Like other cryptos in the market, Shiba Inu’s (SHIB) price experienced a double-digit decline in the last 24 hours. This price decrease could be linked to the rising dominance of SHIB bears, as bulls appear to have taken a backseat.

Under this condition, it might be challenging for the SHIB price to register a notable rally. Other factors could accelerate the drawdown.

Shiba Inu Selling Pressure Rises, Network Activity Slides

Two days ago, SHIB’s price was $0.000024. As of this writing, the value of this meme coin has decreased to $0.000019 and is in tune with the broader market condition, which has seen Bitcoin (BTC) and other altcoins drop.

According to this analysis, it is likely that cryptocurrency will continue to fall. An indicator suggesting this bias is the Bulls and Bears indicator. This indicator tracks the activity of addresses that bought (bulls) and sold (sellers) 1% of the total trading volume.

When the number of bulls is higher, SHIB’s price might experience significant upward pressure. As of this writing, the number of SHIB bears has increased, suggesting that the meme coin’s value could decline below $0.000019 in the short term.

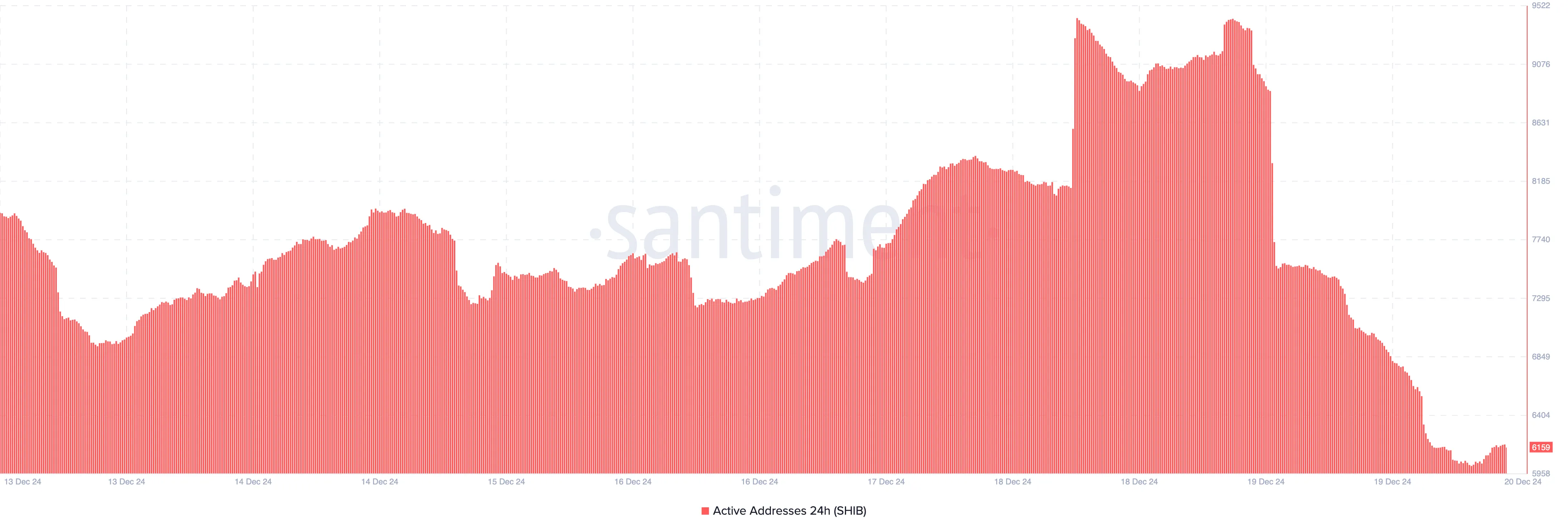

Beyond this, network activity serves as another key indicator that points to a potential further decline in Shiba Inu’s price. On-chain data from Santiment reveals a significant drop in active addresses associated with the token.

Active addresses measure the number of unique wallets interacting with a cryptocurrency over a given period. When this metric rises, it suggests heightened engagement, as more wallets are participating in transactions involving the cryptocurrency.

Conversely, a decline in active addresses, as seen with SHIB, indicates reduced interaction with the token, signifying a drop in successful blockchain transactions. This diminishing activity may reflect waning interest or demand, further supporting the likelihood of SHIB’s value decreasing in the near term.

SHIB Price Prediction: Token Continues to Sink

The last time SHIB’s price attempted to trade higher was on December 11. At that time, the token’s value was $0.000029. On the 4-hour chart, the Relative Strength Index (RSI) reading is 31.53.

The RSI measures momentum using the size and speed of price changes. When the reading is below 50.00, momentum is bearish. On the other hand, if the indicator’s reading rises, the momentum is bullish.

Considering the current outlook, SHIB bears might continue the tug the price down. If this trend continues, the meme coin’s value might decline to $0.000015.

However, if bulls become dominant or the token becomes oversold, this might change. In that scenario, SHIB’s price might break above the $0.000026 resistance, and the rally could hit $0.000033.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/shiba-inu-bears-gain-ground/

2024-12-20 16:00:00