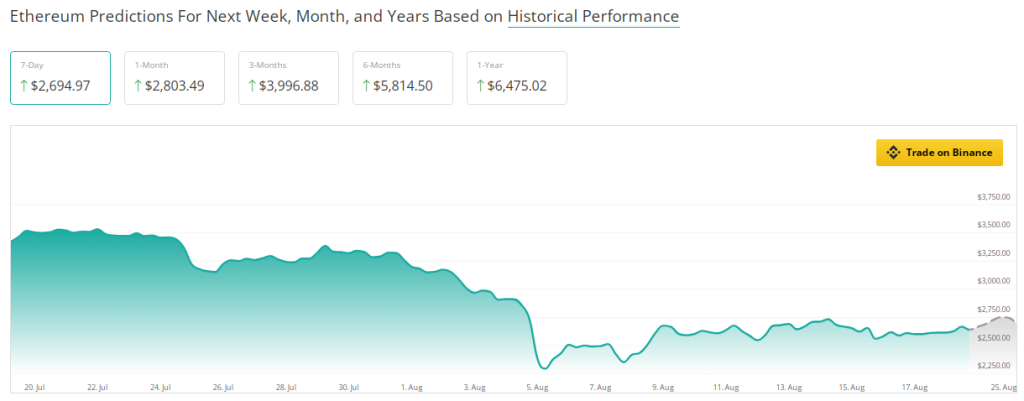

Ethereum might be on the verge of a major breakout, with predictions suggesting it might reach $3,000 next month. According to CoinCheckup, a popular crypto market prediction platform, Ethereum should rise by 51% in the next three months. With such a positive forecast, the current decline in the price of Ethereum could very well be a short-term hiccup against the looming rally.

Related Reading

Short-Term Analysis And Market Indicators

A crypto analyst, Michael van de Poppe, has been following Ethereum’s recent performance and believes it may soon reverse into an upward trend. Poppe shed light on the fact that ETH had been trading 6.14% below the estimated price for the next month.

Despite this, he feels there is an 80% chance ETH will surge above $3,000 in September. He likens the current market to past cycles, recalling the last time the altcoin saw a protracted loss was before the bear market in 2018.

There’s only one occasion where $ETH has been making more than three monthly candles in red.

It was the start of the bear market in 2018.

I think that the chance of $ETH being above $3,000 in September is larger than 80%. pic.twitter.com/deUgSGfqkR

— Michaël van de Poppe (@CryptoMichNL) August 17, 2024

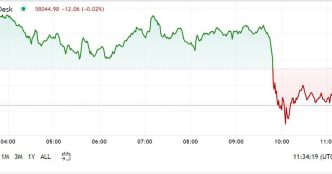

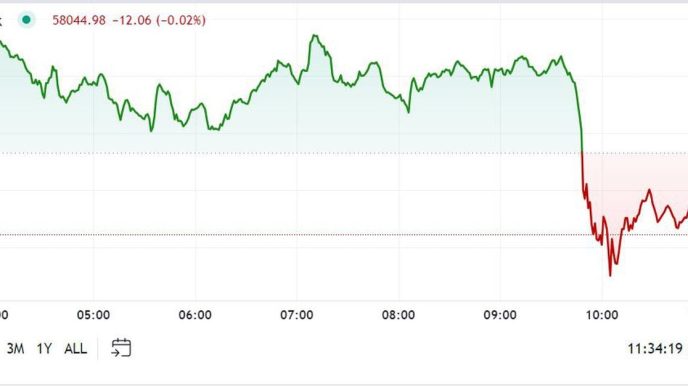

ETH found support close to $2,500 on weekly charts, a level usually seen before big recoveries. Another measure supporting the chances of price reversal lies with the stochastic RSI, now in oversold territory. If ETH could manage to clear itself of the $3,000 resistance and at least show some decent improvements in its demand trends, the rally would then be imminent.

Demand Trends And Investor Sentiment

Though the indicators are pretty promising technically, not everything is rainbow-colored with respect to Ethereum. The biggest altcoin has undergone a downtrend in demand, which the declining weekly RSI reflects. For Poppe’s projection to materialize, this downtrend needs to be negated. However, there will also be the uplifting signs. US investors are showing increased interest in ETH, highlighted by the positive Coinbase Premium Index.

Even futures markets speculators are optimistic, with the Taker Buyer Sell Ratio indicating that there is more buying than selling. This sentiment of traders does tell the fact that the market’s mood is such that it will help Ether go up.

Ethereum: Long-Term Growth Projections

Looking beyond short-term moves, however, CoinCheckup predictions are overwhelmingly positive for Ethereum in the long term. It has forecasted the cryptocurrency will rise by 120% in the next six months and by 145% in the next year. That essentially means the current dip in price could just be a blip before Ethereum rallies significantly.

Related Reading

These independent forecasts now blend to show the big potential of Ethereum. It will be a good opportunity for investors to increase their positions in ETH if the present market conditions play out in accordance with the given predictions.

The current Ethereum price levels, backed by these technical indicators and optimistic investor sentiment, do have the potential to push above $3,000. Of course, improving trends in demand and network activity will be hurdles to climb. However, the long-term outlook for this cryptocurrency is very promising. Investors should keep themselves updated and watch for signs that may confirm the predicted rally.

Featured image from Pexels, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/will-ethereum-hit-3000-in-september-analyst-bets-on-80-odds/

2024-08-19 11:00:56