The possibility of a Dogecoin market reversal has crypto observers interested in the meme coin. While it did record some gains in recent days, CoinCodex’s price prediction still projects a 13% decline, which may further drive DOGE to $0.088742 by October 10, 2024.

Related Reading

This is despite an interesting observation by cryptocurrency analyst Master Kenobi. As Kenobi says, every downtrend is retreating in duration, which in turn means that the bears may exhaust themselves, and it could clear the way for a recovery.

The #DOGE bear market consisted of three major downtrend cycles.

Whether it’s a coincidence or not, the first cycle lasted 540 days, nearly 1.5 years; the second lasted 364 days, exactly one year; and we are now concluding the third downtrend cycle, which lasted approximately 182… pic.twitter.com/GToZmRaPCh— Master Kenobi (@btc_MasterPlan) September 9, 2024

He explained that the initial downtrend lasted 540 days, or approximately 1.5 years while the second cycle was 364 days. Against these, he said, the ongoing downtrend has seen only 182 days, or roughly six months. As a matter of fact, the compressing length of such cycles could be seen as a signal for a momentum shift, setting things up for a likely bull run.

Dogecoin Price Action

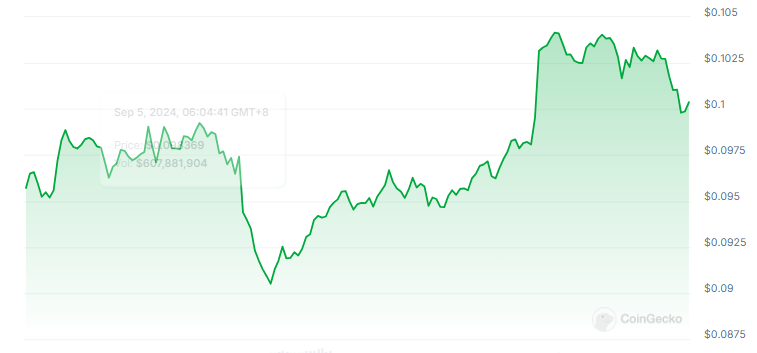

Dogecoin is currently trading at $0.1003, up 6% in the last seven days. The price had bounced off a support line of $0.089 and a bullish falling wedge pattern on DOGE’s daily chart has been identified. Dogecoin’s price would rapidly shoot to $0.15 if it maintains the level above $0.10, the chart suggests.

Fear And Market Sentiment

Despite the recent upward movement, market sentiment still lies in fear. The Fear & Greed Index stands at 33 for now and illustrates the amount of fear investors have. This, despite the performance of Dogecoin in the last 30 days, which stood at 15 green days up.

The price movements of DOGE, on the other hand, usually come pretty stable as the positivity rate stood at 50%. Volatility remains very low, standing at 4.38%. While stability can be reassuring, it also suggests that DOGE lacks the momentum for a major breakout.

Mixed signals in the market have made investors wary of taking any particular call. Investors seem to be performing a balancing act between short-term optimism and longer-term risks. The low volatility and an equal number of green days signal consolidation without showing any reversal signals.

Related Reading

Conflict In Forecasts

While some short-term indicators may have reflected the possibility of a rally, the longer-term forecast is bearish. According to CoinCodex, this cryptocurrency might fall 13.78%, putting Dogecoin at $0.088742 by October 2024. The above forecast really conflicts with the current bullish momentum of this token.

Dogecoin is, therefore, at a crossroads. While the short-term indications may suggest some bullish momentum, technical indicators and recent price action indeed support a plausible rally for the meme crypto.

But until then, the bearish long-term forecast continues with ongoing market fear; it would be best to exercise caution. Investors will do well by keeping a close eye on the short-term price action and broader market development before making serious moves.

Featured image from StormGain, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/analyst-eyes-7-dogecoin-jump-will-it-smash-the-0-15-barrier/

2024-09-11 11:30:44