Solana’s (SOL) price has reached $180 for the first time since July, igniting speculation that the altcoin might be set for an extended breakout. This upward momentum coincides with surging investor interest, but the question remains: will Solana reach $200?

While traders eagerly anticipate this breakout, technical indicators suggest that a pullback may be imminent before SOL can continue its ascent.

Solana Becomes Overbought After Impressive Hike

One key indicator warning of a pullback for Solana is the Chaikin Money Flow (CMF), which measures buying and selling pressure on an asset.

A decreasing CMF, especially during a price rise, signals weakening buying pressure. Conversely, a rising CMF during an upward trend indicates strong buying support. The CMF also reveals whether an asset is overbought or oversold.

Typically, readings above 0.20 indicate an overbought condition, while readings below -0.20 suggest oversold status. In Solana’s case, the CMF recently hit 0.28, indicating that the upward price movement has received sufficient buying volume.

Read more: How to Buy Solana (SOL) and Everything You Need to Know

However, this also suggests that buying pressure has overheated, leading to a potentially negative response to the question: “Will Solana reach $200?”

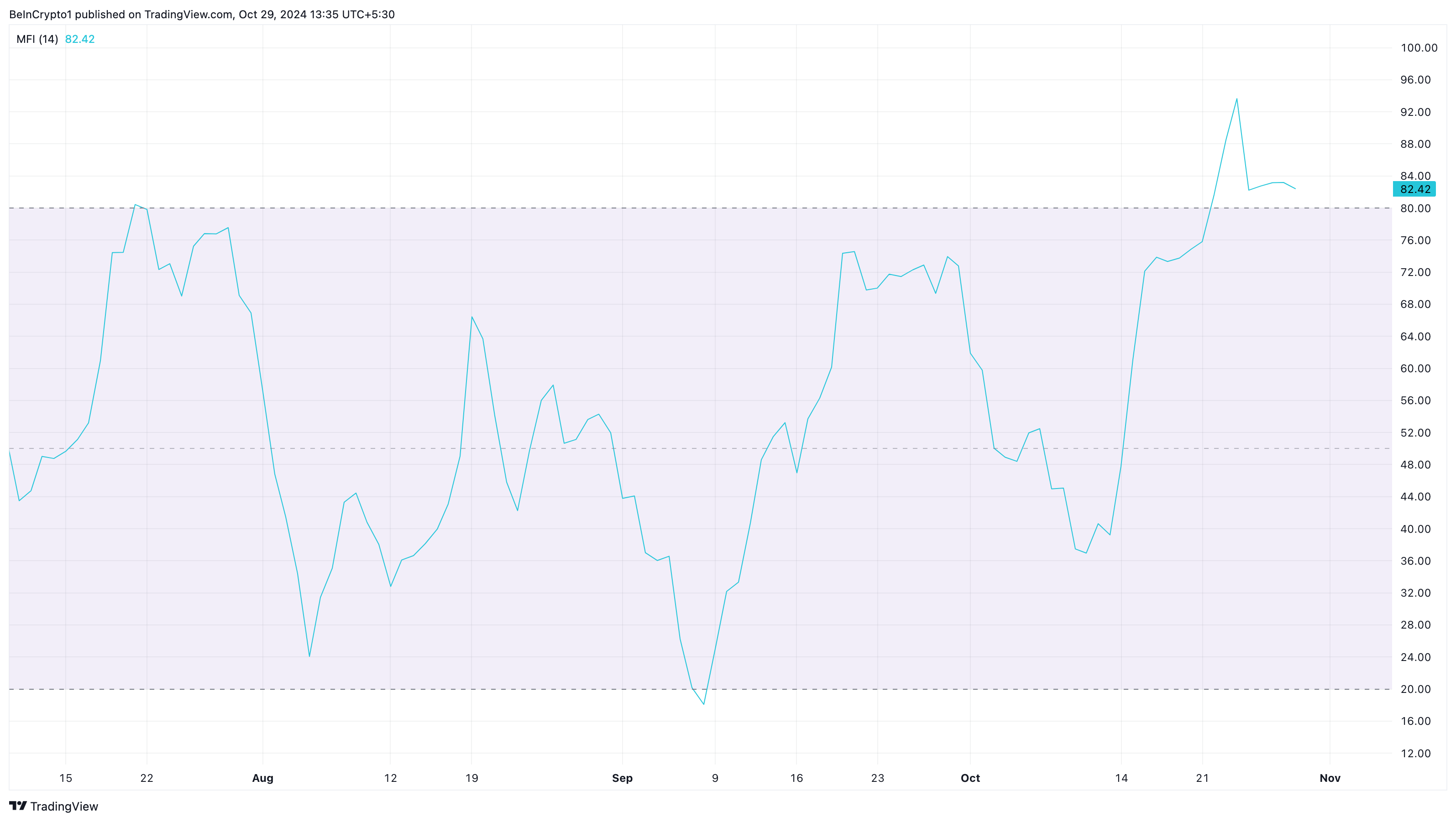

The Money Flow Index (MFI) raises similar caution signals. Currently, the MFI has surpassed a reading of 80.00, confirming that SOL is overbought. If the reading were below 20.00, it would indicate oversold conditions.

Given this outlook, Solana’s upward momentum could ease, potentially resulting in a short-term correction before another notable surge.

SOL Price Prediction: Retracement Could Be Next

On the daily chart, Solana’s price successfully retested the $180 mark after breaking out of an ascending triangle pattern. This breakout signaled a bullish trend, indicating that traders were eager to push the price higher.

However, even though SOL could trade higher, the supply zone at $185 is likely to push the value down. The last time SOL hit $185, it faced a 30% correction and is yet to hit the mark again.

This is not to say that Solana will not reach $200. But before that happens, the overhead resistance could pull the price back to $161.81 before making another attempt to go higher.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

On the other hand, if bulls successfully drive the token above $185, the price might not experience a drawback before it hits $200.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/will-solana-reach-200-analysis/

2024-10-29 10:00:00