Cardano (ADA) has been on a winning streak in recent weeks. Over the past seven days, the altcoin’s value has risen by 55%. It currently trades at $0.57, a price level last observed in April.

On-chain data shows that the spike in the coin’s value has delivered substantial gains to Cardano holders, much of which remains unrealized. However, as profit-taking intensifies, ADA may witness a pullback in the short term.

Cardano’s Rally Puts Many of Its Holders in Profit

Cardano’s market value to realized value (MVRV) ratio, which measures the overall profitability of all its holders, has returned only positive values over the past seven days. Per Santiment’s data, as of this writing, the altcoin’s 30-day and 90-day MVRV ratios are 25.70% and 43.87%, respectively.

When an asset’s MVRV ratio is positive, it is deemed overvalued. This means that its current market price is higher than the average purchase price of its coins in circulation.

Due to this, investors holding profits may be tempted to cash out. This trend often results in a spike in selling activity as investors scamper to lock in their gains, driving down the asset’s price in the short term.

Therefore, while Cardano’s positive MVRV ratio points to strong holder gains, it also highlights the potential for increased volatility. Some investors may decide to realize profits, putting downward pressure on the coin price in the near term.

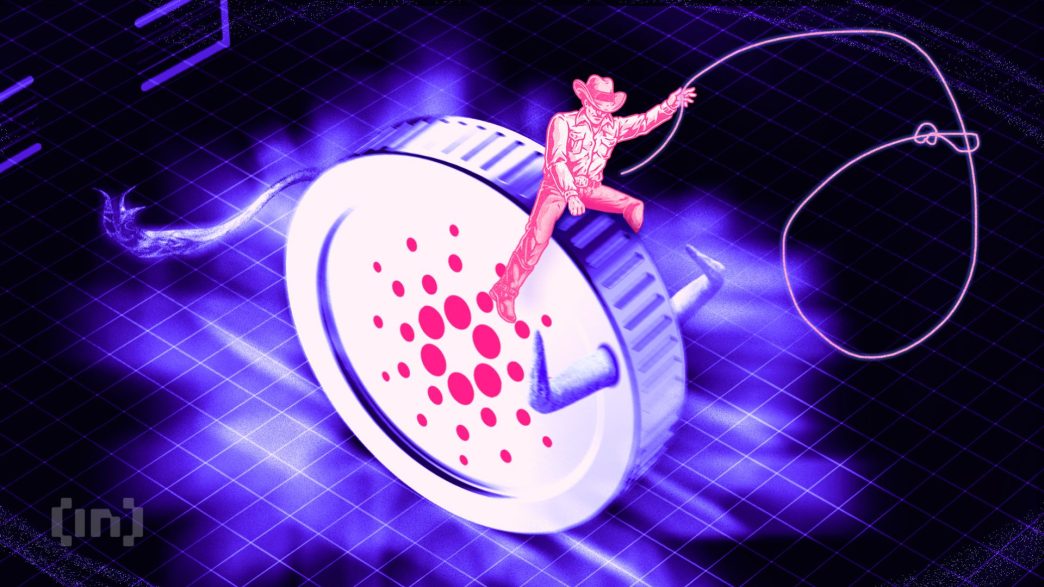

Moreover, the fact that daily transactions involving the altcoin have returned more gains than profit over the past few days may be another reason why Cardano holders may be tempted to sell. BeInCrypto’s assessment reveals a sharp increase in the coin’s daily transaction volume in profit over the past seven days.

As of November 13, this totaled 5 billion. That day, the ratio of daily on-chain transaction volume in profit to loss was 1.04, indicating that for every ADA transaction ending in a loss, 1.04 transactions returned a profit.

ADA Price Prediction: Will Traders Resist the Urge To Sell?

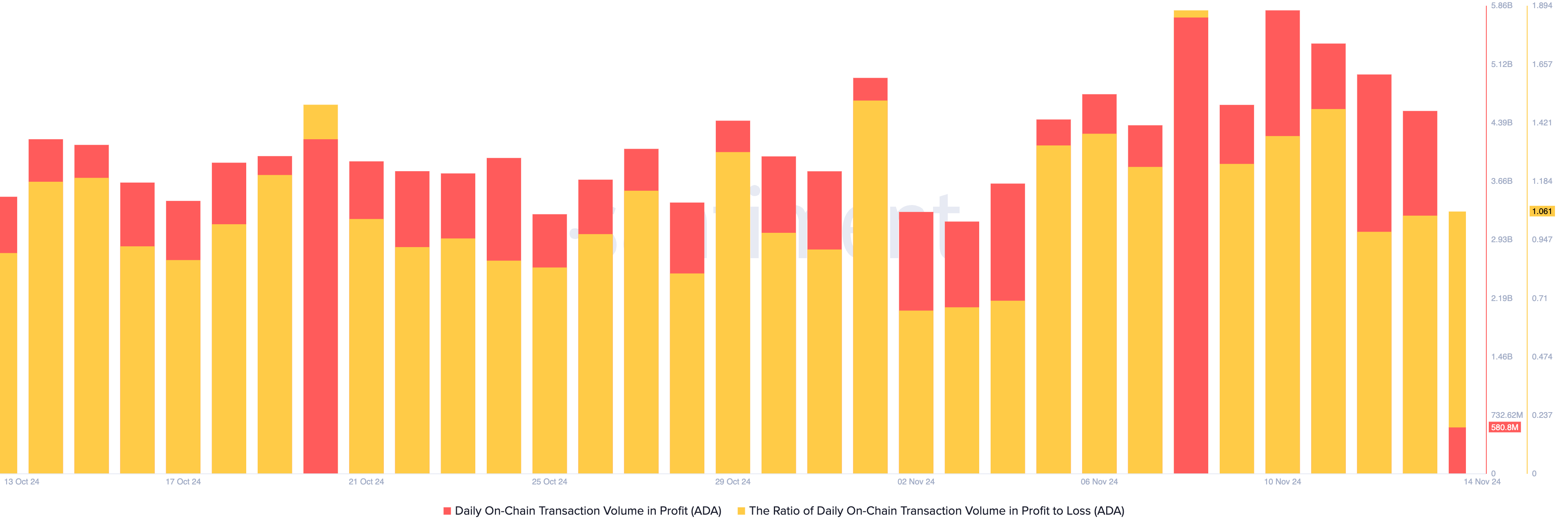

Notably, according to IntoTheBlock, due to the price surge, 52% of all addresses holding Cardano are currently “in the money.” This means that 2.3 million addresses would be profitable if they were to sell their coins at the current market price. Conversely, 41.3% of all Cardano holders, comprising 1.86 million addresses, are “out of the money,” that is, they sit on unrealized losses.

If the coin’s high profitability prompts many holders to sell their coins, it will put downward pressure on its price, preventing a continued rally toward the $1 price mark. Should selling pressure gain momentum, the Cardano coin price may fall toward support at $0.54. If this level fails to hold, its price may plummet further to $0.47.

However, if holders resist the urge to sell and double down on coin accumulation, it could drive the Cardano coin price above $0.60, setting the stage for a potential move toward its year-to-date high of $0.81.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-ada-rally-profit-taking/

2024-11-14 15:00:00