Raydium (RAY) price has surged nearly 20% over the past week, showing impressive strength within the Solana ecosystem. With Raydium maintaining a stronghold as the leading decentralized exchange on Solana, its price momentum is backed by substantial trading activity and liquidity.

Indicators show a bullish setup, with short-term moving averages above long-term ones and RSI still below the overbought level, hinting at potential room for further gains. However, if upward momentum fades or Solana’s trading volume cools, RAY could face downside pressure, testing key support levels.

Raydium Is The Dominant Force In The Solana Ecosystem

Raydium stands as one of the most successful applications within the Solana ecosystem, easily leading in trading volume. Among decentralized exchanges (DEXs) on Solana, Raydium consistently ranks as the largest, with a significant portion of the ecosystem’s activity flowing through its platform.

For instance, during the week beginning October 28, Solana’s DEX volume hit $14.3 billion, with Raydium alone contributing $8.9 billion, representing a dominant 62% of the total.

Read more: What Is Raydium (RAY)?

This weekly trend of Raydium leading the Solana DEX space underlines its stronghold in the ecosystem. Last week, for example, Raydium passed Ethereum in fees.

As Solana continues to gain attention and attract institutional investors, Raydium’s relevance and volume dominance could increase, potentially impacting its price in the near term.

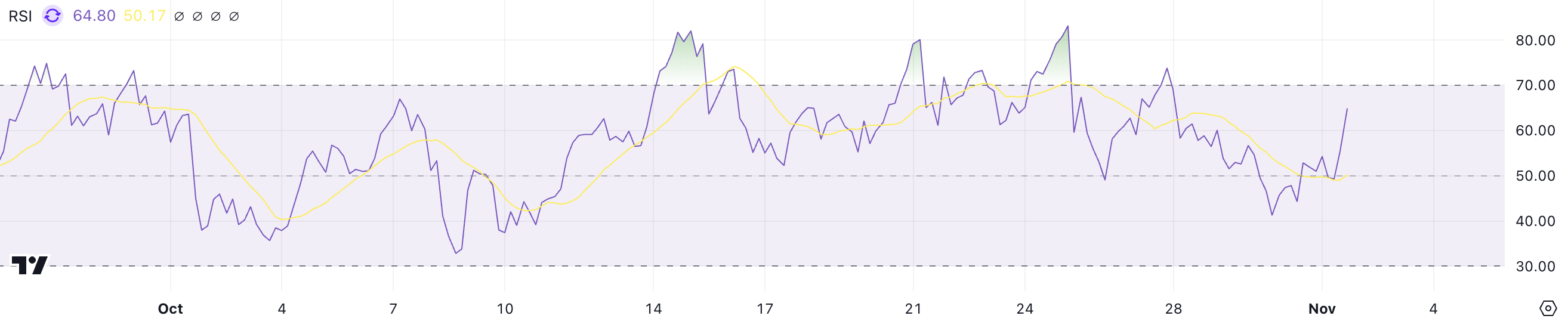

RAY RSI Is Below the Overbought Stage

RAY price has gained 18.51% this week, yet its RSI currently sits at 64.8, still below the overbought threshold. RSI, or the Relative Strength Index, measures the speed and magnitude of recent price changes to gauge potential overbought or oversold conditions.

Typically, RSI values above 70 indicate an overbought asset, while values below 30 suggest it’s oversold. With RAY’s RSI below the overbought level, this suggests that the recent uptrend may still have room to grow.

Although RAY’s price has significantly risen, the moderate RSI level implies that buying pressure isn’t yet extreme, potentially allowing for further gains before reaching an overbought condition.

RAY Price Prediction: Biggest Price Since 2022?

RAY’s EMA lines indicate a bullish setup, with all EMAs positioned below the current price and shorter-term EMAs trending above longer-term ones.

This alignment suggests strong upward momentum, with buyers maintaining control in the short term. If this uptrend holds and RSI remains under the overbought threshold of 70, RAY could surpass $3.62, marking its highest price since 2022.

Read more: 11 Top Solana Meme Coins to Watch in November 2024

However, should the uptrend reverse – potentially triggered by an overbought RSI or a slowdown in Solana DEX activity – RAY might test support at $2.94. If that support level doesn’t hold, RAY price could continue going down toward $2.65.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/raydium-ray-price-surge-solana/

2024-11-01 20:00:00