Shiba Inu’s (SHIB) crypto price has increased by 40% in the last seven days following the broader market rally. But today, SHIB faced a roadblock as it attempted to rise above $0.000030.

Despite the setback, on-chain data reveal that the SHIB holders appear unperturbed. If this remains the same, then the meme coin’s retracement could be temporary.

Shiba Inu Holders Refrain from Selling

Earlier today, SHIB’s price rallied to $0.000030, with speculation spreading that the token could hit a new yearly high. But that did not happen, as the price has now dropped to $0.000025.

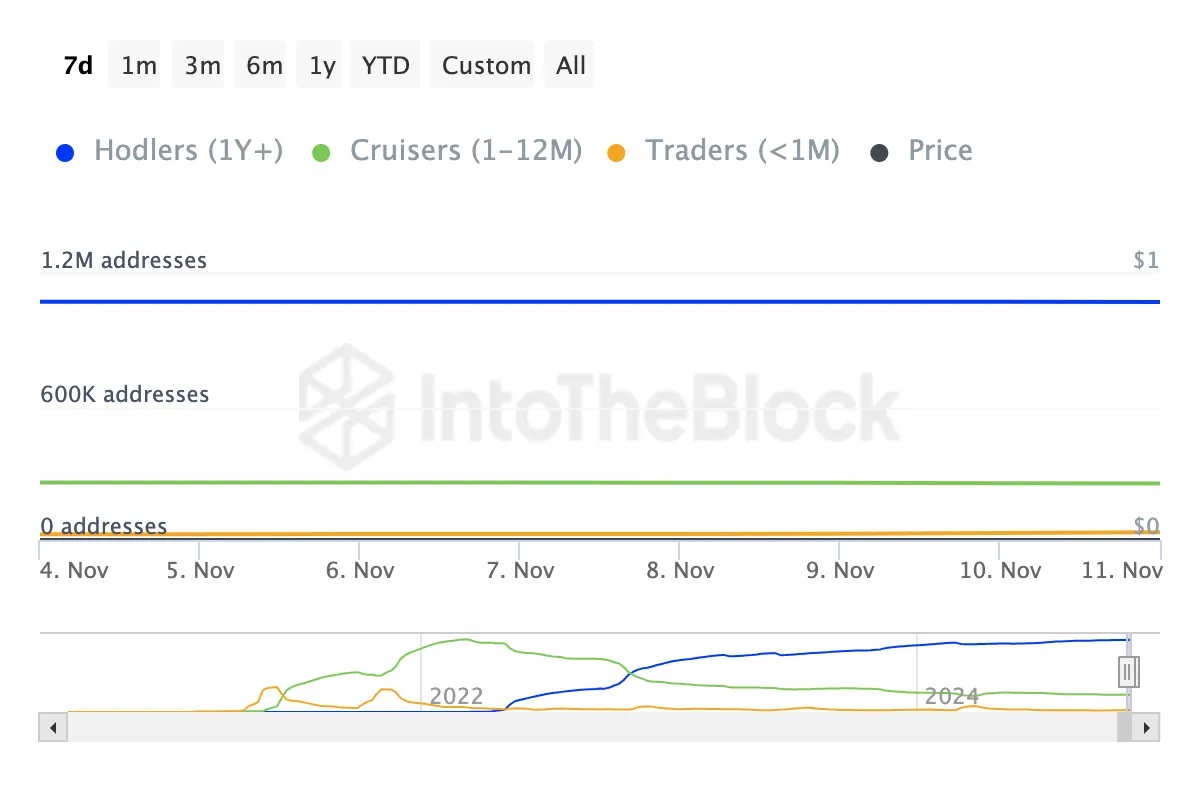

While some other crypto declines could be linked to selling pressure, the Coin Holding Time metric shows that SHIB holders are refraining from exerting downward pressure on it. The Coin Holding Time metric measures how long a coin has been held without being transacted or potentially sold.

When it falls, it means hodlers are selling. However, in this case, the metric has risen by over 500% within the past week, indicating bullish conviction and less selling pressure around the token.

Should the token holders continue to hold this line, the cryptocurrency could see a quick rebound.

Also, a look at the Balance by Time Held metric reveals that most of the traders who accumulated Shiba Inu within the last 30 days are still holding it. If the trend is sustained like the Coin Holding Time, then SHIB’s rally could be back underway soon.

SHIB Price Analysis: Rebound Likely

Based on the daily chart, the SHIB crypto faces major resistance around $0.000028. This pullback brought the meme coin’s value down to $0.000026. However, the daily chart shows that bulls are fiercely defending the region.

Furthermore, the Moving Average Convergence Divergence (MACD) has remained in the positive region. The MACD is a technical oscillator that measures the relationship between two EMAs to gauge momentum.

When the reading drops, it means the momentum is bearish. However, since the reading is in the green zone, it indicates positive momentum around SHIB. Should this remain the same, then SHIB’s price could rally toward $0.000030.

In a highly bullish situation, SHIB’s price might climb toward $0.000035. On the flip side, if bears neutralize the support, the token could decline to $0.000021. If selling pressure intensifies, the token could drop to $0.000017.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/shib-crypto-rally-hits-a-wall/

2024-11-12 15:40:03