XRP’s price has been battling to break above the 78.6% Fibonacci Retracement line since early March, facing significant resistance. Despite repeated attempts, the altcoin has failed to maintain a breakout, keeping it in a bearish zone.

However, recent shifts in market sentiment have provided a glimmer of hope. This growing optimism among long-term holders could lead to a potential price rise, boosting profits for key investors and possibly ending XRP’s prolonged struggle.

XRP Is Noting Mixed Signals

The MVRV (Market Value to Realized Value) Long/Short Difference indicator for XRP currently stands at 3.1%, signaling that long-term holders (LTHs) are in profit. This is a bullish indicator, as LTHs generally hold onto their tokens longer, waiting for larger profits before selling. The absence of short-term holders dominating the market suggests that there is less risk of immediate selling pressure, providing XRP a better chance to rally.

On the other hand, negative values for short-term holders typically signal bearishness, as they tend to take quick profits, leading to price drops. With long-term holders in the profit zone, the possibility of them holding onto their XRP tokens increases. This shift could provide the necessary stability for XRP’s price to attempt another breakout.

Read more: XRP ETF Explained: What It Is and How It Works

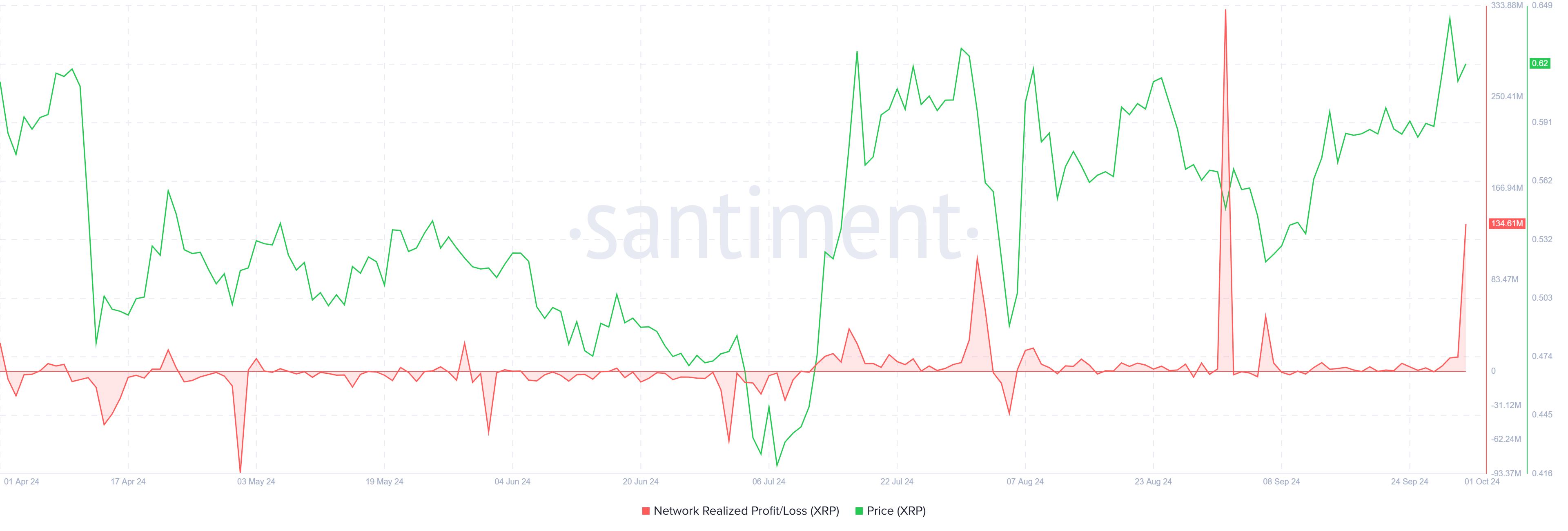

XRP’s macro momentum shows mixed signals. While the Realized Profit indicator has recently spiked, suggesting that investors are selling to secure gains, this could put downward pressure on XRP’s price. A surge in profit-taking often counters the bullish sentiment, especially if long-term holders decide to hold off on further selling.

Despite the spike in realized profits, the support from long-term holders could still help balance the market. However, the short-term bearish signals from profit-taking investors may limit the cryptocurrency’s upside potential, leading to traders’ cautious approach as XRP navigates this delicate situation.

XRP Price Prediction: Finding Strength

XRP is currently priced at $0.62, holding steady above the critical 61.8% Fibonacci retracement line at $0.59. The altcoin is attempting to breach the $0.65 barrier, which aligns with the 78.6% Fib line. This resistance level has kept XRP subdued for six months, and breaking through it is essential for further upward momentum.

The 61.8% Fib line is considered a key support level in bull markets, giving XRP a strong foundation to hold above it. However, the mixed signals from profit-taking and long-term holders may hinder the token’s ability to break through the $0.65 barrier.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

If broader market cues remain positive, XRP could break past the 78.6% barrier in Q4 2024. Failure to do so could lead to consolidation below $0.65, potentially invalidating the bullish outlook for the altcoin in the near term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/xrp-price-aims-at-rally/

2024-10-01 06:24:12