About one week ago, Dogecoin’s (DOGE) price hit $0.43, but it has since fallen to $0.37. Despite the decline, it appears that Dogecoin holders are not resorting to selling, suggesting heightened conviction about the meme coin’s potential.

This sentiment could imply that DOGE’s price is ready for the next leg up. Here is why.

Dogecoin Investors Stick to HODLing Instead of Taking Profits

It’s been seven days since Dogecoin’s price hit a yearly high. Despite dropping since then, data from IntoTheBlock shows that the Coin Holding Time has increased by over 100%.

The Coin Holding Time indicators measure how long a cryptocurrency has been held without being transacted or sold, providing insights into investor behavior. When it decreases, it means that holders are selling, and the price might decrease.

However, since the holding time climbed, most Dogecoin holders have refrained from transacting their coins. This is typically a bullish sign, and if this remains the same, the cryptocurrency’s value might continue to rise.

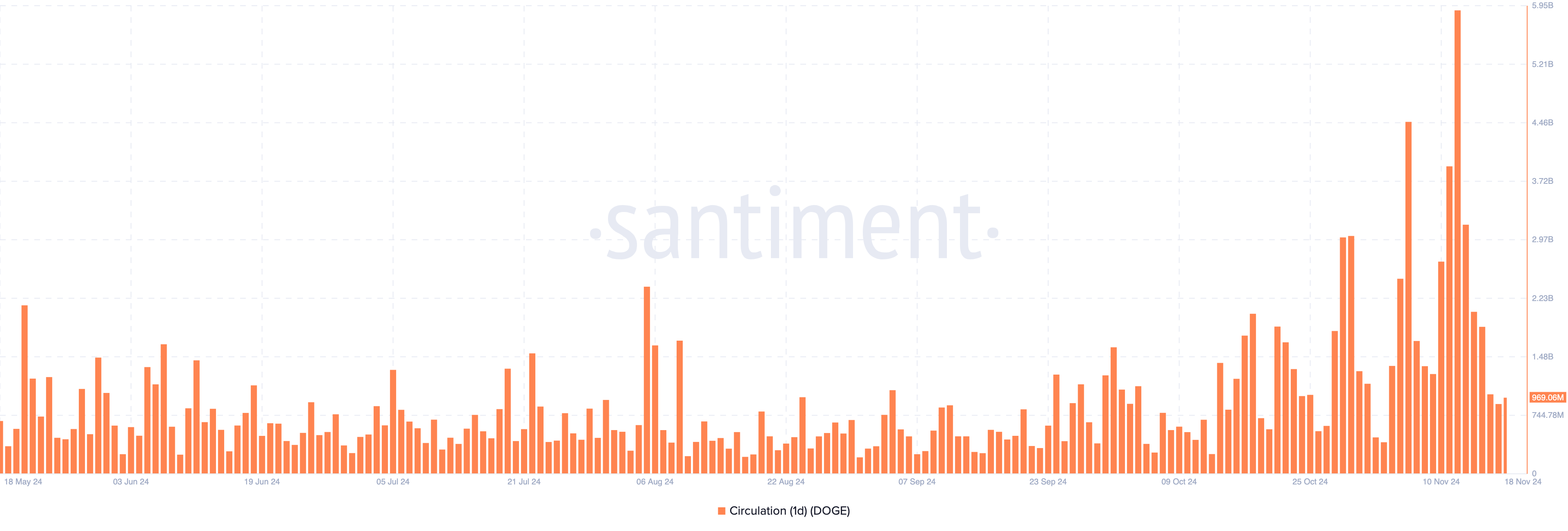

Beyond that, on-chain data from Santiment shows a notable drop in Dogecoin circulation. Circulation shows the number of coins involved in transactions within a given period.

In most cases, when this metric increases, it means selling pressure has potentially increased. However, for DOGE, the circulation has dropped from 5.88 billion to 969.06 million as of this writing.

Like the Coin Holding Time, the decrease in circulation is a bullish sign, indicating rising buying pressure. If this decline continues, DOGE’s price could bounce higher than $0.37.

DOGE Price Prediction: Major Bounce Likely

Once again, Dogecoin has formed a bull flag on the 4-hour chart. The last time this happened, DOGE’s price rallied by more than 100%.

A bull flag is a continuation pattern that signals a likely continuation of a price uptrend following a brief pullback or consolidation. When the price breaks out of the pattern, it typically resumes its upward trajectory.

Considering this outlook, Dogecoin’s price is likely to climb above $0.50 in the short term. However, if Dogecoin holders begin to sell, this might not happen. In that case, the meme coin could drop below $0.30.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/dogecoin-next-rally-coming/

2024-11-18 12:30:00