With the ongoing slump in Bitcoin (BTC) and the broader crypto market, traders should prepare for potential price swings this week, driven by key US economic updates.

Bitcoin is hovering around $54,000, with experts predicting more downward movement. Historically, September is the worst-performing month for BTC, but there’s hope for a rebound in October.

Key US Economic Events to Watch This Week

Risk-on assets like Bitcoin have started the week quietly. The largest cryptocurrency is currently trading at $54,800, reflecting a modest 0.7% rise in the last 24 hours.

However, upcoming US macroeconomic events and the anticipated debate between Donald Trump and Kamala Harris could impact traders’ sentiment and drive shifts in portfolios. Let’s take a closer look at how these events might shape the markets.

Donald Trump Debate Against Kamala Harris

As BeInCrypto previously noted, the upcoming presidential debate between Donald Trump and Kamala Harris has put crypto in the spotlight. Both candidates have made the topic central to their campaigns. Harris appears to be warming up to pro-crypto policies, according to recent reports.

Trump, meanwhile, has made bullish comments about Bitcoin and the broader crypto market, winning favor among industry insiders. Pennsylvania Senator John Fetterman predicts a “close” debate, recognizing that both Trump and Harris are capable of holding their ground.

According to CoinGecko data, PolitiFi meme coins are already seeing volatility in anticipation of the debate, with some Trump-inspired coins posting double-digit gains.

Read more: How Can Blockchain Be Used for Voting in 2024?

US CPI

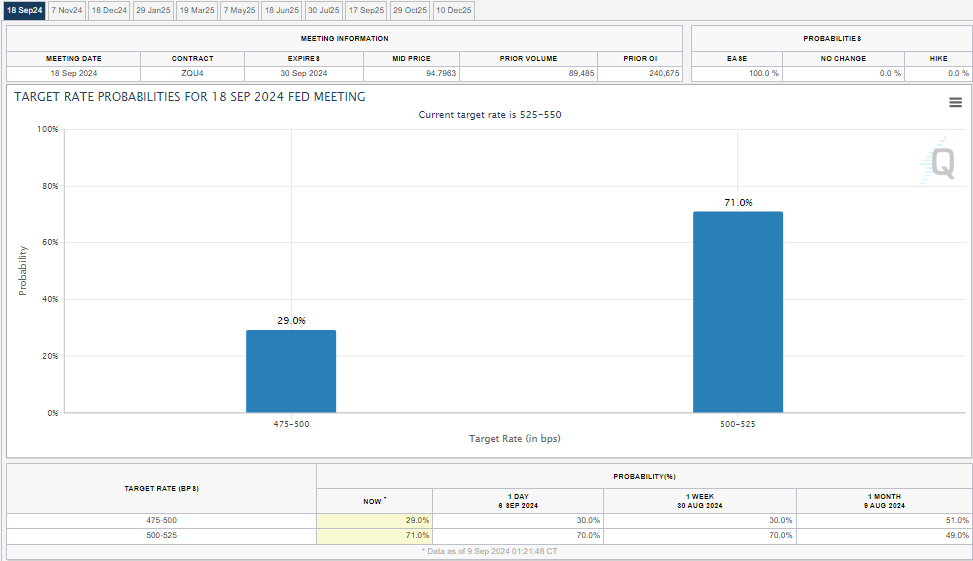

Inflation is the focal point this week with the release of the August Consumer Price Index (CPI) and the less significant Producer Price Index (PPI), both arriving before the Federal Reserve’s next meeting. These figures could play a crucial role in determining the Fed’s interest rate decision.

The Bureau of Labor Statistics (BLS) is set to release the August CPI on Wednesday, September 11. In July, inflation eased to 2.9% from June’s 3%, a shift that boosted Bitcoin’s performance.

Economists now expect inflation to drop further to 2.7%, which could bolster Bitcoin’s strength if realized. Core CPI, excluding volatile items like food and energy, is projected to cool to 3.1% in August, down from 3.2% in July. Both headline and core CPI are expected to show monthly growth of 0.2% for August.

“Amid anticipation for the CPI data and Trump-Harris debate, traders claim Bitcoin’s current value is markedly low. Crypto markets await US economic and political news impacts,” one user noted.

Consumer Sentiment

Markets will also focus on the preliminary consumer sentiment report, set for release on September 13. The University of Michigan’s Consumer Confidence data will highlight the gap between the US economy’s overall strength and how households perceive their financial well-being.

Consumer sentiment tends to be more sensitive to inflation, while consumer confidence is closely tied to the labor market. Strong consumer confidence could boost spending and drive investment in assets like Bitcoin if investors remain optimistic about the economy. However, if Friday’s data reveals that consumers are still struggling with inflation, high interest rates, and job insecurity, crypto markets may react unpredictably.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Additionally, Thursday’s initial jobless claims report could impact crypto volatility. This employment data might influence market sentiment by shaping perceptions of economic health and expectations for monetary policy, both of which could indirectly affect Bitcoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/us-economic-events-crypto-implication-this-week/

2024-09-09 07:39:07