User activity on the Litecoin (LTC) network has declined over the past few days, reaching its 2023 low on Monday. This drop in network usage has coincided with a dip in the LTC token price, which has plummeted by 10% in the past week, falling below the crucial $100 mark.

With these signs pointing to a loss of confidence in the altcoin, LTC is at risk of further losses.

Litecoin Sees Weakening User Demand

On-chain data shows a decline in Litecoin’s user activity in the past four days. According to BitInfoCharts, the number of unique addresses that completed at least one transaction on the Layer-1 network on Monday totaled 193,477, representing its lowest single-day count since November 2023.

A decline in daily active addresses signals reduced user engagement and activity on the network. This downturn indicates waning interest in the network and its native token, potentially impacting its value in the short term.

This has played out with Litecoin’s LTC, which has shed 13% of its value over the past seven days. As of this writing, the altcoin trades at $98.63, below the critical $100 price mark.

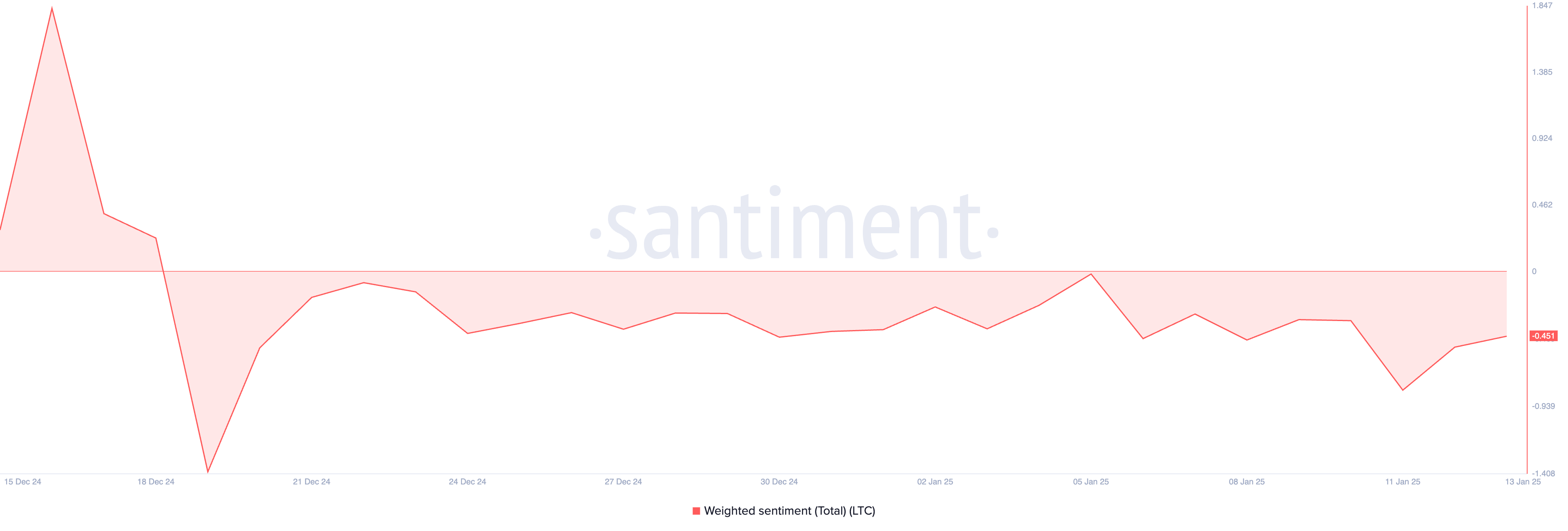

In addition to this decline in network activity, LTC’s weighted sentiment has also remained negative, adding to the downward pressure on its price. As of this writing, this is -0.45.

An asset’s weighted sentiment measures its overall positive or negative bias, considering both the volume of social media mentions and the sentiment expressed in those mentions. When it is negative, it is a bearish signal, as investors are increasingly skeptical about the token’s near-term outlook. This prompts them to trade less, exacerbating the price decline.

LTC Price Prediction: Descending Triangle Confirms the Drop

On the LTC/USD one-day chart, the altcoin trades below a descending trendline. This pattern is formed when an asset’s price consistently creates lower highs over time, indicating a downward trend. The overall market sentiment is bearish in this scenario, with selling pressure outweighing buying.

If the LTC buying pressure weakens further, its price could extend its losses and drop toward support at $86.64.

However, if buying activity resumes, this bearish outlook will be invalidated. In that case, the LTC token price could break above the descending trend line to trade at $109.81.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ltc-token-price-drop-network-demand/

2025-01-14 14:30:00