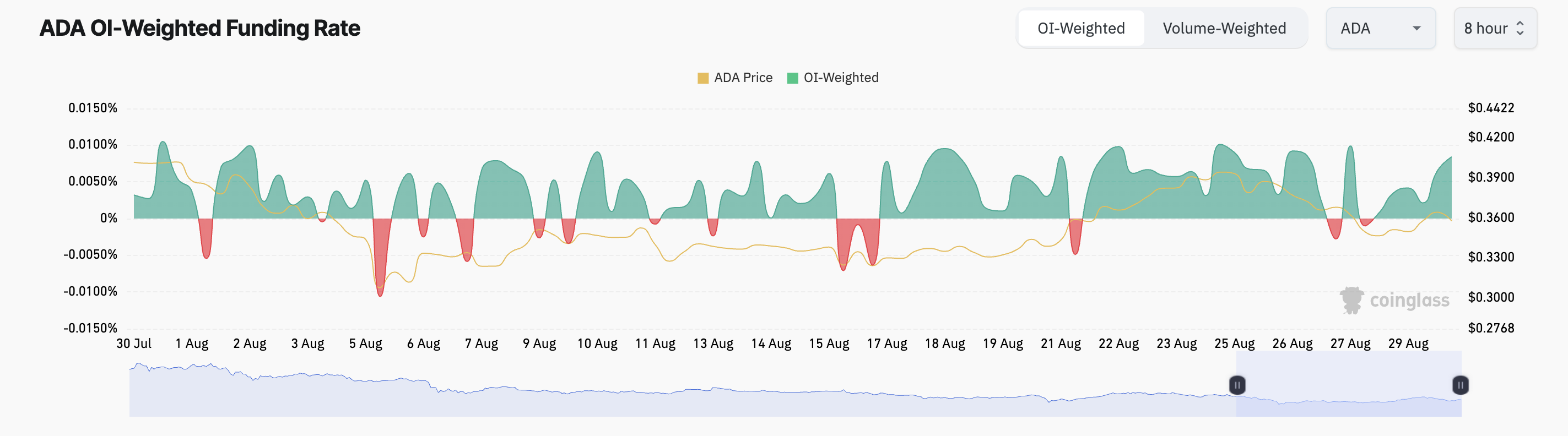

ADA Price Prediction: Futures Traders Are Unmoved

Interestingly, ADA’s futures traders seem unfazed by the “sell the news” concerns. They have continued to open long positions, as indicated by the coin’s positive funding rate. As of press time, ADA’s funding rate stands at 0.0084%.

A positive funding rate indicates higher demand for long positions over short ones, often seen as a bullish signal.

However, if Cardano experiences a wave of sell-offs following the Chang hard fork, its price could drop toward $0.027, confirming the fears of many traders.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

If the upgrade leads to a price rally, ADA’s value could climb to $0.39. As a major milestone in Cardano’s roadmap, Chang might even drive the coin’s price above $0.40.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-traders-show-restraint/

2024-08-30 20:00:00