Cardano’s (ADA) price is preparing for a rise that could send the altcoin to potentially skyrocket following the upcoming Change hard fork.

Supporting this outcome are the large wallet holders as well as the retail investors, whose demand could bring billions of dollars worth of profits.

Cardano Investors See Green

Cardano’s price is potentially on the verge of exceptional gains before the network undergoes the Chang hard fork. This hard fork will implement new on-chain governance features, enabling Cardano users to have a more direct role in network decision-making. Originally scheduled for the end of August, the hard fork has been delayed to September 1.

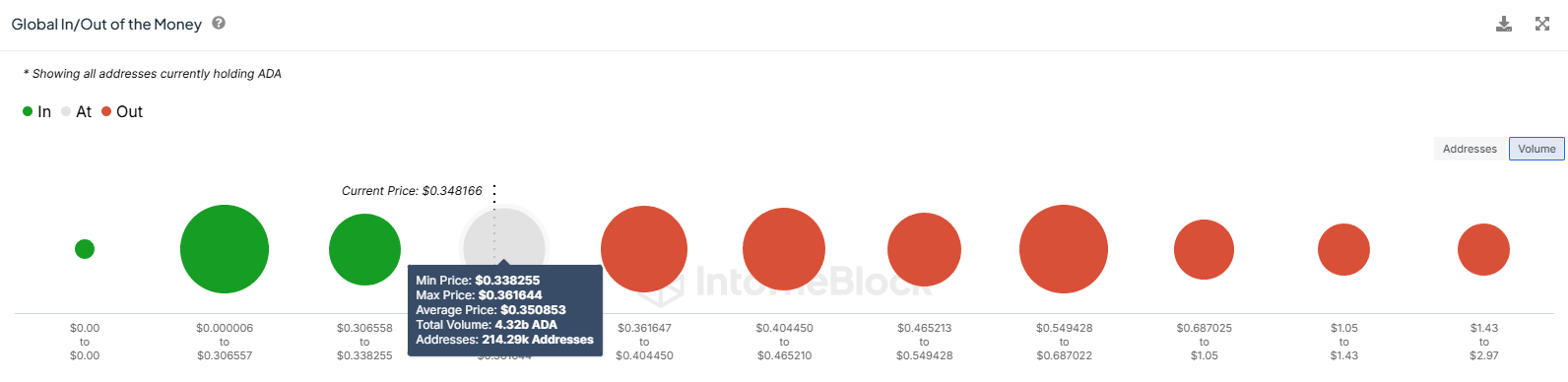

This has resulted in a strong demand for ADA. About 4.32 billion ADA worth $1.57 billion is nearing profitability. The Global In/Out of the Money (GIOM) indicator shows this supply was bought between $0.33 and $0.36. A breakout from the descending wedge pattern could make this supply profitable.

Read More: How To Buy Cardano (ADA) and Everything You Need To Know

Furthermore, the whales have been focusing on accumulating ADA rather than selling for the past month, signaling confidence in the token’s future. The netflows have been largely positive, indicating that large wallet holders are anticipating an increase in ADA’s price.

The high demand, whale accumulation, and positive netflows suggest a potential bullish phase for ADA. These factors combined point to possible significant price gains, which, along with the bullish developmental factors, could result in a rally.

ADA Price Prediction: Looking to the Stars

The Chang hard fork could trigger a massive rise in Cardano’s price provided it successfully breaks out of the bullish descending wedge pattern. This pattern suggests a 45% rise, targeting $0.54 for the altcoin.

There is a chance that the breakout could be delayed owing to uncertainty in the market regarding the impact of the hard fork. This places the delayed breakout target at $0.53. However, the bullish outlook will be confirmed only when ADA flips $0.42 into a support floor and rises to $0.46.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

On the other hand, if the breach of $0.42 fails, the altcoin will enter consolidation. Since $0.42 and $0.37 have previously served as a consolidation range, they could once again act as key levels. This would invalidate the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-ada-price-bullish-signs-surge/

2024-08-31 15:00:00