SPX’s price has climbed by 25% over the past 24 hours, significantly outperforming major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and other assets in the top 100. This rally propelled SPX to a new all-time high of $1.25 during Friday’s early Asian session.

While it has since noted a 4% pullback, the bullish bias toward the token remains significant, hinting at further price growth.

SPX6900 Enjoys Increased Trading Activity

The surge in activity around SPX is reflected in its rising open interest, which now sits at an all-time high of $30.46 million. According to Coinglass, this has increased by 90% over the past 24 hours.

Open interest measures the total number of outstanding derivative contracts, such as futures or options, that have not been settled or closed. When open interest rises during a price rally, new money is entering the market, indicating stronger participation and confidence in the upward trend. It signals that the rally has momentum and is less likely to be a short-term move.

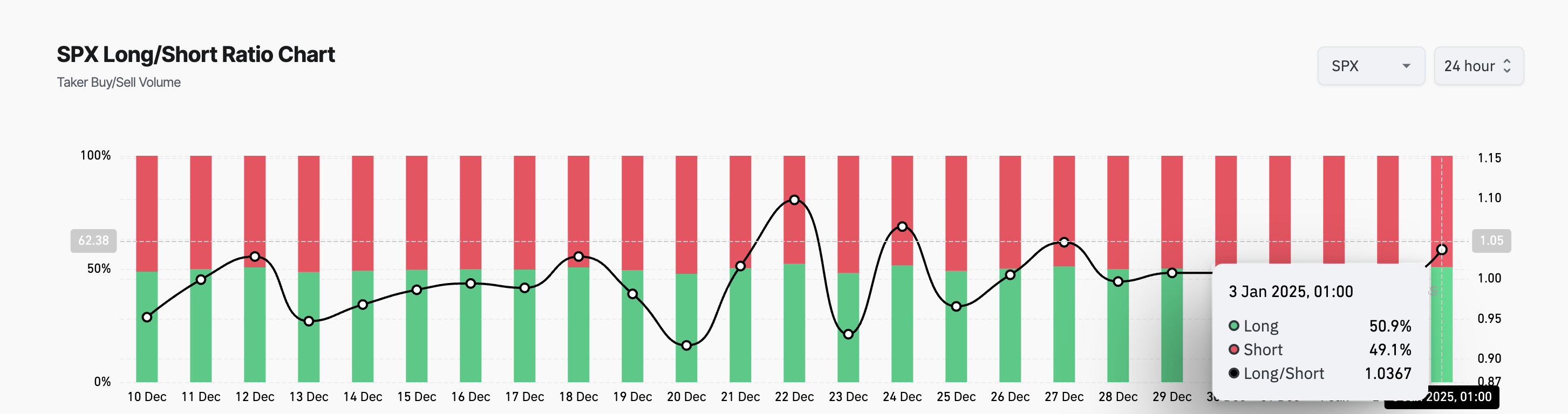

Additionally, SPX’s Long/Short ratio confirms the bullish bias toward the altcoin. As of this writing, this is 1.03.

An asset’s Long/Short ratio measures the proportion of its long (buy) positions to short (sell) positions in a market, reflecting trader sentiment. As with SPX, when the ratio is above 1, it shows more traders are taking long positions, often signaling bullish sentiment.

SPX Price Prediction: Profit-Taking Poses Risks to Bullish Outlook

On the daily chart, SPX’s Chaikin Money Flow (CMF) highlights the growing demand for the altcoin. At press time, this indicator, which measures the flow of money into and out of an asset, is in an upward trend at 0.08.

When an asset’s CMF is positive, it indicates that buying pressure is stronger than selling pressure, suggesting bullish market sentiment. If this bullish sentiment persists, SPX could reclaim its all-time high of $1.25 and rally past it.

However, if token holders begin to sell for profits, this could invalidate this bullish projection. In that scenario, SPX’s price may dip to $0.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/spx-outperforms-top-coins/

2025-01-03 11:30:00