Since October 1, Ripple’s XRP has been confined to a narrow trading range, balanced between resistance at $0.54 and support at $0.52. With bearish sentiment intensifying, the chances of a breakout above this range have diminished.

As selling pressure mounts, XRP’s price targets may shift lower, signaling potential downward movement in the near term.

Ripple Bears Push For Price Decline

XRP’s negative weighted sentiment is a clear marker of the bearish bias that has trailed the altcoin in the past few days. This metric, which measures the overall market mood regarding an asset, currently stands at -0.08.

When an asset’s weighted sentiment falls below zero, it signals a bearish outlook, indicating that more investors expect the asset’s price to decline or are pessimistic about its mid-term potential. This negative sentiment often leads to increased selling pressure, as investors act on their concerns, further driving the asset’s price down.

Read more: XRP ETF Explained: What It Is and How It Works

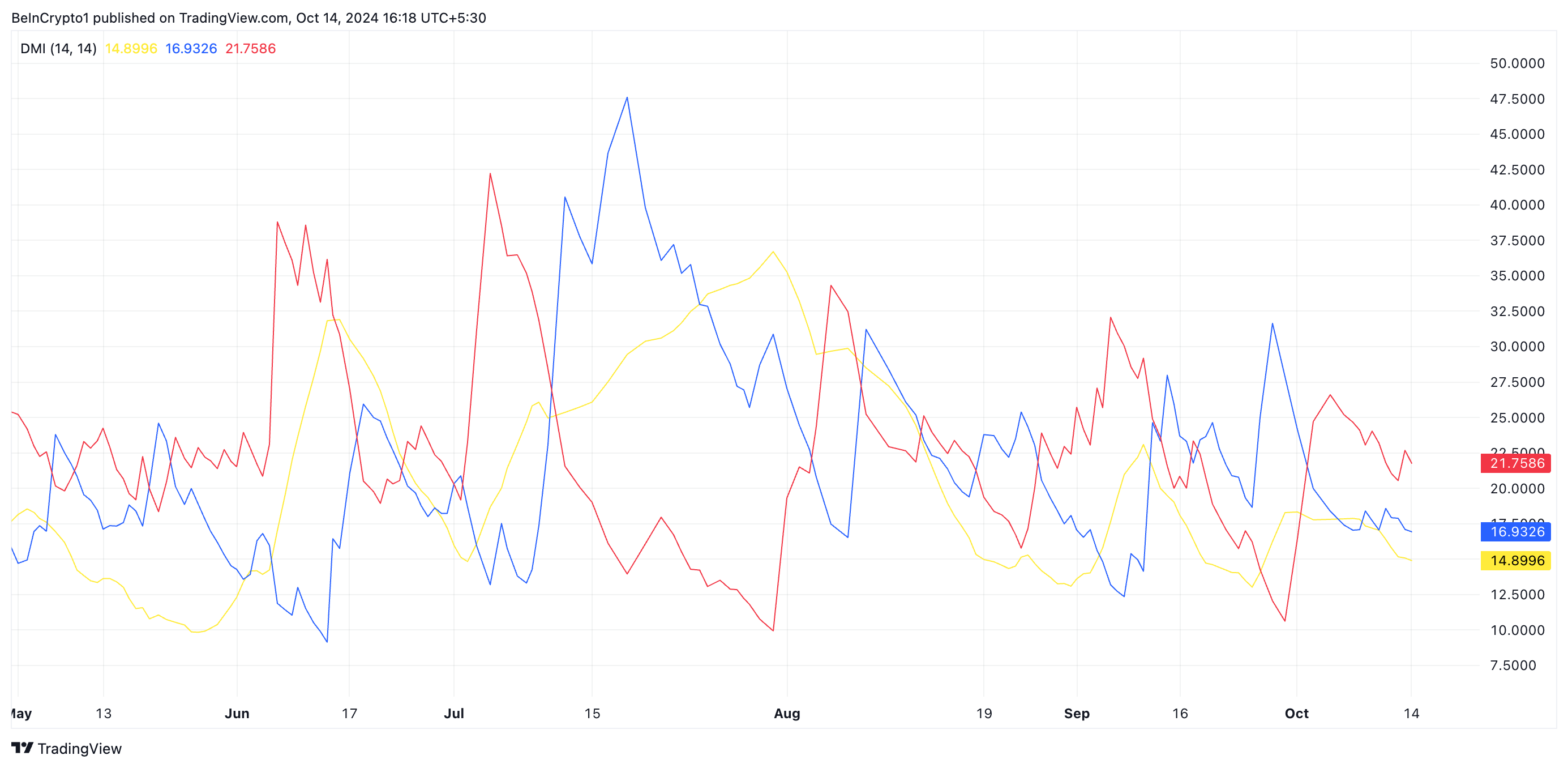

Furthermore, readings from XRP’s Directional Movement Index (DMI), as assessed on a one-day chart, confirm the growth in bearish momentum against the altcoin. At press time, the token’s Positive Directional Indicator (+DI) is below its Negative Directional Indicator (-DI).

The indicator tracks an asset’s price trends and direction. The +DI reflects the strength of upward price movements, while the -DI gauges the strength of downward trends.

For XRP, the -DI being above the +DI indicates that downward price movements are stronger than upward ones. This suggests that selling pressure currently outweighs buying pressure, reinforcing a bearish outlook.

XRP Price Prediction: Decline to $0.46 Or Rally To $0.54

XRP’s negative Elder-Ray Index supports the outlook above. Currently sitting at -0.01, this indicator, which gauges the strength of bulls and bears, signals increased selling pressure when below zero.

If XRP continues to experience heightened selloffs, the bulls may struggle to defend the $0.52 support. Failure to hold this level could cause XRP’s price to drop toward $0.46 or lower.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

However, if bearish sentiment fades and new demand emerges, XRP’s price could push past resistance at $0.54, with the potential to rally toward $0.63.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/xrp-price-loses-bullish-support/

2024-10-14 17:00:00