On August 5, Ethereum’s (ETH) price dropped to $2,226, causing the broader market to panic. But since then, the altcoin has been able to erase some of the losses, trading at $2,660 at press time.

However, investors are wondering whether ETH has survived its most difficult phase. This on-chain analysis reveals the answer.

Ethereum’s Bull Run Is Back on Track

One way to assess this is by analyzing the Market Value to Realized Value (MVRV) pricing bands. These bands allow investors to estimate the price levels at which a cryptocurrency will reach a high level of unrealized profits or losses.

When a cryptocurrency reaches its highest level of unrealized profits, it means that the price has reached its cycle top. However, when there is a high level of losses, the crypto appears to be close to the bottom.

According to Glassnode, the extremely high MVRV pricing level (red) is at $6,759. This value points to the potential price that establishes the top of the Ethereum market cycle.

As mentioned earlier, this metric also spots potential bottoms. As seen above, the extremely low MVRV pricing level (blue) was $1,687. The last time ETH reached this level was in December 2023, suggesting that the cryptocurrency’s price might no longer drop below this point before the end of this cycle.

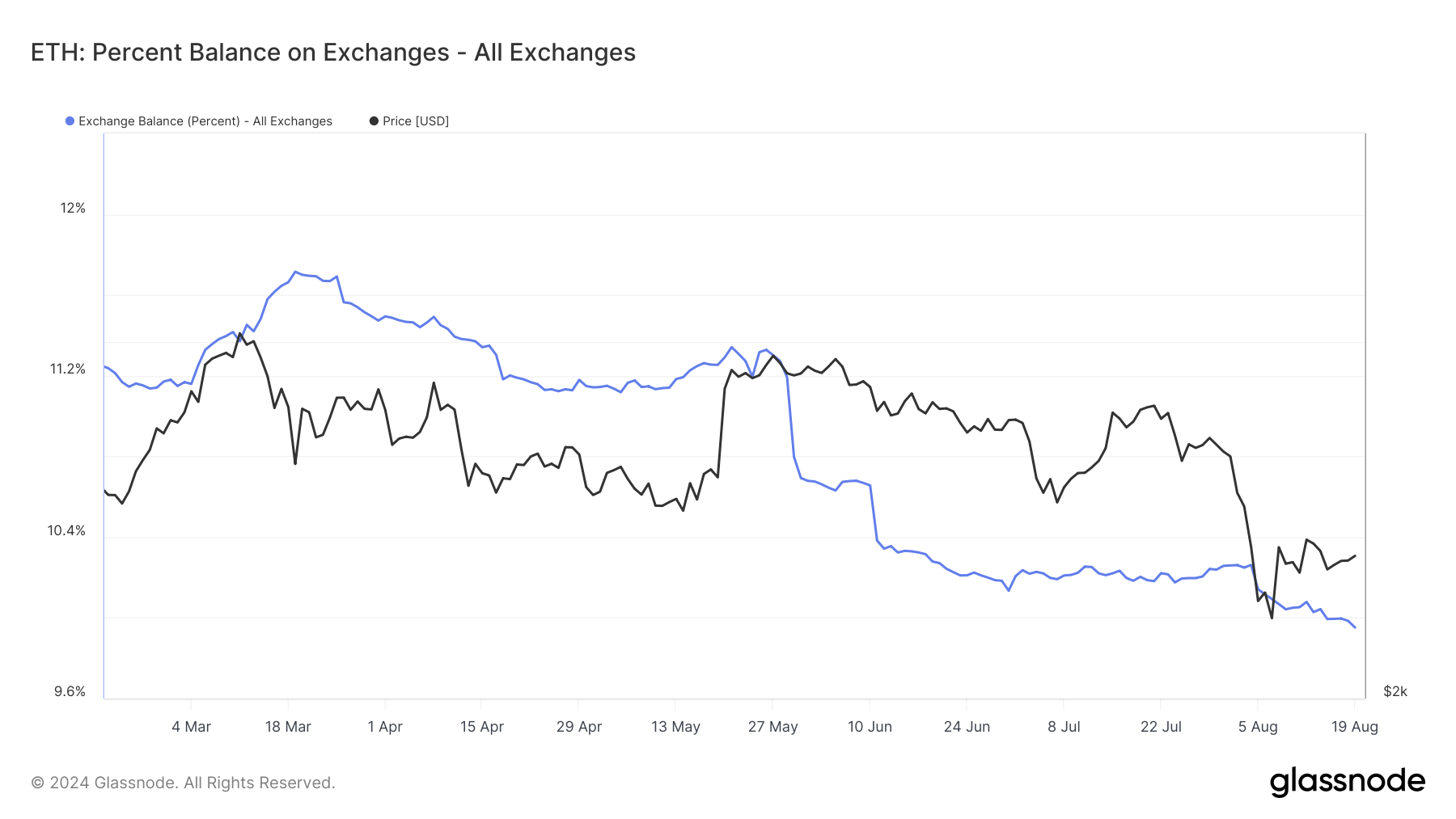

Furthermore, the percentage of ETH held on exchanges continues to decline, indicating a shift in investor behavior. Typically, when more cryptocurrencies are stored on exchanges, it signals an intent to sell, which can put downward pressure on prices.

As of March 19, the percentage of ETH on exchanges stood at 11.71%. Currently, that figure has dropped to 9.95%. This reduction suggests that Ethereum holders are increasingly opting to retain their assets rather than sell them, indicating a growing confidence in the coin’s long-term value.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

Historically, a decision like this points to the conviction that the price may increase and is a crucial sign that the bull market is not down and out. Thus, if this ratio continues to drop, ETH’s chance of surpassing $6,000 this cycle also jumps.

ETH Price Prediction: $2,900 First, $4,700 Later

On the daily chart, Ethereum paints a bullish picture, aiming to exit the supply zone between $2,625 and $2,693. From the chart below, ETH was around a similar region in January. Between that period and March, the price of the cryptocurrency jumped by 88.20% and hit $4,082.

Therefore, if the altcoin aims to replicate such a pattern, the value of the ETH’s price could rise as high as $4,770 in a few months. On a short-term horizon, ETH price looks set to reach $2,932 as long as buying pressure increases.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, the crypto faces resistance around $2,779. If bulls fail to break above it, the altcoin price could be rejected. Should this be the case, ETH’s price may retrace to $2,487.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/ethereum-worst-days-over/

2024-08-20 18:00:00