Cardano’s recent price action shows prolonged consolidation, with ADA hovering between $0.37 and $0.33 for over a month. Despite a few upward moves, ADA has struggled to generate any sustained bullish momentum, and as it increasingly decouples from Bitcoin, concerns arise.

With Bitcoin approaching an all-time high, Cardano’s separate path may mean missed rally opportunities for ADA.

Cardano Investors Face Losses

Cardano’s correlation with Bitcoin has been gradually declining, now sitting at 0.15. This low correlation implies ADA may not benefit from Bitcoin’s price movements, which historically influence altcoin trends. For Cardano, this divergence could be problematic, as Bitcoin’s rallying momentum often supports altcoin growth.

As Bitcoin inches closer to a new all-time high, ADA’s inability to track BTC’s trajectory could result in missed gains for Cardano investors. Low correlation usually signals independent price action, which, for Cardano, given recent bearish trends, may not be favorable.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

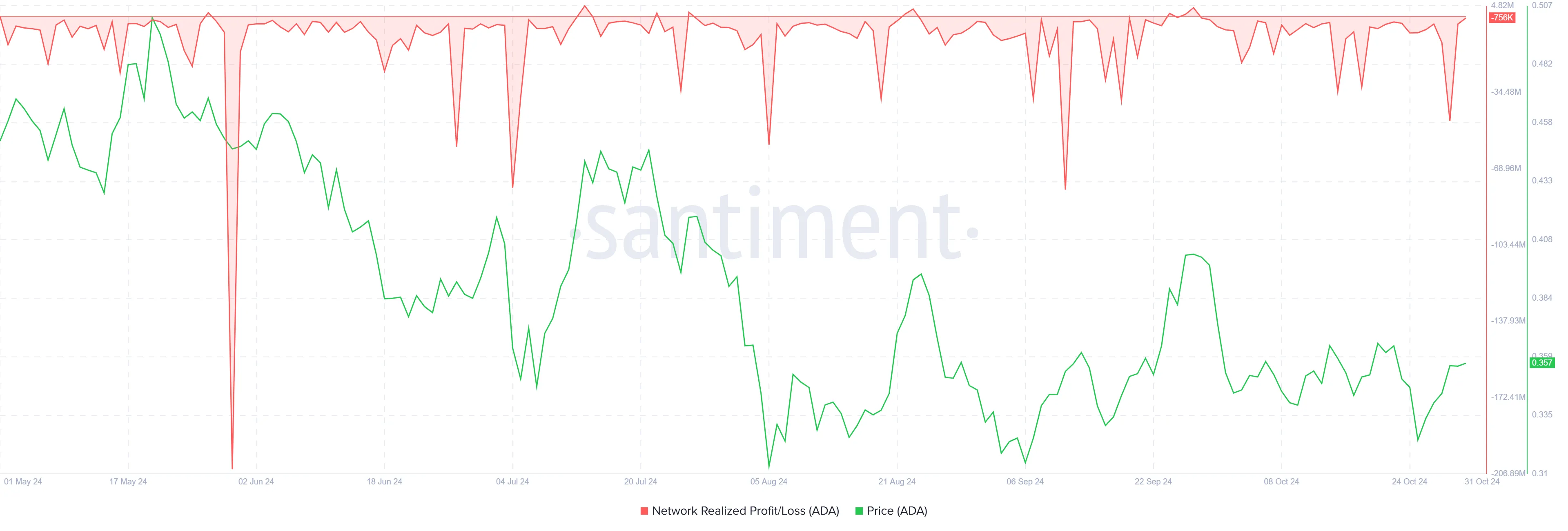

The macro momentum for Cardano also signals caution. Recently, investors have experienced significant realized losses, with the latest selling wave marking the highest loss rate in over six weeks. This trend suggests that holders may hold back on additional selling, potentially leading to reduced trading volume. Lower volume typically results in less volatility, which, while stabilizing, may also curb upward potential.

With investor losses mounting, there may be hesitation to engage actively in the market. A reduction in selling pressure could provide ADA some relief, but it may also limit fresh buying interest. This cautious sentiment might sustain Cardano’s range-bound price behavior, reducing the chances of a breakout rally.

ADA Price Prediction: Remaining Rangebound

Cardano’s price rose by 9% in the past 24 hours, though this increase has yet to recover the 10% losses from earlier in the month. While the recent gain is encouraging, it has not been sufficient to reclaim higher ground, leaving ADA in a neutral position.

Given current market sentiment, ADA is likely to continue consolidating within the $0.37 and $0.33 range. The bullish momentum appears too weak to push ADA past the upper resistance of $0.37, signaling continued range-bound movement.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

If ADA falls below the $0.33 lower support, it could slip further to $0.31. A break below this range would invalidate hopes of consolidation and leave ADA vulnerable to additional losses, potentially extending the bearish outlook for Cardano in the near term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-price-fail-to-benefit-from-bitcoin-ath/

2024-10-31 06:56:22